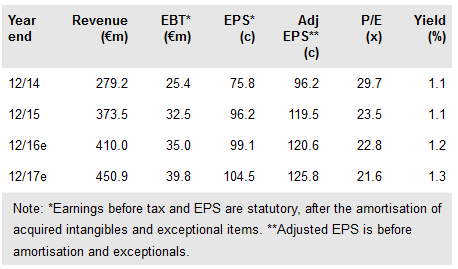

FY15 was another year of solid growth at GFT (DE:GFTG), with organic revenue growth of 18% at constant currencies. This was achieved in spite of the turmoil in the European investment banking sector, as participants needed to invest in compliance projects and outsourcing trends remain favourable. In our view, if management can continue to maintain the momentum, the stock looks attractive, trading on c 18x our FY17e EPS.

Q4 results: Organic growth 15% including FX tailwind

FY15 organic revenue growth was 20%, including 2% of currency headwinds as the euro weakened against the dollar and UK pound. There was also a full period contribution from Rule Financial, which was acquired in mid-2014 and an initial five months from Adesis Netlife. In total, revenues grew 34% to €374m, including 5% in favourable currency moves. The growth has continued to be led by elevated demand for regulatory compliance projects, primarily from investment banks. Nevertheless, organic growth has been decelerating from recent exceptionally high levels, with growth (before currency adjustments) at 15% in Q4, down from 19% in Q3 and 23% in Q1 and Q2. Operating margins expanded over the year in typical fashion, with Q4 adjusted operating margin lifting to 12.5% up from 11.0% in Q3, 10.0% in Q2 and 9.4% in Q1. Cash flow was strong with net debt falling by €5.6m over the year, despite the group paying record amounts of tax and net capex and investing a net €16.8m in acquisitions.

To read the entire report Please click on the pdf File Below