Gilead Sciences, Inc. (NASDAQ:GILD) announced that Health Canada has granted a Notice of Compliance for its single-tablet regimen, Vosevi (sofosbuvir 400 mg/velpatasvir 100 mg/voxilaprevir 100 mg), for the treatment of chronic hepatitis C virus (HCV) infection.

Vosevi has been approved for the treatment of HCV infection in adults with genotype 1, 2, 3, 4, 5 or 6 previously treated with an NS5A inhibitor-containing regimen, or with genotype 1, 2, 3 or 4 previously treated with sofosbuvir-containing regimen without an NS5A inhibitor. The drug is already approved in the U.S.

Gilead is known for its presence in the HCV market because of its blockbuster HCV drugs, Sovaldi and Harvoni. The HCV portfolio received a huge a boost when Epclusa gained approval in both the U.S. (Jun 2016) and EU (Jul 2016) to become the first and only all-oral, pan-genotypic, STR consisting of Sovaldi and velpatasvir (an NS5A inhibitor), for the treatment of adults with genotype 1-6 chronic HCV infection. The approval of Voseviwill further boost Gilead’s strong HCV portfolio.

However, the HCV franchise is under pressure as a result of competition and pricing issues. We note that Harvoni, Sovaldi and Epclusa, face competition from AbbVie’s (NYSE:ABBV) Viekira Pak and Viekira XR and Bristol-Myers’ (NYSE:BMY) Daklinza among others. Competition as well as pricing pressure intensified further with the launch of Merck’s (NYSE:MRK) Zepatier.

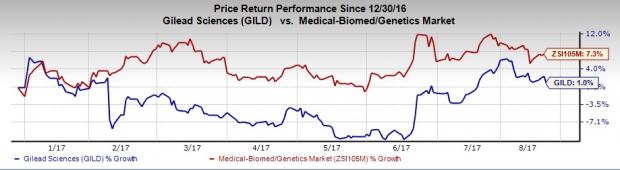

Gilead’s stock has moved up 1.0% in the year so far compared with the industry’s gain of 7.3%.

Meanwhile, the HIV franchise maintains momentum driven by the rapid adoption of TAF-based regimens in the U.S. and EU, which now represent 51% of total prescription volume. Genvoya is now the company’s bestselling HIV product with a treatment-naïve patient share of 41%. Strong uptake for Truvada for use in the pre-exposure prophylaxis setting is expected to further boost sales. However, Gilead will lose exclusivity for Viread in 2017 in some countries outside the U.S. which will impact sales.

Zacks Rank

Gilead currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Original post

Zacks Investment Research