The 17-nation currency bloc GDP contracted by 0.2 percent on the quarter, data showed. Despite Germany showed a growth of 0.3 percent however, economists said could soon be snuffed-out. Worse is likely to come and even Europe's largest economy is unlikely to defy gravity for long unless decisive action is taken to tackle the bloc's debt crisis, economist added. Growth turned out to be pretty solid and good. But this could be the last positive piece of news out of Germany for some time. The German economy could contract in the summer.

It is fundamentally in good structural shape but can't decouple from the recession in the euro zone, plus the global economy has also shifted down a gear. Meanwhile, for France, it was the third consecutive quarter of zero growth. The central bank has already said it expects a mild contraction in the third quarter. Austria and the Netherlands almost matched Germany's performance, each posting growth of 0.2 percent. But Finland, one of Germany's northern European allies in pushing for austerity, suffered a 0.7 percent year-on-year fall in GDP. For the countries at the sharp end of the debt crisis, the picture is bleaker still and as economies shrink, so do tax revenues, making deficit-cutting even harder to achieve. Bailed-out Portugal's recession deepened with GDP diving by 1.2 percent on the quarter and Cyprus contracted by 0.8 percent.

Figures released showed deficit-cutting measures helped to shrink Greece's economy 6.2 percent year-on-year in the second quarter. Italy's second quarter data last week showed the economy contracted 0.7 percent quarter-on-quarters, compounding the difficulties for Mario Monti’s technocrat government as it tries to avoid a bailout. Spain's economy shrank 0.4 percent over the same period, pushing it deeper into recession. EUR/USD" title="EUR/USD" width="1227" height="582">

EUR/USD" title="EUR/USD" width="1227" height="582">

GBP/USD

U.K. inflation unexpectedly accelerated in July for the first time in four months as airfares increased and there was some unwinding of early summer discounting by clothing stores. Consumer prices rose 2.6 percent from a year earlier, compared with 2.4 percent in June, the Office for National Statistics said in London. The pound extended its advance against the dollar after the data and was trading at $1.5725 up 0.2 percent on the day. Consumer prices rose 0.1 percent in July from June, according to today’s report.

Clothing and footwear prices dropped 2.6 percent after a 4.2 percent drop in June, a record for that month. The statistics office said there was anecdotal evidence that stores had brought forward summer sales. British stores brought forward discounting amid the wettest June on record to lure shoppers whose confidence is being undermined by a double-dip recession and the euro-area debt crisis. The economy shrank 0.7 percent in the three months through June, the third consecutive quarter of contraction. In addition to clothing, there was an upward impact on inflation from transport, particularly airfares, which surged 22 percent on the month, the biggest July increase since 2004.  GBP/USD" title="GBP/USD" width="1227" height="582">

GBP/USD" title="GBP/USD" width="1227" height="582">

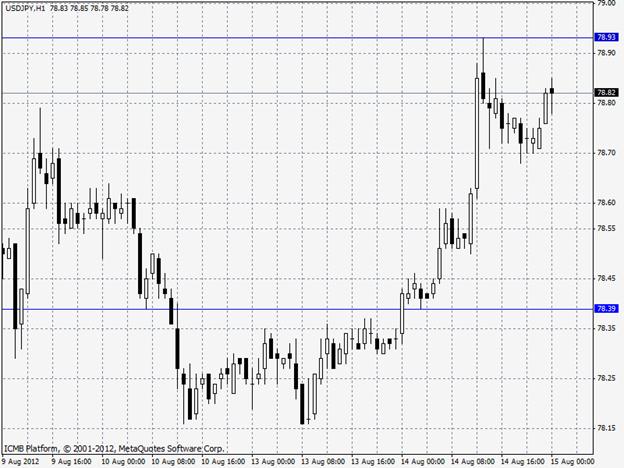

USD/JPY

Japanese stocks rose, with the Nikkei Stock Average rising the first time in three days, as minutes from the Bank of Japan showed policy makers weren’t ruling out any options to boost the economy and on expectations U.S. retail sales rose in July. Uniden Corp., an electronic equipment maker that counts North America as its biggest market, climbed 5.9 percent. Makita Corp., a maker of power tools that gets more than 40 percent of its sales in Europe, rose 1.9 percent after the yen weakened.

Keisei Electric Railway Co. soared 6 percent after its price estimate was raised by Nomura Holdings Inc. Nippon Yusen K.K., Japan’s top shipping line, slid 1.7 percent after the sector’s rating was cut to neutral by JPMorgan Chase & Co. The Nikkei 225 rose 0.5 percent to 8,929.88 at the 3 p.m. close in Tokyo. Volume was about even with the 30-day average even as many traders took the week off for the O-bon holiday. The broader Topix Index added 0.4 percent to 749.53 with more than three times as many shares advancing as falling.  USD/JPY" title="USD/JPY" width="1227" height="582">

USD/JPY" title="USD/JPY" width="1227" height="582">

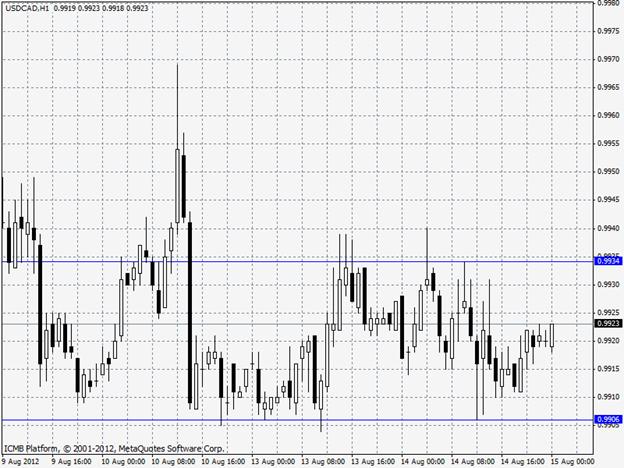

USD/CAD

Canadian Natural Resources Ltd., the country’s worst-performing major energy stock this year, is sitting on its shale-gas reserves until the price rebounds rather than joining the race to export the fuel to Asia. Canadian Natural is the second-largest landholder in British Columbia’s Montney gas region, which holds an estimated 49 trillion feet of gas near the Pacific Coast. Encana Corp. and Royal Dutch Shell Plc lead companies proposing at least eight LNG projects to export the gas to Asian buyers who are paying as much as nine times the domestic price, which is near decade lows. Backing an LNG terminal doesn’t make sense as Canadian Natural has “enough projects” on its plate, including an expansion of its Horizon oil-sands project north of Fort McMurray, Alberta, Laut said. Costs tied to the expansion, about 755 kilometers (470 miles) northeast of Calgary, account for 23 percent of Canadian Natural’s 2012 budget while gas spending in North makes up 8 percent.  USD/CAD" title="USD/CAD" width="1227" height="582">

USD/CAD" title="USD/CAD" width="1227" height="582">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Germany Economy Could Contract This Summer

Published 08/15/2012, 06:09 AM

Updated 04/25/2018, 04:40 AM

Germany Economy Could Contract This Summer

EUR/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.