It was not so long ago, when we wrote about the record-breaking volume in gold. We described the implications of the extreme monthly volume and we discussed the very high readings in individual sessions. We even described these sessions as the most important sessions of the year – at that time. Well, “at that time” those volume readings were indeed extreme, but what we saw Tuesday made the previous sessions seem regular. Tuesday’s volume in gold was the highest that we’ve seen ever (in the case of daily upswings). The volume was even higher than the one that accompanied the results of the Brexit vote. With extreme volume, there can be extreme implications.

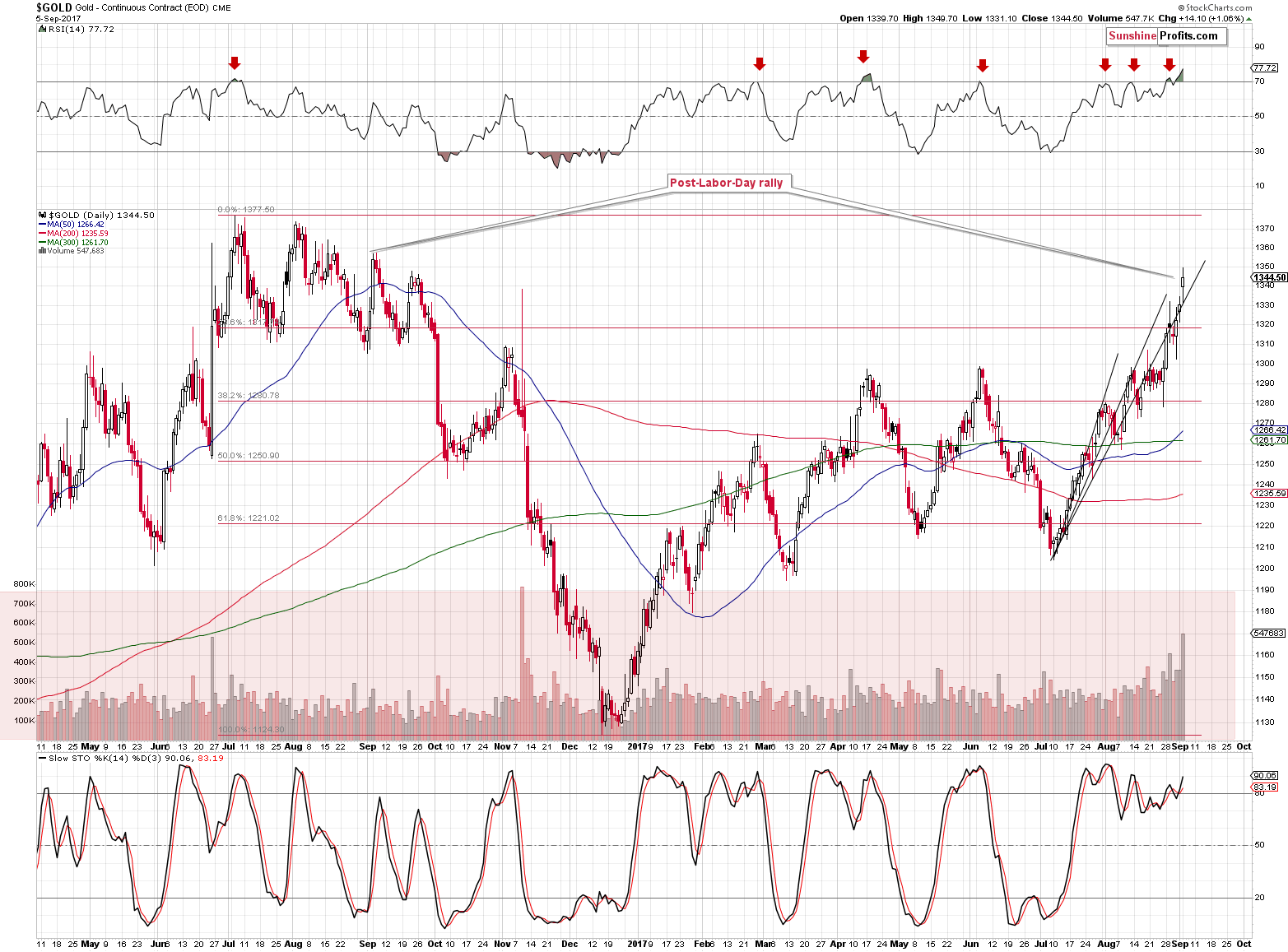

Let’s take a look at gold’s chart for details.

