GlaxoSmithKline (NYSE:GSK) along with partner Pfizer, Inc. (NYSE:PFE) announced that its HIV-focused company, ViiV Healthcare, has initiated a phase III program to evaluate combination of long-acting, injectable cabotegravir and Johnson & Johnson’s (NYSE:JNJ) rilpivirine for treating adults with virally suppressed HIV-1 infection.

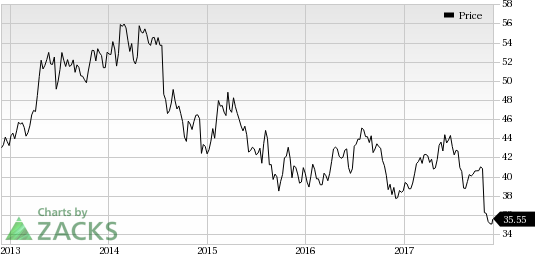

Shares of GlaxoSmithKline have underperformed the industry so far this year. The stock has lost 7.7%, comparing unfavorably with the industry’s 15.3% rally during the period.

The ATLAS-2M trials comprise the third phase III study undertaken by ViiV Healthcare to investigate a two-drug regimen for the treatment of HIV. The phase III program is designed to evaluate non-inferior antiviral activity of the combination regimen at 48 weeks when administered every 8 weeks versus every 4 weeks. The study will also evaluate pharmacokinetics, safety and tolerability of the combination therapy. Preliminary data from the study is anticipated in 2019.

Notably, ViiV Healthcare was formed in November 2009 by GlaxoSmithKline and Pfizer. The partners were later joined by Shionogi in October 2012.

We remind investors that another phase III ATLAS study is already evaluating the monthly dosing of the combination regimen in virally suppressed patients, while the FLAIR study is evaluating the combination in the first-line setting. Outcomes from the study are expected in 2018.

Notably, last week, GlaxoSmithKline and partner J&J (NYSE:JNJ) announced the FDA approval for Juluca, a two-drug complete regimen of Tivicay/rilpivirine and Edurant/dolutegravir as a single tablet for treating HIV-1 infection. Most medicines for HIV treatment are made up of three or more antiretroviral drugs. Juluca is the first two-drug regimen that reduces the number of medicines HIV patients take without compromising on the efficacy of a conventional three-drug regimen.

Meanwhile, several companies are working on developing drugscombination regimens to treat HIV. Gilead's (NASDAQ:GILD) bictegravir single table regimen (STR) is under priority review in the United States. The FDA is expected to announce its decision in February next year.

To the uninitiated, Mylan (NASDAQ:MYL) has received a tentative approval to treat HIV from the FDA for its combination tablet comprising efavirenz, lamivudine and tenofovir disoproxil fumarate.

With companies increasingly developing drugs to treat this life-threatening disease, competition has intensified manifold in the space.

Zacks Rank

GlaxoSmithKline carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Pfizer, Inc. (PFE): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

GlaxoSmithKline PLC (GSK): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Original post

Zacks Investment Research