Investing.com’s stocks of the week

More signs of trouble.

We’ve been told countless times that Europe was “fixed.” The problem is that the market is beginning to realize it's just not true.

Euro's In Trouble

Much of the European recovery counts on Germany. The ECB owns the printing presses… but without Germany’s support, the Euro is done for.

However Germans are only going to be supportive of the Euro up to a point. That point is when the German economy contracts enough that Germany has its own problems to deal with, rather than focusing on Europe’s.

Q4 Contraction

That point appears to be approaching. Germany’s economy contracted in the fourth quarter of 2012. The country has since seen its credit rating downgraded to A from A+ by Egan Jones.

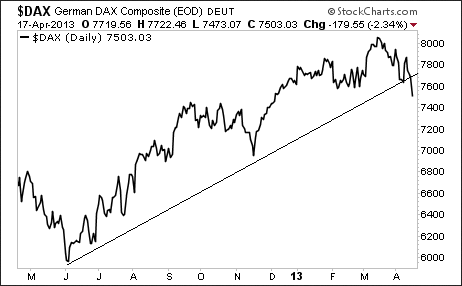

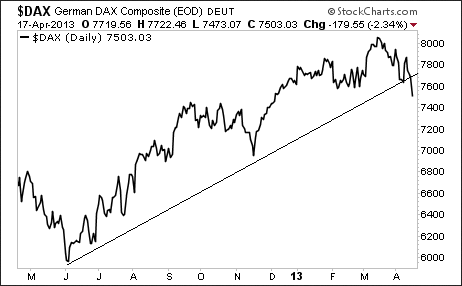

Germany's stock market -- the DAX -- has officially taken out its trendline from the June 2012 low when European Central Bank President Mario Draghi promised “unlimited bond buying” to support Europe.

Uh Oh

And that's bad news for the rest of Europe. With Angela Merkel up for reelection in September, Germany will be less likely to OK any more bailouts.

Europe better pray nothing goes wrong between now and then.

Contagion Watch

Watch the DAX and the Spanish Ibex. As noted in Monday’s market commentary, Spain is the European canary in the coalmine. If it starts to drop -- and the German DAX follows -- then the contagion is back.

Investors take note, the markets are sending multiple signals that things are not going well in the world.

Best Regards, Graham Summers

We’ve been told countless times that Europe was “fixed.” The problem is that the market is beginning to realize it's just not true.

Euro's In Trouble

Much of the European recovery counts on Germany. The ECB owns the printing presses… but without Germany’s support, the Euro is done for.

However Germans are only going to be supportive of the Euro up to a point. That point is when the German economy contracts enough that Germany has its own problems to deal with, rather than focusing on Europe’s.

Q4 Contraction

That point appears to be approaching. Germany’s economy contracted in the fourth quarter of 2012. The country has since seen its credit rating downgraded to A from A+ by Egan Jones.

Germany's stock market -- the DAX -- has officially taken out its trendline from the June 2012 low when European Central Bank President Mario Draghi promised “unlimited bond buying” to support Europe.

Uh Oh

And that's bad news for the rest of Europe. With Angela Merkel up for reelection in September, Germany will be less likely to OK any more bailouts.

Europe better pray nothing goes wrong between now and then.

Contagion Watch

Watch the DAX and the Spanish Ibex. As noted in Monday’s market commentary, Spain is the European canary in the coalmine. If it starts to drop -- and the German DAX follows -- then the contagion is back.

Investors take note, the markets are sending multiple signals that things are not going well in the world.

Best Regards, Graham Summers