Does Barron’s have a point? Or is it simply spreading fear?

In the latest issue, Randall W. Forsyth warns about passing by your local newsstand.

Apparently, there’s an image lurking there that’s the “kiss of death” for the stock market.

It’s so ghastly, in fact, that it prompted the researcher who tracks these appearances to gasp and use the Lord’s name in vain. (Repent!)

Supposedly, the appearance alone means there’s an 80% chance that the current bull market will come to an end within a month.

Now, we’ve made it a habit here to routinely dispel market mistruths.

Case in point: We told you to shrug off the fearmongering in the headlines about September being the worst month for stocks. Why? Because the double-digit rally we witnessed leading up to this month actually pointed to even more gains.

Sure enough, the S&P 500 Index has traded higher in nine out of the last 11 sessions. Total gain for the month so far? A stout 4.4%, compared to the average return the mainstream financial rags told you to expect for the month of negative 1.1%.

Armed with the data, it’s time to dish out the truth again. So here goes…

Warning: Graphic Content

This is the image that should scare you stockless.

It’s the latest cover of TIME Magazine, emblazoned with the iconic Wall Street bull.

As Forsyth says, “The cover of general-interest magazines has been a redoubtable contrarian indicator, since, well, Henry Luce came up with the idea of TIME Magazine in the 1920s.”

Forget the content of the articles, though. (The most recent TIME article isn’t irrationally exuberant.)

According to expert magazine tracker, Paul Macrae Montgomery of Universal Economics, it’s the image that matters most. It carries utmost importance because of the broad message it sends to everyday Americans.

In fact, Montgomery told Forsyth, “If historic probabilities reliably forecast the future, there’s an 80% chance the market will top in a month and will be lower a year from now.”

No doubt, that’s what prompted Forsyth to write his most ominous line, “For stock market investors, there is no kiss of death like seeing a bull on the cover of TIME.”

Scared? Don’t be.

It’s Different With TIME

The classic example of the magazine cover indicator is, of course, the August 1979 issue of BusinessWeek. It proclaimed “The Death of Equities.” And then the markets went on to enjoy two decades’ worth of prosperity.

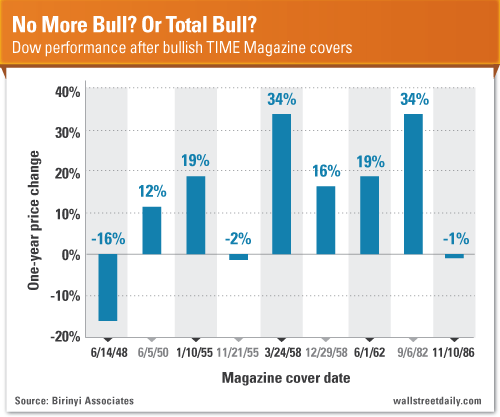

Apparently, Forsyth forgot to ask if the accuracy of the indictor changes with each circulation. Because according to Laszlo Birinyi of Birinyi Associates, things are different when it comes to TIME.

“Over the last 65 years, TIME Magazine has featured the picture of a bull on its cover multiple times,” says Birinyi. “We’ve gone back and pulled the historical TIME Magazine covers and have found that the myth has been mostly incorrect.

Almost 70% of the time, stocks are actually higher one year later, averaging a return of 12.79%. There’s only been one instance, back in 1948, when the market hit the skids.

So much for that “kiss of death” thing, huh?

Bottom line: Don’t automatically do the opposite of what magazine covers tell you. And shame on Barron’s for suggesting as much. Not long ago, on April 22, its cover featured a bull on a pogo stick and the headline “Dow 16,000!” Yet they weren’t exactly telling investors to bail because of it.

Now, I’m not saying the stock market is guaranteed to go higher from here. Only that nobody knows when it’ll stop for sure. Not even the top brass at magazines who decide on the art and headlines to accompany each issue.

And that means, as always, the best strategy for us is to stay invested and simply mind our protective stops. Period.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Get A Load Of This Bull From Barron’s

Published 09/19/2013, 06:05 AM

Updated 05/14/2017, 06:45 AM

Get A Load Of This Bull From Barron’s

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.