Gilead Sciences, Inc (GILD) - a large cap bio-pharmaceutical company is known for its vast product portfolio for the treatment of human immunodeficiency virus (HIV). After the recent failure of Bristol-Myers Squibb's experimental hepatitis C drug INX189 it seems that Gilead becomes a lider in developing an "all oral" combo of Hep C drugs with its promising experimental drug GS7977.

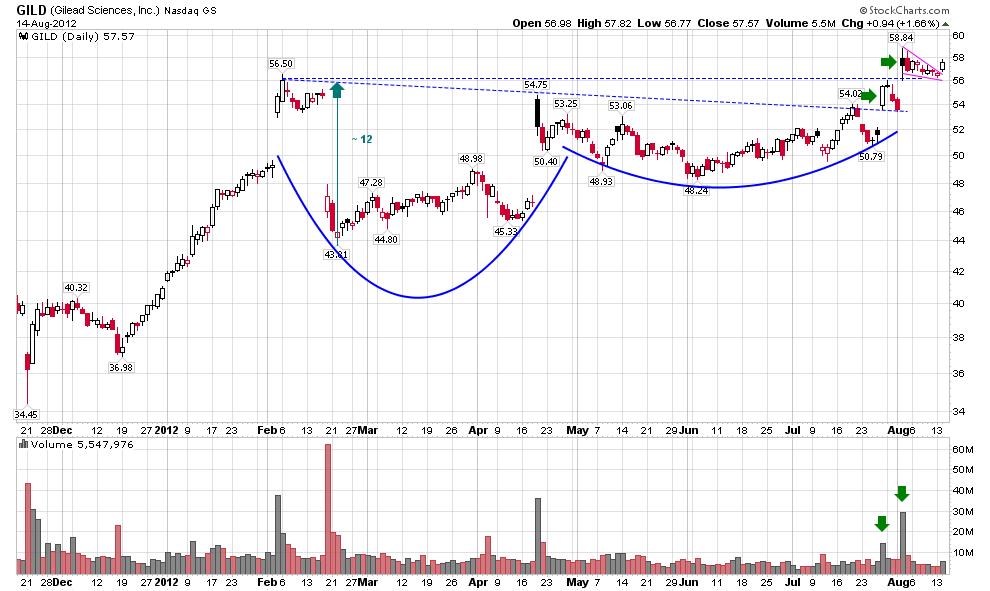

After the December-January rally, the GILD stock price entered into a 6-month consolidation phase. A pattern formed during this phase resembles a Cup And Handle pattern (blue). Though it doesn't look like an ideal pattern, two breakouts through the previous highs have occurred on increased volume (green arrows) confirming that the consolidation period might be over.

Following the breakout through the February high the price formed a well defined bullish pennant (magenta). The pennant was stopped at the breakout level and the price moved higher today. A potential price target from a consolidation pattern measured from the depth of the pattern (~12) and added to the point of a breakout gives us the 66 area.

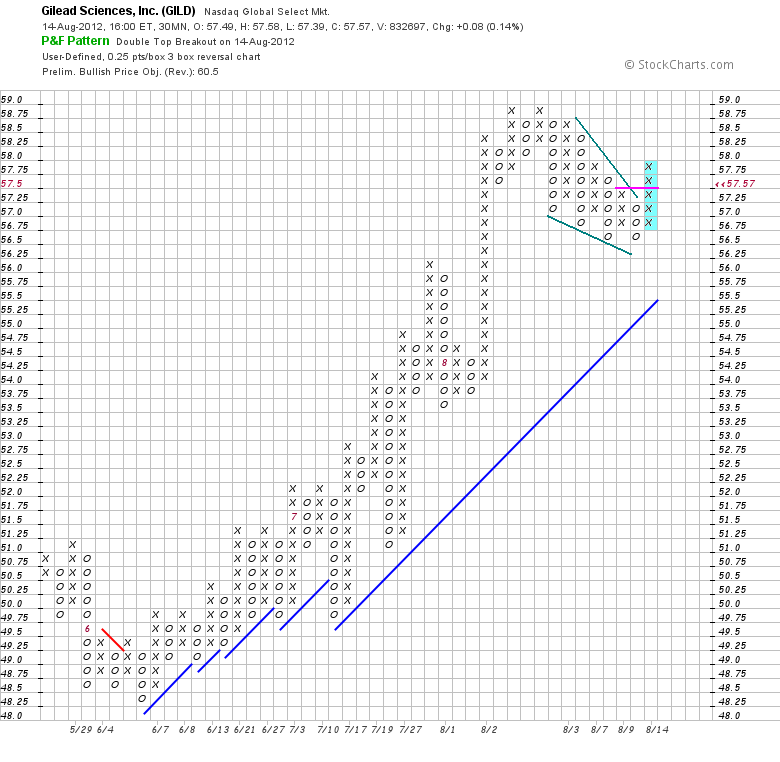

Now let's take a look at the GILD short-term P&F chart with the 30 min period and 0.25 pts/box (box size is adjusted to intrinsic volatility of the security within a determined time period). Before today's action a Bearish Pattern Reversed with lower lows and lower highs was formed (green lines) on this short-term chart. That is how the pennant on the GILD daily chart looks on the short-term P&F chart. Today the price formed a new column of Xs (light blue boxes) which rose past the previous column of Xs and gave a new short-term buy signal (magenta line). My "buy limit" order was triggered and filled upon this signal.

Disclaimer: I express only my personal opinion on the market and do not provide any trading or financial advice (see Disclaimer on my site).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gilead Sciences Is Breaking Out Of A 6-Month Consolidation

Published 08/15/2012, 02:52 AM

Updated 07/09/2023, 06:31 AM

Gilead Sciences Is Breaking Out Of A 6-Month Consolidation

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.