The IFO expectations increased again and current condition was close to unchanged. It appears that the forward-looking Ifo index bottomed out in October.

We expect Ifo expectations to increase moderately and to stay in line with very

moderate positive growth in Q1. Our IFO expectations model also points to further increases.

Today’s release added upside risk to our estimate of zero growth q/q in Q1 in

Germany. We forecast German growth in 2012 of 0.8% and 1.9% in 2013.

IFO expectations increased again

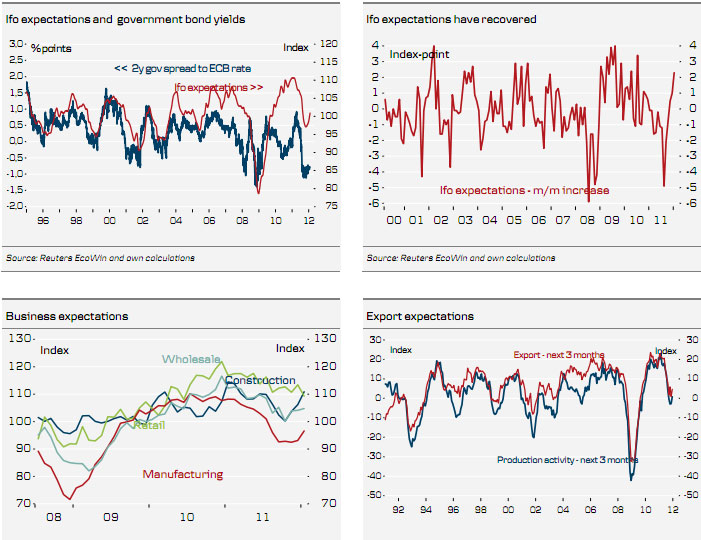

The IFO expectations increased again in January and it appears that it bottomed out in October. Expectations surprisingly increased from 98.4 in December to 100.9. This level is around the average value for this index. Ifo current conditions decreases slightly to 116.3 in January from 116.7. The current condition index has remained remarkably resilient. The aggregate IFO business climate increased to 108.3 from 107.3.

Manufacturing expectations increased from 93.1 to 96.6, which is somewhat comforting. Overall today’s release is much better than consensus expectations. This is in line with yesterday’s better than expected PMI data.

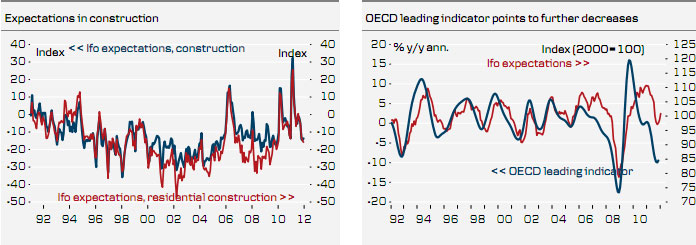

Despite a drop in retail expectations from 113.4 to 109.3 the index remains at a decent level. Construction expectations increased for the third month in a row from 106.2 to 110.9 and in wholesale expectations increased moderately from 104.1 to 104.8. We expect Ifo expectations to increase moderately and to stay in line with very moderate growth in Q1. Our Ifo expectations model also points to further increases.

The German economy faces substantial headwinds from ongoing fiscal consolidation. The ongoing debt crisis should weigh on the German economy as investments, exports and private consumption are being affected negatively. However, some support can come from the strong rise in the DAX, which is up by around 10% since the beginning of year.

The introduction of the 3 year LTROs has halted the escalation of the crisis and has limited the negative impact of the European bank recapitalization. The improvement in both US and emerging market yields support the export-sensitive German economy as well.

Today’s release adds upside risk to our estimate of zero growth q/q in Q1 in Germany. We forecast German growth in 2012 of 0.8% and 1.9% in 2013.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Germany: IFO Improves Once Again

Published 01/25/2012, 07:30 AM

Updated 05/14/2017, 06:45 AM

Germany: IFO Improves Once Again

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.