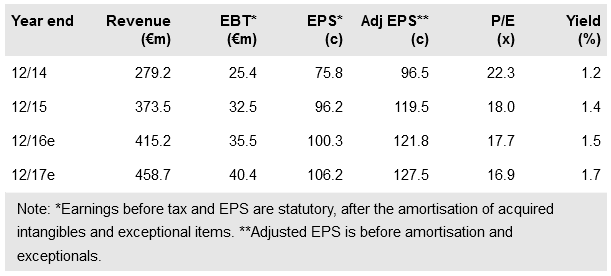

GFT Technologies AG (DE:GFTG) reported a solid Q1, with constant currency organic growth of 7.6%. This was slightly below the long-term trend, as the group saw some deferrals in Anglo Saxon regions due to poor results in the investment banking sector and uncertainty relating to the imminent UK vote on the EU. Nevertheless, management expects orders to pick up later this month and in Q3, regardless of the outcome of the BREXIT vote. We have edged our forecasts up with the inclusion of Habber Tec Brazil, which GFT acquired in early April. In our view, if management can continue to maintain the momentum, the stock looks attractive, trading on c 17x our FY17e EPS.

Q1 results: Total growth of 10%

Group revenue grew by 10% to €97.4m, reflecting 7.6% organic growth, a 1.3% FX headwind and €3.3m from Adesis, which was acquired in July 2015. In the Americas and UK segment, there was an organic revenue decline of 1.3% (€51.2m), reflecting contract deferrals in the investment banking sector. Consequently, onshore utilisation in the US and UK was below expectations, although capacity utilisation in the group’s nearshore centres remained high. In the Continental Europe segment, organic revenue growth was a healthy 18.2% (€46.1m), reflecting growth in digitisation and business integration projects. Adjusted EBITDA rose by 6.9% to €10.2m to provide a slightly lower margin.

To read the entire report Please click on the pdf File Below