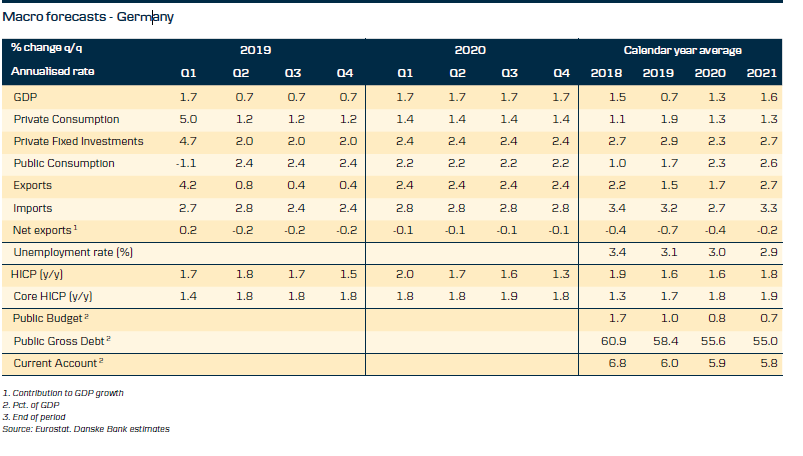

In the near-term a rocky road still lies ahead for the German economy with renewed headwinds to external demand, but over time we expect the growth pace to gather some speed reaching 1.6% in 2021.

The domestic side of the economy remains fairly resilient and rising real wages and fiscal stimulus should continue to underpin growth.

We project core inflation pressures to continue to build up in light of a strong labour market and dynamic wage growth.

Many risks to the growth outlook for the German economy continue to linger from the external side, the most prominent remaining the threat of US car tariffs.

In stormy waters

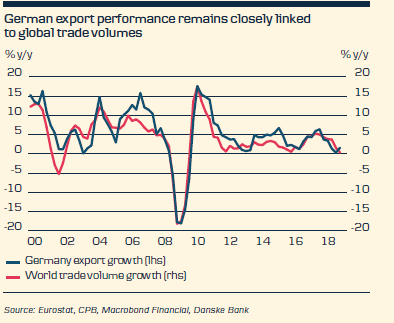

The German economy has been at the epicentre of the euro area slowdown, finding itself caught in the crosswinds of the US-China trade war and ensuing decline in global trade growth. Although the export-dependent economy narrowly avoided a recession in Q4, a rocky road still lies ahead with renewed headwinds to external demand. This expectation is also reflected in our GDP growth forecasts, which see the German economy expanding by only 0.7% in 2019 (1.7% previously) and 1.3% in 2020, with some acceleration in 2021 back to potential growth at 1.6%.

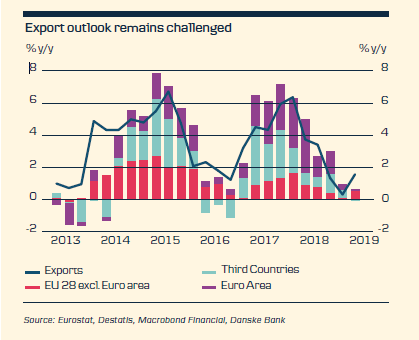

A slowdown in global trade volumes on the back of rising protectionism and weaker growth in key export markets such as Turkey, China and the UK has taken its toll on the export-driven German manufacturing sector. Export growth came more or less to a halt at the end of 2018, as both extra- and intra-euro area trade slowed steeply. Added headwinds came in the form of bottlenecks in the car sector related to new emission test procedures (WLTP) and significant transport problems caused by a low water level in the Rhine river in Q4, which alone are estimated to have dragged GDP growth down by some 0.4pp in Q3 and 0.3pp in Q4. Although water levels have returned to normal, another dry spell in the summer could reignite the problem in the autumn of 2019 and, while car manufacturing and exports have improved from the trough in Q3, both have yet to return to previous levels. The sluggish recovery in the car sector might also reflect structural changes that will remain a headache for the industry in coming years, such as driving bans on diesel cars in a growing number of German cities and shifting consumer preferences towards electric and hybrid cars, where Volkswagen (DE:VOWG_p), Daimler, BMW and co. have long remained dormant and are now lagging behind international competitors.

