Greek PM Samaras paid a visit to Merkel today and he got what we all expected, a handshake and some nice words. The Troika is supposed to help with the decision making process. Well, we know what their reports looked like so far. Anyway, it seems like public service wages will get paid until October, the private sector remains on the floor. There is still an army of people going to their "job" day in day out without getting paid. That's been going on for more than a year across the private sector.

Schaeuble gave an interview to the Irish Times, here is the link: In a way he is already telling us what the German constitutional court might have to say about it all when he is pointing towards a referendum. That will be a tough sell but the propaganda engine is doing its best to create favourable weather: With former chancellor Helmut Schmidt holding the banner this initiative is steaming ahead pro Europe. Its main sponsors are the Robert Bosch Foundation and the Mercator Foundation. Naturally big business wants the Eurozone hold together and if possible with a weaker EURUSD exchange rate.

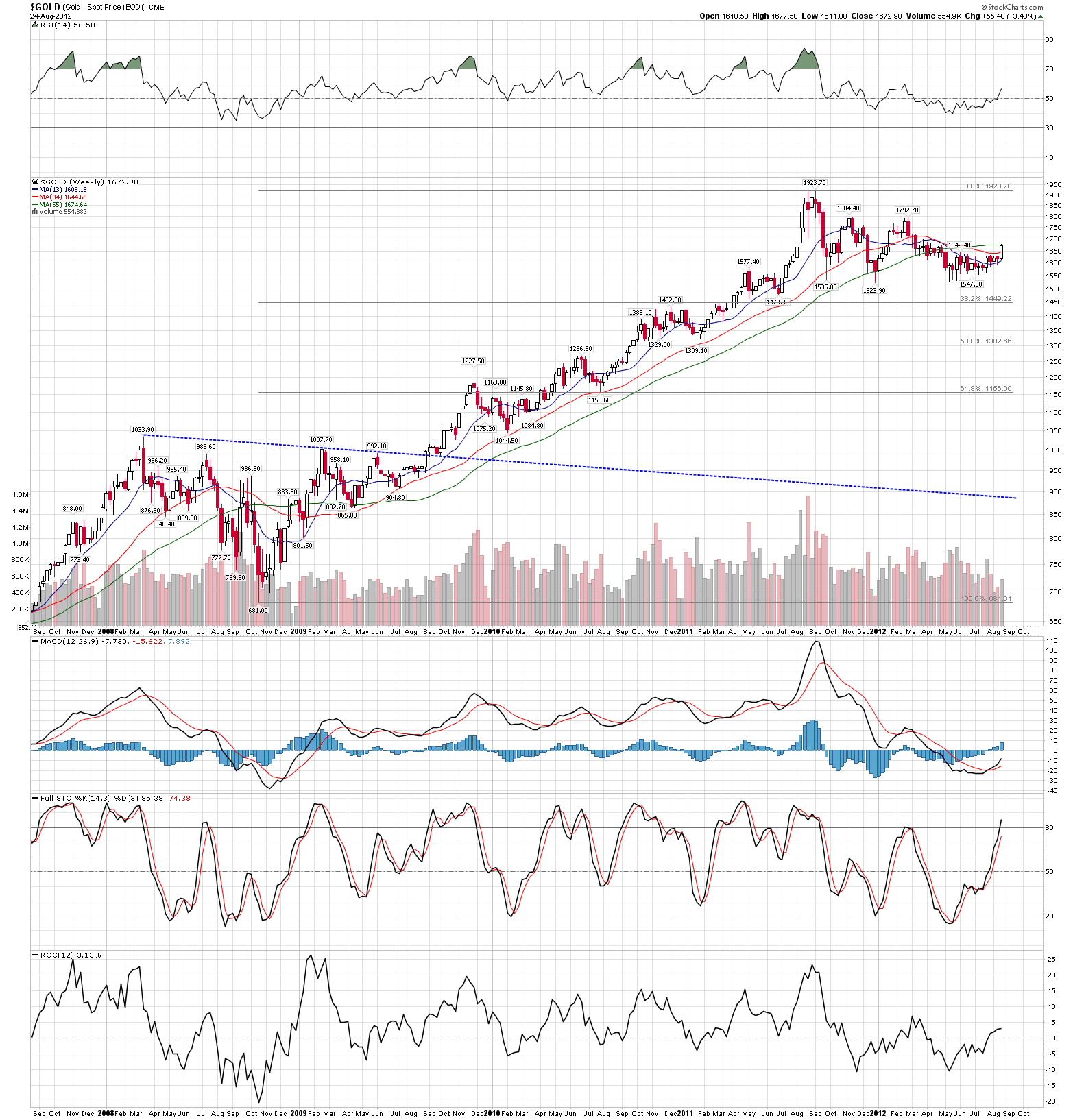

Precious metals held the levels today but could not extend the run. They have done very well as a reaction to all the QE and "bazooka" talk. Anyhow, as we have seen this week, in whatever happens it's not going to be the one measure that solves everything for everyone. Merkel repeated this today and Bullard told us yesterday via CNBC. As soon as the market realizes that these two actually mean what they say, it should let some air out of precious metals. I am still looking for a good buying opportunity in Gold, Silver and Gold mining shares later this quarter or maybe even later in Q4. The FT also had a few interesting things to say about the Gold standard today, here is the link;

Precious metals held the levels today but could not extend the run. They have done very well as a reaction to all the QE and "bazooka" talk. Anyhow, as we have seen this week, in whatever happens it's not going to be the one measure that solves everything for everyone. Merkel repeated this today and Bullard told us yesterday via CNBC. As soon as the market realizes that these two actually mean what they say, it should let some air out of precious metals. I am still looking for a good buying opportunity in Gold, Silver and Gold mining shares later this quarter or maybe even later in Q4. The FT also had a few interesting things to say about the Gold standard today, here is the link;

