GlaxoSmithKline plc (NYSE:GSK) reported adjusted earnings of 79 cents per American depositary share (“ADS”) for the fourth quarter of 2018, which beat the Zacks Consensus Estimate of 70 cents. Earnings were up 10% at constant exchange rate (“CER”) from the year-ago figure.

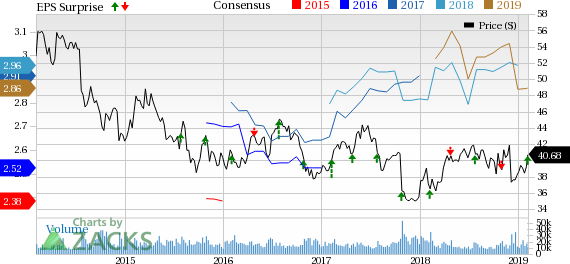

Shares of Glaxo were up almost 3.1% on Feb 6. However, the stock has lost 1.8% in the past six months against the industry’s 1.3% rise.

Quarterly revenues rose 6% at CER to $10.4 billion (£8.2 billion), driven by growth in all the three business segments, especially strong performance at the Vaccines segment. The top line beat the Zacks Consensus Estimate of $9.85 billion.

Full Year Results

The company’s adjusted earnings per ADS were $3.18 per share for the full year, up 12% at CER. Full year revenues rose 5% at CER to approximately $41 billion.

All growth rates mentioned below are on a year-over-year basis and at CER.

Quarterly Highlights

Sales were up 8% in the United States and 6% in the International markets. Sales in Europe were up 1% year over year

Glaxo reports financial figures under three segments: Pharmaceuticals, Vaccines and Consumer Healthcare.

The Pharmaceuticals division registered 4% increase in revenues at CER. The upside was driven by HIV drugs, Tivicay and Juluca, and new respiratory disease drugs. Growth in Nucala and the Ellipta portfolio offset the strong decline in sales of Seretide/Advair. Sales of Established Pharmaceuticals rose 1%.

HIV sales increased 6% at CER on the back of 7% and 18% growth in the Europe and International markets, respectively. U.S. sales were up 3% at CER. These encouraging numbers were driven by continued sales growth for Triumeq, Tivicay and Juluca. The company continued to hold 27% of the HIV vaccine market share in the United States during the fourth quarter. However, sales of another HIV drug named Epzicom/Kivexa tumbled 31% at CER due to severe generic competition.

Notably, the company’s latest product from the HIV portfolio is Juluca (dolutegravir + rilpivirine), the first two-drug regimen, once-daily, single pill for HIV. The drug was approved in the United States in November 2017. It generated sales of £62 million, a marked improvement from £37 million registered in the third quarter of 2018.

Respiratory sales were also up 2% at CER. The sales increase from the Ellipta portfolio and Nucala was partly offset by a fall in sales of older products like Seretide/Advair. Sales of new respiratory portfolio grew 34%, including £77 million quarterly contribution (up 83.3% sequentially) from the newly launched Trelegy Ellipta (only once-daily single inhaler triple therapy for COPD) benefiting from the U.S. label expansion in April.

In the International markets, sales of respiratory drugs increased 10% and 7% in Europe. However, sales in the United States were down 3% as decline in Advair sales offset growth registered by the new products in the category.

Earlier this month, the FDA approved Mylan’s (NASDAQ:MYL) generic version of Advair – Wixela Inhub – the first Advair generic in the United States, which is expected to be launched by the end of this month. Glaxo expects the generic launch to severely impact the already declining sales of Advair in 2019. Moreover, Glaxo will move Advair to its Established Pharmaceuticals portfolio starting with the first quarter of 2019.

Immuno-inflammation drugs like Benlysta rose 34% in the quarter under discussion.

Sales in the Consumer Healthcare segment increased 1% at CER as strong performances in Oral health and Nutrition were partly offset by decline in the Wellness and Skin health category. Although the segment performed well in the United States and International markets, it is facing increased competition and slowing demand in Europe.

Unfavorable impact of Horlicks and MaxiNutrition divestment along with other smaller brands in the United Kingdom was offset by growth of Transderm Scop in the United States as it benefited from supply constraints faced by its generic competitors.

In December 2018, the company announced the divestment of renowned brands – Horlicks and MaxiNutrition – in the emerging markets, which is expected to be closed by the end of 2019. In the same month, it announced a joint venture with Pfizer (NYSE:PFE) to create the world’s largest Consumer Healthcare business. Glaxo expects to eventually spin off the business in the next three years following the closure of the deal in the second half of 2019.

Sales from the Vaccines segment were impressive, having increased 18% at CER, primarily driven by higher sales of new shingles vaccine, Shingrix and strong performance of influenza products. However, sales of meningitis vaccines Bexsero and Menveo were down 3% and 37%, respectively. Shingrix sales more than doubled to £221 million in the reported quarter driven by market expansion in new patient population.

The company, however, expects its meningitis portfolio to return to strong growth in 2019.

Influenza vaccine, Fluarix grew 69% due to improved European sales and stronger sales in the United States.

Selling, general and administration (SG&A) costs increased 3% year over year to £2.5 billion due to increased commercial activities to support launches, partly offset by cost control initiatives.

Research and development (R&D) expenses were down 1% to £1 billion, reflecting benefits of re-prioritization of the R&D portfolio, which was partially offset by increased investments to support progress of clinical studies, especially oncology.

2019 Outlook

Glaxo expects its EPS to decline 5-9% at CER in 2019, including the impact of Advair generic and costs related to the acquisition of TESARO. The guidance assumes closure of joint venture with Pfizer for Consumer Healthcare business and divestment of certain nutrition brands in India/Bangladesh in 2019

Loss of Advair sales in the United States due to generic launch is expected to result in a slight decline in sales in Glaxo’s Pharmaceutical segment in 2019. Novartis (NYSE:NVS) and Hikma Pharmaceuticals are also looking to get approval for its Advair generic. A potential approval of their drugs will further erode sales of the branded drug.

Our Take

We are encouraged by Glaxo’s restructuring initiatives to focus on strengthening its pharmaceutical portfolio. The company boosted its oncology portfolio with the acquisition of TESARO in January and a collaboration agreement with Germany-based Merck KgaA, announced this month. Following these two transactions, the company will have 16 oncology pipeline candidates including candidates developed in-house.

These transactions along with the restructuring initiatives related to the Consumer Health segment will help the company to get rid of slowing businesses and should help in successful development of its oncology pipeline.

Zacks Rank

Glaxo currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

Novartis AG (NVS): Get Free Report

Pfizer Inc. (PFE): Get Free Report

GlaxoSmithKline plc (GSK): Free Stock Analysis Report

Mylan N.V. (MYL): Get Free Report

Original post