charts courtesy of stockcharts.com

Gold is after a sizable rally, so at this point it would be natural to expect the huge volume to indicate a reversal. This, by itself, does not make it a strong bearish factor, but taking into account the current time, does. Tuesday’s session was the first one after Labor Day. In Tuesday’s alert, we discussed the implications as follows:

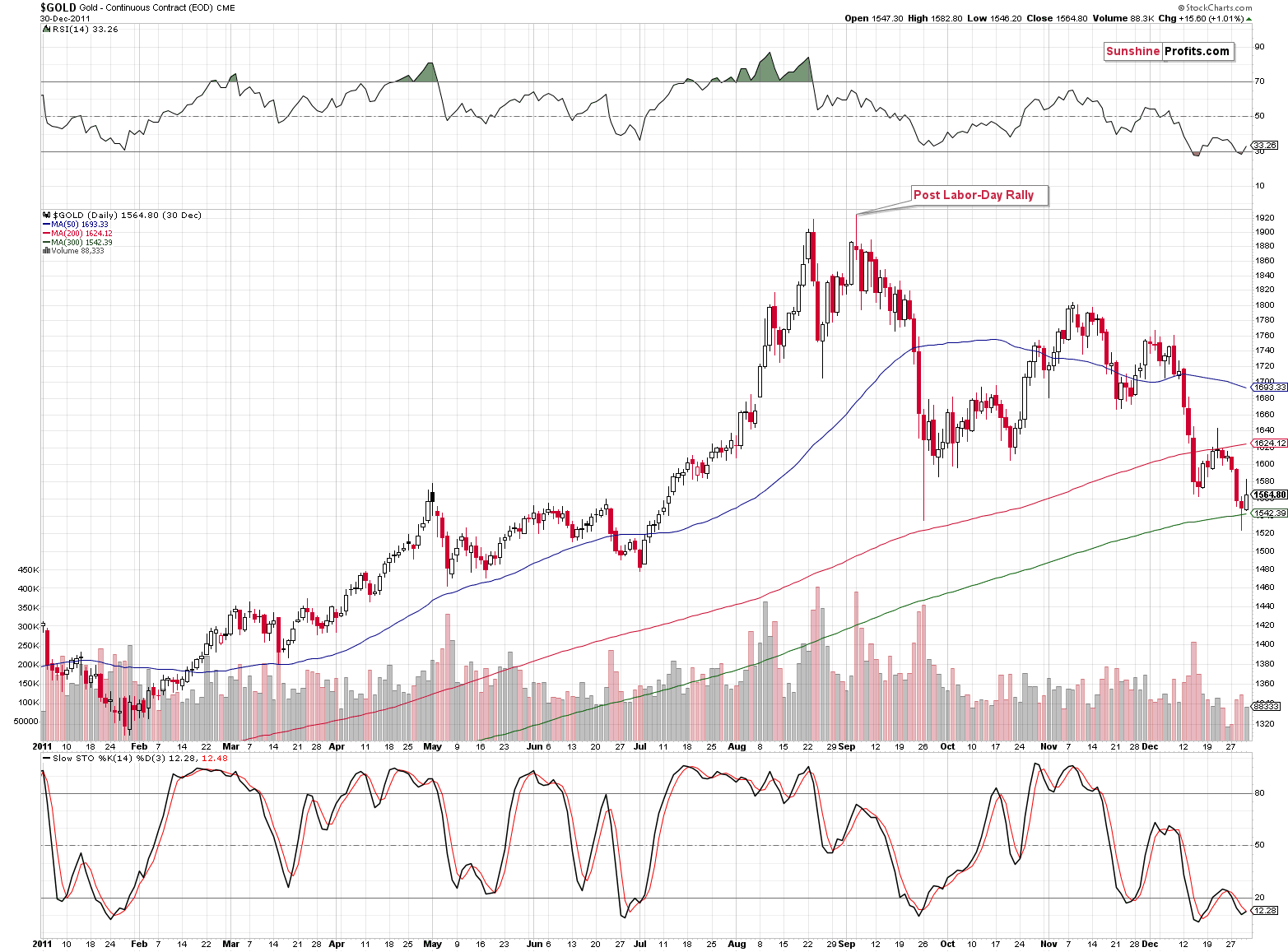

- 2011: gold plunged about $300

- 2012: gold moved higher at the beginning of September and shortly thereafter formed the key top – the one that started the biggest decline of the past decades

- 2013: gold declined about $200

- 2014: gold’s decline was underway, but still declined over $100 after Labor Day

- 2015: rather sideways trading followed by a sharp decline in the final part of the year

- 2016: daily rally right after Labor Day that started a $200+ decline

The implications here are clearly bearish – almost always huge declines started either immediately or shortly after Labor Day. This kind of efficiency alone is something that should make one consider opening short positions in the precious-metals market even without taking into account the situation in the USD Index.

Today, we would like to add more details to the above. Namely, last year, the session that marked the final top before the plunge was not approximately after Labor Day – it was exactly the first session thereafter. Higher gold prices were not seen since that time. Of course, one might say that one swallow doesn’t make a summer and that could have been a coincidence. However, there is something that most analysts currently seem to forget:

It was the single session after the Labor Day holiday in 2011 that marked THE top after a decade-long rally in gold. Does it still look like a coincidence? The volume that accompanied the 2011 post-Labor-Day top was extreme, which is yet another similarity to the current situation. Gold also moved a bit above the previous intraday high, but not significantly so – just like gold performed relative to the post-Trump-election high.

The current situation is very similar to the previous post-Labor-Day tops. Consequently, gold rallying on record-breaking volume after a sizable rally right after Labor Day is something that is very likely to be followed by declines – not significant rallies.

Also, based on the size of the previous rally, the time for the current one is up – the 3 rising, black lines on the previous chart apply the sizes of the initial 2016-2017 rallies (ending in January and February) to the rally that started in July. Based on the Tuesday’s upswing, it seems that even if (which is not likely) gold was to rally further, it should take a bigger breather before it does. Based on the long-term factors, it doesn’t seem that it would be just a breather, but a major downswing. Still, regardless of the above, a short-term decline appears likely either way.