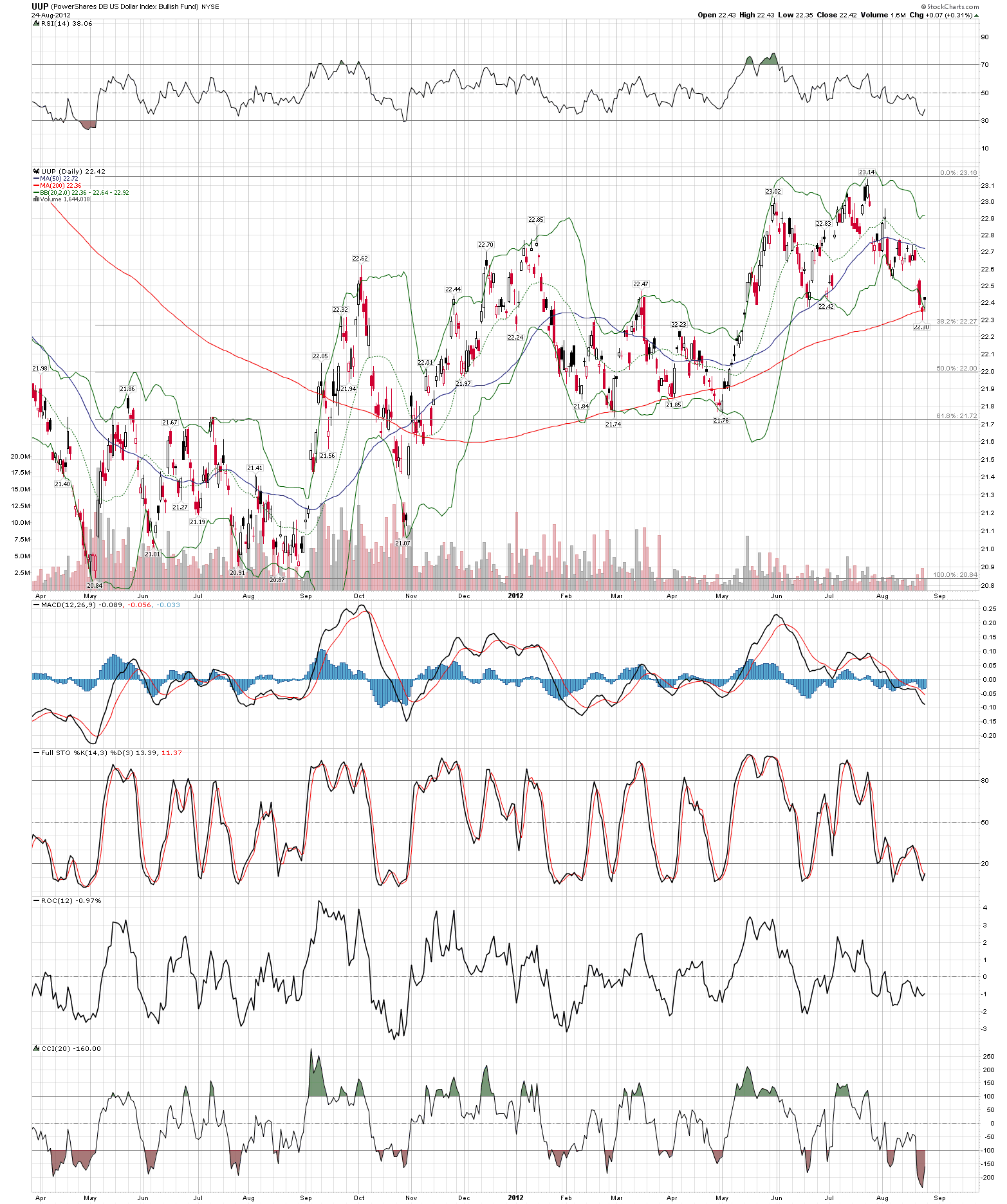

The USD had a decent day, showing some strength. AUD/USD dropped back into the 1.0390-1.0430 zone. A break to the downside should lead us back to the 50% fib level at 1.0235 pretty soon. USD/CAD traded stable on the day, exceeding this week's high will take it back up to the important 1.0030 level. USD/SEK with some interesting action, battling out that bottom right now. I think it did really well on the day and we are probably looking at the bottom there. EURUSD produced a down day after that recent run, nothing special there, it remains a sell and should drop back to 1.20 rather sooner than later. GBP/USD had also quite a decent drop today after squeezing into the 1.59(!) area. It remains a massive sell. USD/MXN is slowly looking to break out of the consolidation zone, it has been steadily improving over the last few weeks, I remain bullish on that pair as I do for the USD in general. As long as the June low at 81.16 holds I see no reason to not be long USD. By now the USD is heavily oversold, I actually believe short USD positions are very risky now.

