GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/GBP: long at 0.7150, target 0.7400, stop-loss 0.7080, risk factor ***

EUR/CHF: long at 1.0440, target 1.0680, stop-loss moved to 1.0440, risk factor *

EUR/CAD: long at 1.3780, target1.4020, stop-loss moved to 1.3780, risk factor ***

EUR/USD: Possible EUR/USD Jump After Greece Negotiations End Should Be Used To Go Short

(stop-loss hit at 1.1160)

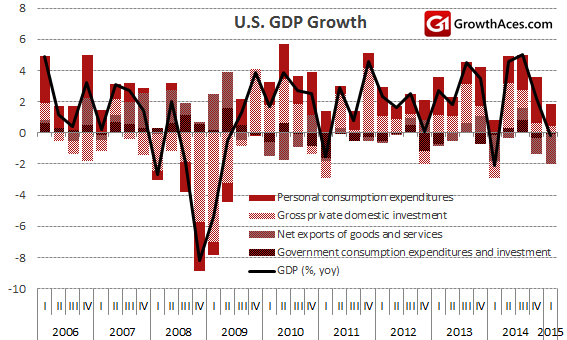

- The US Commerce Department said GDP shrank at a 0.2% annual rate in the January-March quarter instead of the 0.7% pace of contraction it reported last month. A fairly stronger pace of consumer spending and inventory accumulation than previously estimated accounted for the upward revision to GDP. Business investment spending was less weak than the government had estimated last month. Though export growth was revised higher, that was offset by an upward revision to imports, leaving a still-large trade deficit that subtracted almost 2 percentage points from GDP. Businesses accumulated USD 4.5 billion more in inventory than previously estimated in the first quarter, which could mean they have little incentive to keep on adding to stock in the current quarter. Inventories contributed 0.45 percentage point to GDP instead of the previously reported 0.33 percentage point.

- Growth, however, has since rebounded in the second quarter as the temporary drag from unusually heavy snowfalls and the ports dispute faded. Retailers reported strong sales in May and employers stepped up hiring. Housing is also strengthening and manufacturing activity is beginning to stabilize. We estimate that GDP growth in the second quarter was about 2.8%. A steadily firming economy could encourage the Federal Reserve to raise interest rates in September.

- Negotiations to avert a Greek debt default stumbled on Wednesday. With European Union leaders due in Brussels for a summit on Thursday, leftist Greek Prime Minister Alexis Tsipras negotiated into the early hours with heads of creditor institutions to try to thrash out a cash-for-reform deal before the Eurozone ministers reconvene at 11:00 GMT. Officials said the talks could drag on for another two days but without a deal by Saturday, endorsed by Greek lawmakers and a vote in the German parliament on Monday, Greece may not get the cash to meet Tuesday's repayment deadline. Its EU/IMF bailout expires the same day. Among key unresolved disputes were Greek demands for debt restructuring, which several Eurozone ministers rejected, and differences over reforming Greece's costly pensions system.

- We maintain our opinion that a short-term jump in the EUR/USD rate is possible when the Greece deal is reached. However, we still do not know when the negotiations end – Saturday seems to be the most likely date now. Higher EUR/USD levels that are likely after Greece-creditors negotiations end should be used to get short on this pair. The market’s focus will shift from the Greek saga to the prospects of higher US interest rates and that may result in deeper fall in the EUR/USD rate. It is worth keeping in mind that we have US non-farm payrolls report next week. This will be released on Thursday, a day early due to the Independence Day holiday on Friday. A strong employment report would firm expectations of a September hike which is currently only priced with a 50% probability.

Significant technical analysis' levels:

Resistance: 1.1235 (high Jun 24), 1.1277 (10-dma), 1.1292 (low Jun 19)

Support: 1.1154 (session low Jun 25), 1.1135 (low Jun 23), 1.1049 (low Jun 5)

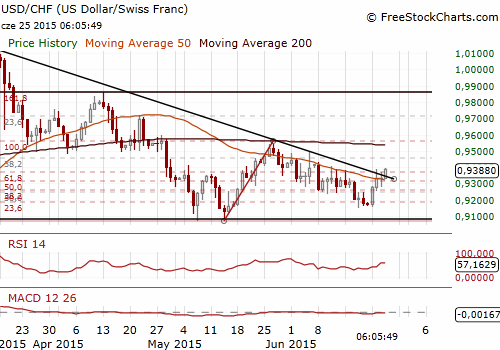

USD/CHF: Bullish In The Medium Term, But A Plunge Likely After Greece Deal

(stop-loss hit at 0.9380)

- Swiss National Bank Chairman Thomas Jordan said: “The global economy has been in a nearly permanent state of crisis for almost eight years. The pressure on the franc is the mirror image of this. The franc is considerably overvalued. Our current monetary policy is aimed at this difficult situation.” Jordan, who expects consumer prices to rise again in 2017 after contracting this year and next, said the SNB does not currently expect a sustained drop in prices or a deflationary spiral.

- At a policy meeting last week, the SNB kept its target range for three-month Libor at -1.25 to -0.25% and a charge on some cash deposits at 0.75%. Both measures are still too weak to discourage investors from buying CHF.

- We do not expect any rate cuts by the SNB, but such a move could be very helpful for Swiss economy. The SNB chairman Thomas Jordan said the bank would remain active in the foreign exchange market as necessary in order to influence monetary conditions. On the one hand the SNB suggests interventions, but on the other hand the bank made clear when it removed its explicit currency ceiling that it was no longer comfortable making massive interventions that were causing its balance sheet to increase.

- In our opinion the USD/CHF is likely to fall after Greece deal is reached probably next week. The impasse in last-minute Greek debt negotiations is lengthening and our short USD/CHF position was a false start.

- The medium-term outlook on the USD/CHF is slightly bullish. The Fed’s comments are getting more hawkish, while the Swiss economy is deep in deflation and contracting. Lower USD/CHF levels expected after Greece agreement could be used to get long on this pair.

Significant technical analysis' levels:

Resistance: 0.9395 (session high Jun 25), 0.9400 (psychological level), 0.9410 (high Jun 11)

Support: 0.9282 (low Jun 24), 0.9275 (10-dma), 0.9211 (low Jun 23)

Source: Growth Aces Forex Trading Strategies