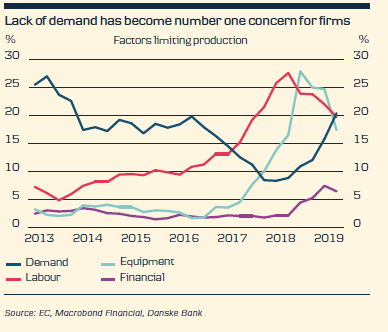

Whereas labour shortages and capacity constraints were firms’ top worries at the start of 2018, a lack of demand has now become the main factor limiting production according to business surveys. Combined with more uncertainty on the global trade front, this leaves us expecting a more moderate pace of export growth ahead, as many German companies are highly integrated into global value chains and we believe collateral damage will be difficult to avoid. In theory, the US-China trade conflict could also lead to positive spill-over effects for Europe, as trade flows are diverted to products and countries not affected by the tariff hikes (the so-called ‘substitution effect’). However, we expect this effect to be limited, as the German export performance remains highly correlated with global trade volumes.

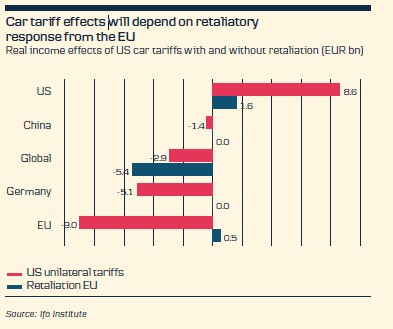

Despite the US decision to extend the deadline for car import tariffs until the end of the year, as negotiations over a trade agreement with the EU on industrial goods are ongoing, it remains a significant downside risk for the German economy in 2020. Germany is the fourth-largest car exporter to the US, accounting for some 8% (EUR28.5bn) of total US car imports in 2018. According to an ifo study, just the direct effects of a 25% tariff hike could reduce German real GDP by around EUR- 5bn (0.2% of GDP). However, the economic effects will depend not least of all on the retaliatory response from the EU side.

Labour market strength remains key

While the 2018 growth weakness can be attributed mainly to supply-side issues and weaker external demand, the domestic side of the economy remained fairly resilient. This said, private consumption growth still stagnated in H2, as car sales cooled due to production bottlenecks and consumers reacted to the rising economic uncertainty by saving a larger share of their income, with the savings rate standing at 18.3% in Q4 18 (the highest level since 1999). We expect private consumption to remain the most important growth driver, supported by rising real wages and a stabilising savings rate in light of the continued strong labour market situation.

In our view, a buoyant construction sector (that remains supported by government initiatives to spur residential building and infrastructure investments) and low financing conditions will continue to underpin the investment outlook. However, we remain sceptical about whether the current pace can be maintained in light of growing uncertainty about global sales prospects, declining margins and biting capacity constraints in the construction sector.

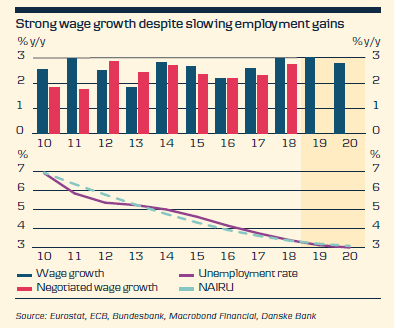

Despite the cooling growth momentum, employment growth has remained dynamic, with the unemployment rate at 3.2% in Q1 19, remaining below the NAIRU. We see scope for the unemployment rate to decline further to 3.0% in 2020 but compared with previous years, we expect job creation to slow down. The tight labour market and increasing labour shortages gave rise to higher negotiated wage agreements in 2018, taking nominal wage growth to its highest rate since 1995. We expect wage growth to remain elevated at 3.0% in 2019 but flatten out somewhat in 2020 at 2.8%, as both wage drift and negotiated wage growth abate. We project core inflation pressures to continue to build up in light of dynamic wage growth, reaching 1.7% in 2019, while we expect headline inflation to decline to 1.6% due to moderating energy prices.

