It is still one month until Oktoberfest is will take over Germany, but it seems the preparations are already in place. This young lady has been practicing her 10 liter curls and the stock market is on the edge of a breakout to the upside. What a combination.

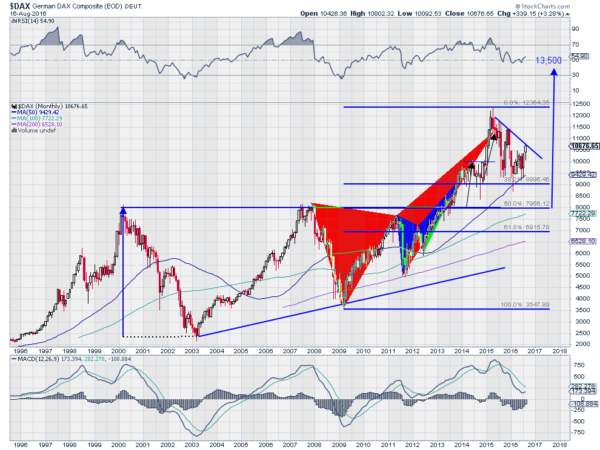

The chart below shows the German DAX Composite over the last 20 years. The two red triangles highlight a Deep Crab harmonic pattern that played out from 2008 until it reached the Potential Reversal Zone (PRZ) in early 2015. This calls for a 38.2% retracement of the pattern and it achieved that at the start of 2016 as it retouched the rising 50 month SMA.

Since then it has reversed higher. August finds it at falling trend resistance with two weeks of trading left. This will be the key signal. A break and close over this trend line is a buy signal. It is backed up by momentum indicators. The RSI is turning back higher at the mid line and the MACD has bottomed and is curling up towards a bullish cross.

Broadening out the view, the Composite had been in an ascending triangle formation, creating tightening support against resistance near 8000 from 2000 until 2013. The break of that triangle gives an upper target on the move to about 13,500. A possible 3000 point move on the DAX. Yes, that is worth raising a stein.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the blog, please see my Disclaimer page for my full disclaimer.