AZZ Inc. (NYSE:) currently seems to be a smart choice for investors seeking exposure in the manufacturing electronics space. Solid fundamentals and positive revision in earnings estimates are reflective of healthy growth potential of the stock.

This Fort Worth, TX-based company currently carries a Zacks Rank #2 (Buy) and has a VGM Score of A. It belongs to the Zacks Manufacturing - Electronics industry, which belongs to the broader Zacks Industrial Products sector.

We believe that technological advancement in manufacturing processes, favorable changes in tax policies and growth in e-commerce business have been benefiting the industry.

Below we discussed why investing in AZZ will be a smart choice.

Share Price Performance, Impressive Earnings Outlook: Market sentiments seem to be working in favor of AZZ over time. Year to date, the company’s share price has gained 8.1% compared with the industry’s growth of 4.6%.

It is worth mentioning here that AZZ reported earnings of $1.96 in fiscal 2019 (ended Feb 28, 2019), above $1.73 recorded in fiscal 2018.

For fiscal 2020 (ending February 2020), the company anticipates gaining from healthy segmental growth opportunities, acquired assets and its digital galvanizing systems (DGS) initiatives. Earnings in the fiscal year are predicted to be $2.25-$2.75, above $1.96 earned in fiscal 2019.

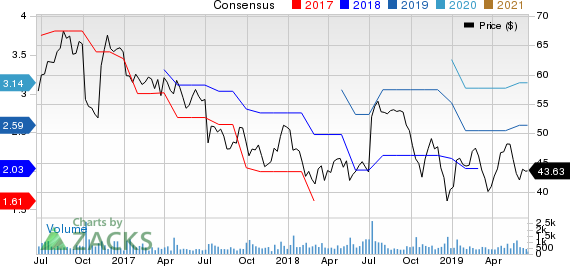

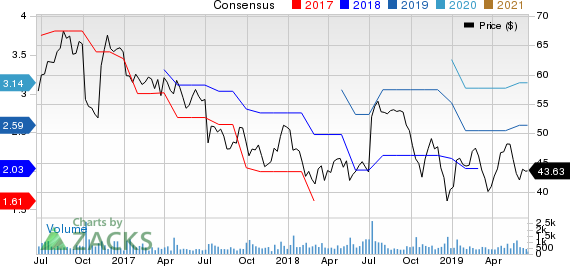

In the past 30 days, earnings estimates for the company in fiscal 2020 and fiscal 2021 (ending February 2021) have been revised upward, reflecting positive sentiments about its growth prospects. Currently, the Zacks Consensus Estimate for earnings is pegged at $2.59 for fiscal 2020 and $3.14 for fiscal 2021, suggesting growth of 2.8% and 2.3% from the respective 30-day-ago figures.

AZZ Inc. Price and Consensus

AZZ Inc. price-consensus-chart | AZZ Inc. Quote

Top-Line Strength: AZZ reports results under two segmental heads — Energy and Metal Coatings. In fiscal 2019, the company’s revenues increased 14.4% year over year while its bookings improved 32.4%. Backlog stood solid at $332.9 million at the end of fiscal 2019, reflecting 25.4% growth over the previous year.

For fiscal 2020, the company anticipates that refinery turnaround in North America will benefit its Energy segment. Metal Coatings are likely to gain from AZZ’s sales and marketing initiatives. Annual sales in the year are predicted to be $950-$1,030 million, up from $927 million recorded in fiscal 2019.

Shareholder-Friendly Policies, Buyouts: The company remains committed to rewarding shareholders handsomely through dividend payments and share buybacks. In fiscal 2019, it refrained from purchasing treasury stocks while paying dividends totaling $17.7 million.

It is worth mentioning here that the company announced to have received authorization to buy back $20 million worth shares in November 2018.

Beside using its capital for rewarding shareholders, AZZ believes in making acquisitions to fortify its product portfolio and enhance growth opportunities. During fiscal 2019, the company successfully integrated assets — including Rogers Brothers Company, Powergrid Solutions, Inc. and Enhanced Powder Coating Ltd. — acquired in fiscal 2018 (ended February 2018). Moreover, the company acquired Lectrus Corporation in March 2018 (reported under the Energy segment).

In April 2019, AZZ acquired Tennessee Galvanizing Inc. and K2 Partners Inc. These assets were added to the company’s Metal Coatings business.

Debt Profile: AZZ’s long-term debt was approximately $240.7 million at the end of fiscal 2019, reflecting a decline of 16% from the previous year. The company’s debt profile is better than the industry. Its long-term debt/capital of 6.4% is significantly lower than the industry’s 27.5%.

Other Key Picks

Some other top-ranked stocks in the Zacks Industrial Products sector are Chart Industries, Inc. (NASDAQ:) , DXP Enterprises, Inc. (NASDAQ:) and RBC Bearings Incorporated (NYSE:) . While Chart Industries currently sports a Zacks Rank #1 (Strong Buy), DXP Enterprises and RBC Bearings carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, earnings estimates for all these three stocks have improved for the current year. Further, average earnings surprise for the last four quarters was positive 16.56% for Chart Industries, 48.47% for DXP Enterprises and 8.36% for RBC Bearings.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>