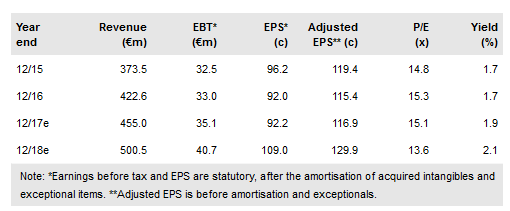

While GFT Technologies (DE:GFTG) reported FY16 revenues and EBITDA slightly ahead of our forecasts, the shares fell in response to unexpectedly weak FY17 guidance and higher than expected debt. The guidance reflected the challenging investment banking backdrop, which has been holding back profits in the UK and North America. Nevertheless, GFT’s retail banking activities remain buoyant, benefiting from digital banking projects in continental Europe, and management expects group growth to return to trend levels from FY18 on digitization strength and recovering investment banking markets. Hence, we believe the shares look attractive on c 14x our FY18 earnings.

Q4 results: Q4 organic revenue growth was 5%

Q4 revenues grew by 6% to €108.3m, including 5% organic growth and 1% from acquisitions. The growth was driven by digital banking projects in the European retail banking sector. Adjusted EBITDA slipped by 10% to €12.8m reflecting the challenging environment in investment banking. FY16 revenues grew 13% to €422.6m, representing constant currency organic growth of 12% and 3% from acquisitions, less a 2% currency headwind. End FY16 net debt was €42.1m. In addition, there are acquisition liabilities of €34.1m and a pension deficit of €8.7m.

To read the entire report Please click on the pdf File Below