When it comes to currency strength, King Dollar had a pretty good 2014. Speaking of strength, the performance spread between the USD ETF and Euro ETF (UUP)/(FXE) has been 23% over the past 6 months.

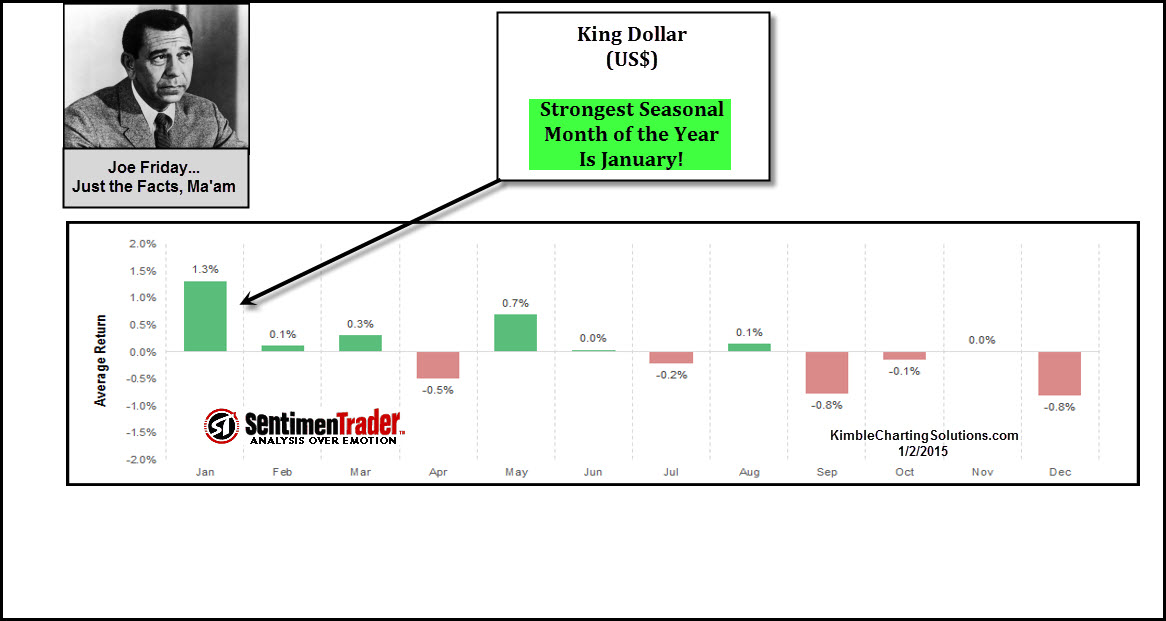

The chart above from Sentiment Trader shows that the USD is now entering its strongest seasonal month of the year and its strongest 90-day window of the year too.

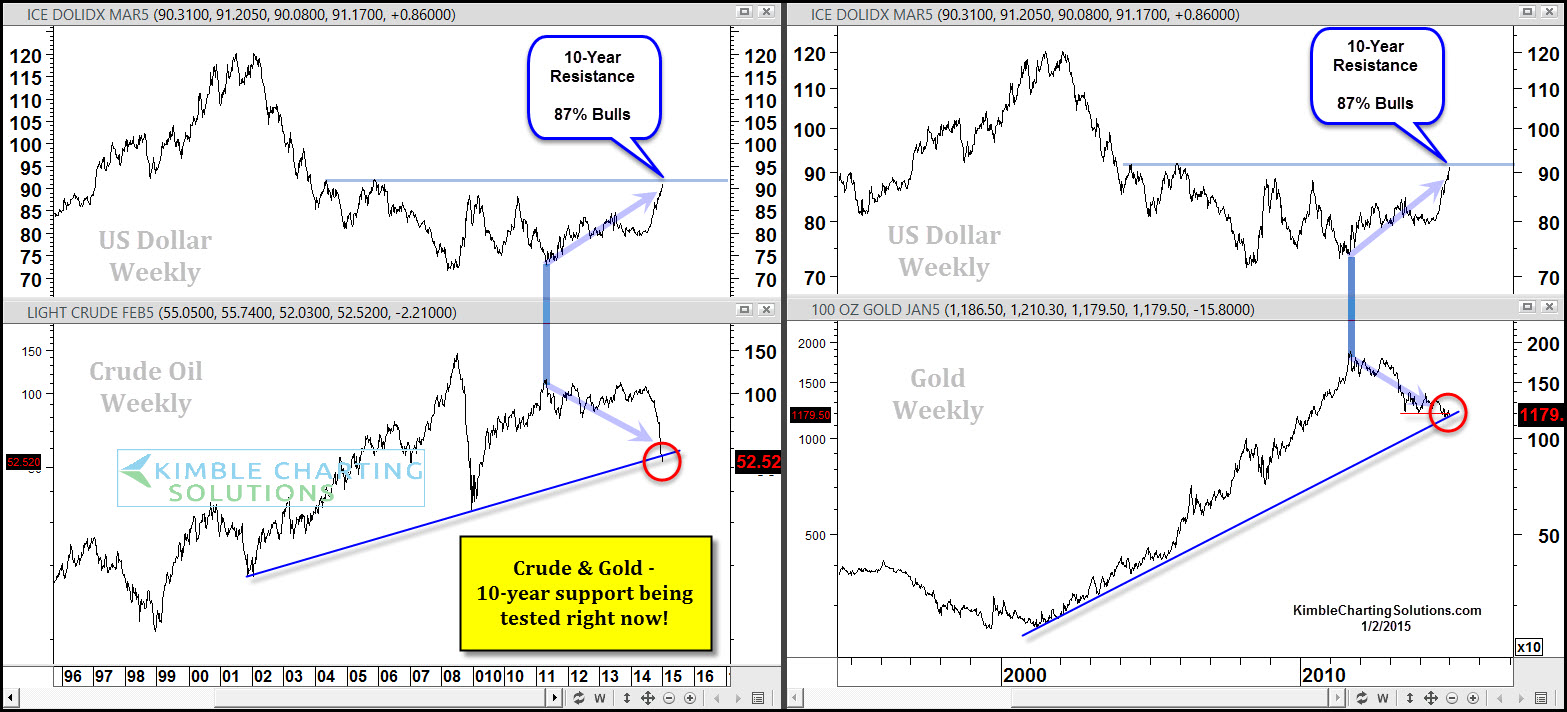

As the USD enters its strongest month, the chart below shows that it's nearing a 10-year resistance line as 87% of investors are now bullish the USD.

The above chart reflects that the USD has rallied for the past three years as crude and gold have done just the opposite.

All three are testing 10-year support/resistance lines -- and at the same time. This is the time of year that many predict or look to others to predict what they think will happen in the year ahead.

As for me, the USD is now entering its strongest seasonal month of the year. What it does at the 10-year resistance line should tell investors quite a bit as to whether or not support will hold or fail in both crude and gold.