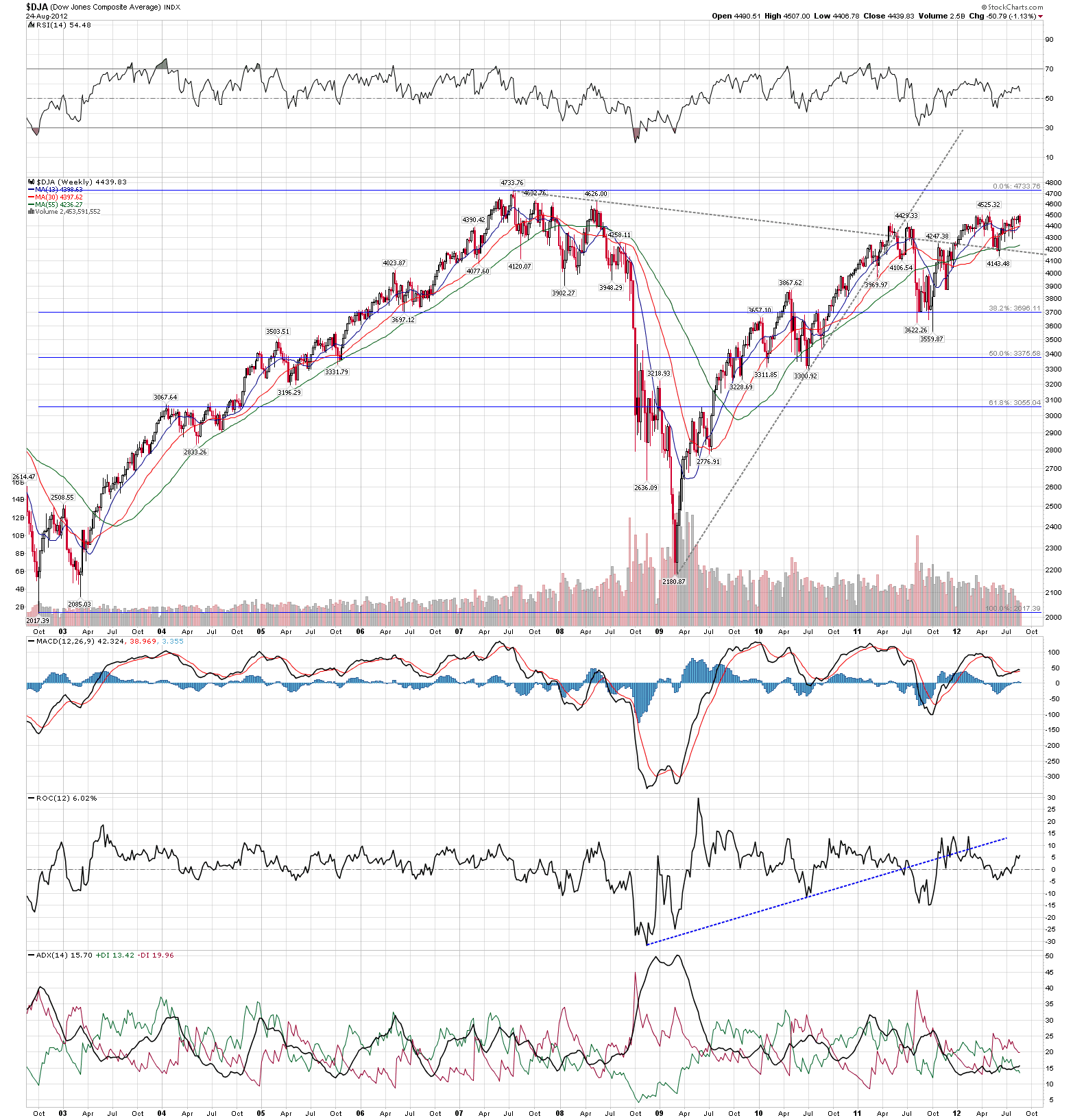

Stocks finally produced a red candle on the week. Of course it wasn't meant to be deep red, the "invisible hand" lifted the DAX as soon as it ran into my initial target zone of 6880/90, SPX did not get a chance to touch on 1395 either. I regard this as merely postponed to next week, nothing more.

T-Bonds and Bunds were very bid this week, the buying was almost relentless. I have mentioned it on may occasions, these two will keep going. I would not touch them with a tweezer but I do not want to sell them either. It's pure insanity of course but in the end the whole shop is still (and only) holding together as long as the bonds of the few solvent nations remaining trade in the green. It's "peak gov" and that will go on for the time being.

In the end, it's been a slow week, the market is still refusing to deal with reality. At some point in the near future that is likely to change and if it doesn't precious metals will go on a crazy run. The European periphery has shown how important the bond markets are to all heavily indebted western "democracies", I do not think Merkel & Co want to take excessive risk on that for the time being. Nothing will happen fast and only things will happen that Bunds will be able to stomach. Therefore, stay defensive, sell rallies in stock indices and buy USD on dips. Although I think we have seen the "beef" in the recent run of precious metals, stay put there and always be ready to buy just in case..