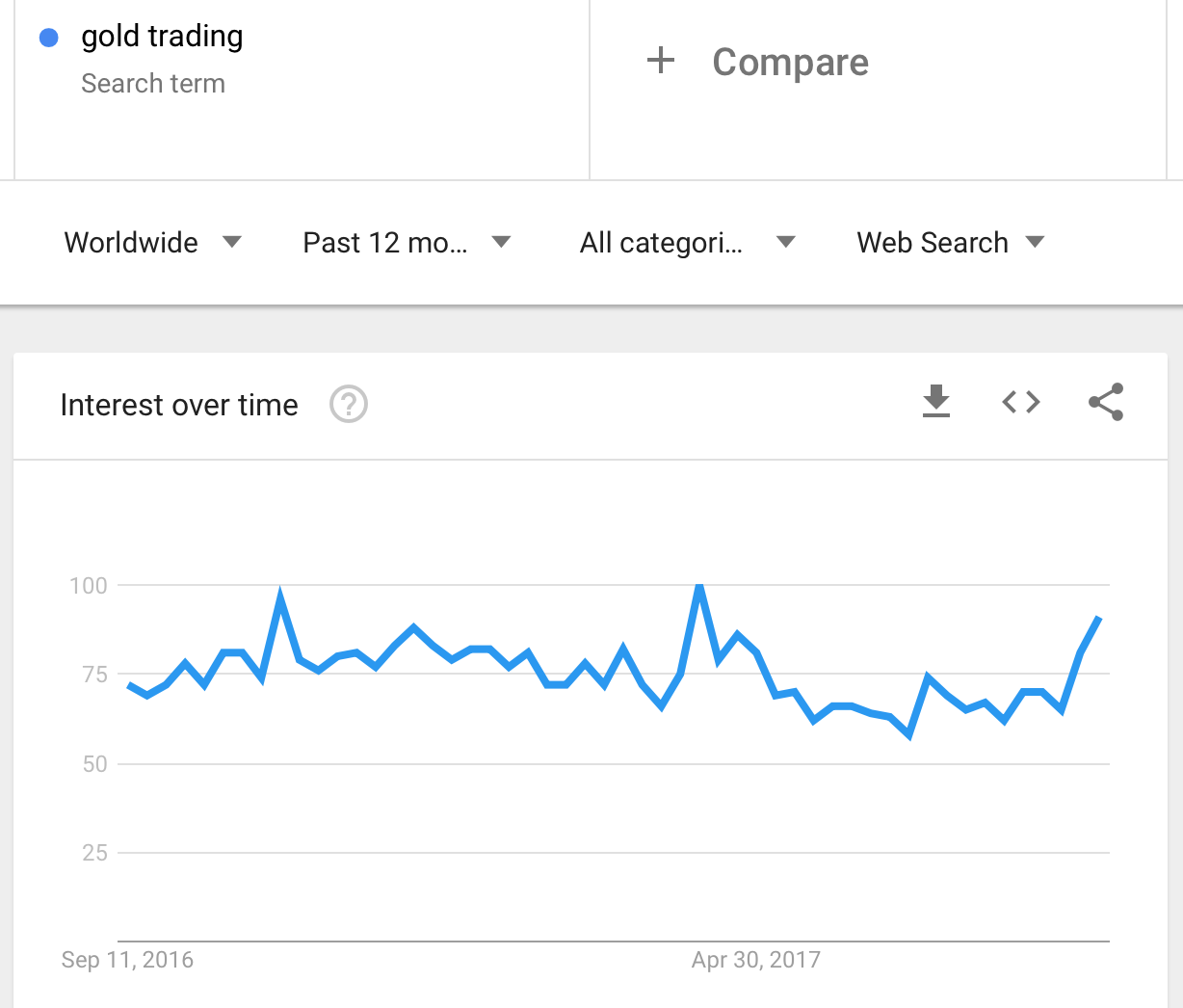

The significantly increased interest in gold confirms it. We noted on Tuesday the following:

Before moving to charts we would like to add that we have also seen a lot of non-price and non-volume confirmations that an important top is being formed – the number of messages with questions regarding gold (and the wording that was used in them) that we received (including phone calls from friends that are generally not interested in the markets at all) was not typical. The interest in gold has definitely increased in the last week or so.

Today we've added a chart that illustrates the point above.

The above chart features data from Google (NASDAQ:GOOGL) Trends – it shows how often people were searching for the phrase 'gold trading' in the past 12 months. There are 3 cases when the interest spiked: now, in the April 9 – April 15 2017 week and in the November 6 – November 12 2016 week. In both cases: in April 2017 and in November 2016 we saw major tops in gold and the same is likely to be seen this time.

Summing up, at the first sight, the situation on the precious metals market appears to have become much more bullish based on the most recent price action, however, looking at these developments from a broader perspective, reveals that the recent upswings are likely to be just temporary. The analysis of the previous North-Korean-based price swings suggests that their implications will disappear relatively quickly. At the same time, the post-Labor-Day seasonality is likely to kick in, and since in almost all cases, huge declines in gold followed in the previous years, the same is very likely to happen this year. In particular, the two most important analogies (last year being the closest analogy and 2011 being the most significant year for the gold investors) suggest that the top is already in or is very likely to be in this week. The extremely high volume in gold that we saw last month confirms that and the same goes for the sudden increase in the interest in gold trading. Consequently, the outlook for the gold price in September 2017 doesn’t seem to be as bullish as many people expect it to be – the buying opportunity is quite likely still ahead.

We hope you enjoyed today’s analysis, even though it might appear controversial.

Thank you.