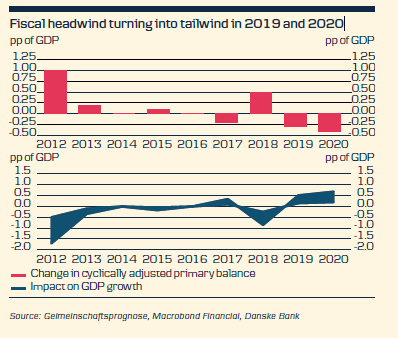

While we believe households’ spending power will continue to benefit from real wage gains, we expect fiscal policy to become an additional tailwind for the growth outlook. However, government measures remain heavily skewed towards supporting household incomes rather than ramping up public investment, despite crumbling transport infrastructure. In total, we expect fiscal policy to lift GDP growth by 0.4-0.6pp over the coming two years, with around one-third of the fiscal easing achieved directly through higher public consumption growth (mainly through higher spending on defence, police personnel, kindergartens and other public investments).

Is Europe’s growth engine heading for recession? As long as the domestic side of the economy remains underpinned by strong fundamentals, notably the labour market and private and public consumption, we still do not think so. However, the resilience of the employment-consumption relationship remains an important precondition. The manufacturing sector in particular remains vulnerable to a trend shift in employment dynamics, with the recent high collective wage agreements increasingly at odds with the waning order situation. Many risks to the growth outlook for the German economy continue to linger from the external side, where further escalation in the US-China trade conflict and the risk of a no-deal Brexit could exert a stronger drag on the economy than initially expected. Additionally, policy uncertainty is looming in the background, with the current CDU/CSU-SPD grand coalition remaining a fragile truce.

Fiscal policy – loosening the brake

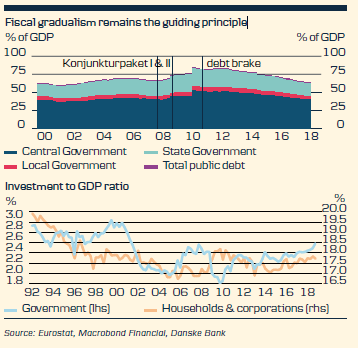

During the global financial crisis the German government launched two ‘Konjunkurpakete’ (fiscal stimulus packages) totalling some EUR73bn. Although the packages helped to cushion the economic downturn, they also left sizable holes in state coffers. To bring public debt back on a downward trend the so called ‘debt brake’ came into force in 2011, which restricts structural deficits to a maximum of 0.35% of GDP.

While the debt brake has suceeded in reversing the debt dynamics it has also been blamed for aggravating Germany’s infrastructure problems, with crumpling bridges, traffic jams and capacity constraints in the railway system becoming ever more pressing. Although the public investment share has crept up somewhat since 2016, it remains well below the levels observed in the 1990s. As the German growth engine has started to stutter and borrowing costs remain at rock bottom, discussions about a loosening of the debt brake have gathered pace.

However, although the fiscal situation remains favourable in the euro area comparison – with a budget surplus of 1.7% in 2018 and public debt close to 60% of GDP – the weaker growth outlook already leaves a EUR10.5bn gap in the budget until 2023 according to the finance ministry. Furthermore, changes to the debt brake require a change to the constitution which seems unlikely at the current stage as it lacks support from a two-thirds majority in parliament. In light of this we expect the threshold for additional fiscal stimulus to be high. However, should the outlook for 2020 start to weaken materially and the economy edge closer to recessionary territory, we would be surprised to see politicians just sitting on their hands.