Kronos Worldwide, Inc.’s (NYSE:KRO) stock looks promising at the moment. This leading producer of titanium dioxide (TiO2) pigments has seen its shares shot up around 25% over the past six months.

We are positive on the company’s prospects and believe that the time is right for you to add the stock to portfolio as it looks promising and is poised to carry the momentum ahead.

Let's see what makes this Zacks Rank #2 (Buy) stock an attractive investment option at the moment.

An Outperformer

Kronos Worldwide has significantly outperformed the industry it belongs to year to date. The company’s shares have surged 32.6% compared with a roughly 16.8% decline recorded by the industry. The company has also outpaced the S&P 500’s rise of 18.6% for the same period.

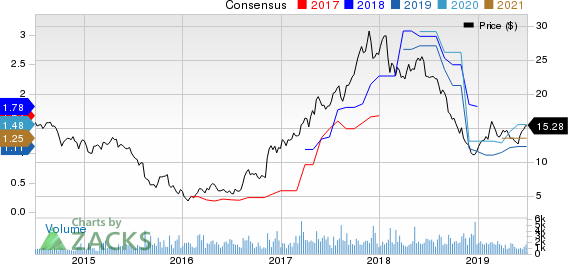

Estimates Northbound

Earnings estimate revisions have the greatest impact on stock prices. Annual estimates for Kronos Worldwide have moved up over the past three months. Over this period, the Zacks Consensus Estimate for 2019 has increased by around 9.9%. The Zacks Consensus Estimate for earnings for 2020 has also moved up 26.5% over the same timeframe.

Superior Return on Equity (ROE)

ROE is a measure of a company’s efficiency in utilizing shareholder’s funds. ROE for the trailing 12-months for Kronos Worldwide is 19.3%, above the industry’s level of 11.5%.

Capital Deployment

Kronos Worldwide remains focused on returning value to shareholders. Earlier this year, the company hiked its quarterly dividend by a penny per share to 18 cents per share. Kronos Worldwide paid dividend worth $20.9 million to its shareholders during the first three months of 2019. The company also had repurchase authorization of roughly 1.95 million shares at the end of first-quarter 2019.

Growth Drivers in Place

Kronos Worldwide is poised to gain from rising demand for TiO2. Demand for TiO2 has been growing on the back of strong consumptions across Western Europe and North America. Moreover, markets for TiO2 are rising in South America, Eastern Europe, the Asia Pacific region and China and the company sees continued growth across these regions.

The company is seeing strong demand for its TiO2 products across most segments, which is expected to continue through 2019. It expects demand to grow 2-3% annually over the long term.

Kronos Worldwide also expects its sales volumes for 2019 to be higher year over year based on expected production levels and assuming current global economic conditions to remain stable. The company also expects its sales to be higher year over year in 2019, mainly due to higher expected sales volumes.

Other Stocks Worth a Look

Other stocks worth considering in the basic materials space include Materion Corporation (NYSE:MTRN) , Flexible Solutions International Inc (NYSE:FSI) and Israel Chemicals Ltd. (NYSE:ICL) .

Materion has an expected earnings growth rate of 30.3% for the current year and carries a Zacks Rank #1 (Strong Buy). The company’s shares have gained around 21% over the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Flexible Solutions has an expected earnings growth rate of 342.9% for the current fiscal year and carries a Zacks Rank #1. Its shares have surged around 152% in the past year.

Israel Chemicals has an expected earnings growth rate of 13.5% for the current year and carries a Zacks Rank #1. Its shares are up roughly 15% in the past year.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Flexible Solutions International Inc. (FSI): Free Stock Analysis Report

Israel Chemicals Shs (ICL): Free Stock Analysis Report

Materion Corporation (MTRN): Free Stock Analysis Report

Original post

Zacks Investment Research