GlaxoSmithKline plc (NYSE:GSK) announced that it has entered into a global strategic alliance with Germany-based Merck KGaA MKGAF to co-develop and co-commercialize the latter’s next-generation immunotherapy candidate, M7824 (bintrafusp alfa), which has potential in multiple difficult-to-treat cancers. The move is line with Glaxo’s strategy to boost its oncology pipeline.

The deal has a potential value of $4.2 billion (€3.7 billion), which Glaxo will be eligible to pay to Merck KGaA in upfront and milestone payments. Per the deal terms, Glaxo will make an upfront payment of $341.7 million (€300 million) to Merck KGaA and $569.5 million (€500 million) in potential milestone payments related to development of the candidate in its lung cancer program. Glaxo will be eligible to pay additional $3.3 billion (€2.9 billion) for future approval and commercial milestones. Moreover, the companies will equally share the cost of global development and profits on worldwide sales related to M7824.

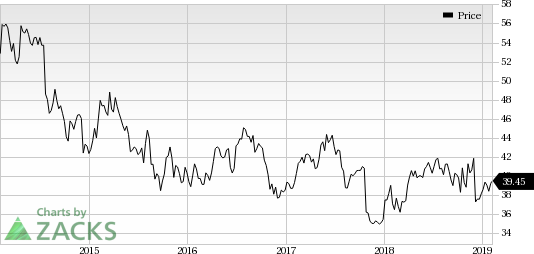

In the past six months, Glaxo’s shares have underperformed the industry, falling 4.8% against a 1.1% increase for the industry.

M7824 is a novel immunotherapy and the first of its kind as it simultaneously targets two immuno-suppressive pathways – transforming growth factor-β (TGF-β) along with the currently favorite, anti-programmed cell death ligand-1 (PD-L1). Targeting these two pathways, which are commonly used by cancerous tumors to spread, is expected to help the candidate in restoring and enhancing anti-tumor responses. This may result in better efficacy compared to individual therapies or combinations of individual therapies. Successful development of this next-generation immunotherapy may help Glaxo to gain lead in the market targeted by checkpoints inhibitors, which already generate several billion dollars in annual sales.

Merck KGaA has eight high priority immuno-oncology clinical development studies on M7824. While some of these are ongoing, the rest will commence this year. The candidate has shown encouraging clinical anti-tumor activity in phase I studies across several difficult-to-treat cancer indications. A phase II study is comparing the candidate against U.S.-based Merck’s (NYSE:MRK) blockbuster immunotherapy, Keytruda, as first-line treatment for non-small cell lung cancer (“NSCLC”)

We remind investors that Glaxo sold its oncology assets to Novartis (NYSE:NVS) in 2015 in exchange for the latter’s Vaccine portfolio. In the following years, Glaxo has significantly benefited from strong growth in Vaccine sales. However, it missed the opportunity to tap into the lucrative cancer market, which also witnessed impressive growth over the past couple of years and is the most sought-after segment for pharma companies.

Moreover, Glaxo’s Consumer Healthcare segment is facing slowdown and pricing pressure as new entrants have increased competition in the segment. The company is also facing generic competition for key respiratory and HIV drugs in its Pharmaceuticals division.

The company is re-prioritizing its strategies to make up for the lost opportunity in the cancer market as well as offset loss in sales due to slowdown and rising competition by focusing on its oncology portfolio.

Apart from the Merck KGaA deal, the company bought TESARO, Inc. adding an interesting cancer drug, Zejula.

The company is also looking to spin off its consumer healthcare business into a separate entity in the next three years. Glaxo’s joint venture with Pfizer (NYSE:PFE) announced in December will be the world’s largest consumer healthcare business. In December 2018, it announced the sale of its Horlicks brand to London-based consumer giant Unilever (LON:ULVR). These steps were taken to enable the company focus on its pharma segment.

Zacks Rank

Glaxo currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

GlaxoSmithKline plc (GSK): Free Stock Analysis Report

Novartis AG (NVS): Get Free Report

Merck & Co., Inc. (MRK): Get Free Report

Merck KGaA (MKGAF): Get Free Report

Original post

Zacks Investment Research