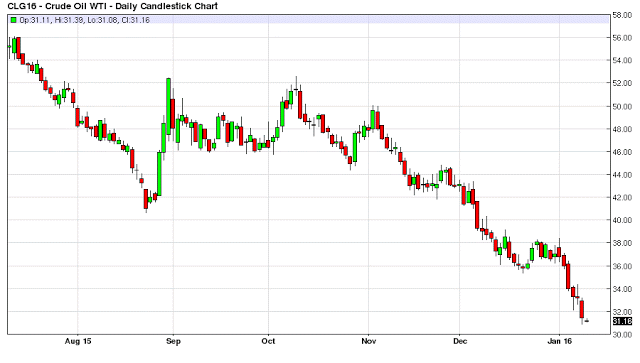

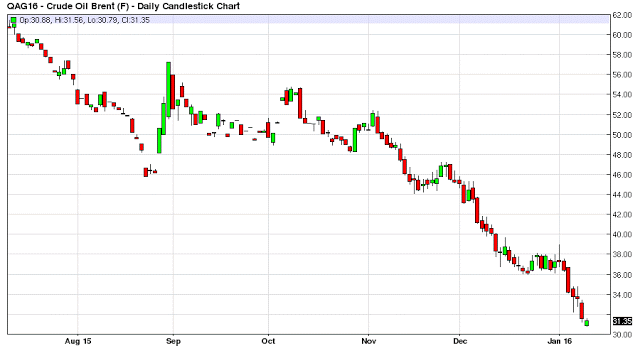

Pricing in Catastrophic Collapse

We accurately predicted that the beginning of the New Year would bring in a bunch of new money into the oil market, and it is all from the short side seeing just how low they can push the market down or in trader terms lean on the market. Well they sure are leaning heavily on the market with the shorts in the oil futures market at record highs. As Barclays (L:BARC) puts it, traders are pricing in a catastrophic failure in the oil market. Are conditions in the oil market highly oversold? Yes they are, but remember, conditions can stay at extreme levels for longer than you think; especially with so many just stepping away from the oil markets. In order to play either from the crowded short side or wait until oil prices just get ridiculous crazy like $25 or $28 a barrel - something like that area of craziness.

Record Number of Shorts in the Oil Market

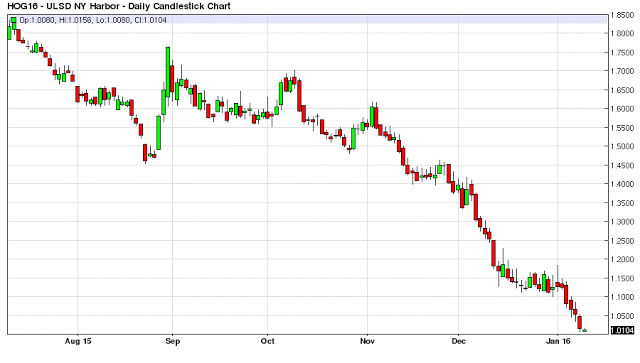

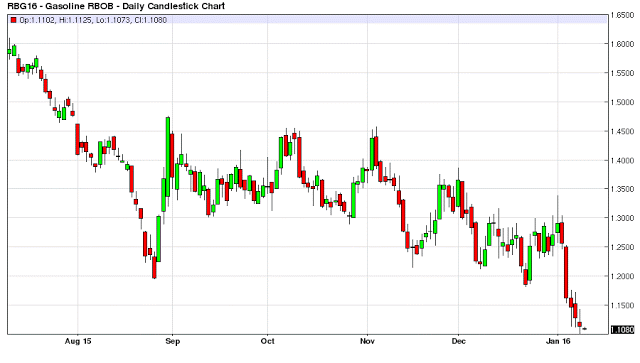

Given the all-time record amount of shorts in the market, and given the fact that this is an expected first of year pushdown trying to purposefully clear out all longs and firmly establish a bottom, i.e., a committed move. Add to this the fact that all these shorts inevitably have to buy to close out positions. Plus the fact that we have a 30 year historical record of wherever gasoline prices are in January, they are higher come April because of the run-up in demand for the summer driving season of warmer weather and vacation time involving increased travel. Also throw in the fact that gasoline prices held up better today than oil itself on this smash down for the last leg down even after a huge gasoline stocks inventory build last week.

$10 Short Squeeze

We are probably looking at a $10 plus short squeeze that is going rip the heads off of the shorts in the oil market. This short squeeze is literally going to be one of the most violent price swing, stop destroying, explosive moves that we have seen in a while. In fact we might have a couple of five dollar moves up in the market where stops and shorts are brutally destroyed with slippage on stops in excess of 60 to 70 cents kind of destruction. And if there is a catalyst for these moves like a news event or huge inventory moving data metric, just forget about it. The shorts will lose more money on the trade before they are able to fully close out the complete positions, and this after having made so much paper profits on the trade up to this point in the year.

All Shorts are Guaranteed Future Buyers on Rollover

But one of the first maxims of trading is that you haven't made anything until you close out the position, as I have seen a lot of strange things happen in financial markets! But expect a monumental short squeeze at any moment from here on - the market is just set up entirely too bearish at very oversold levels. Frankly I would never short a market under these conditions, this is just career suicide. One of the dumbest things that a trader can do is get greedy on a trade, and lean on an oversold market trying to push it over the edge only to have it snap back with such velocity that it takes your face off. This is where we are currently at in the oil markets. The RBOB contract is telling you this. Here comes the short squeeze that accompanies the record, historical short position in the oil market!