Forex News and Events

German ZEW weakens

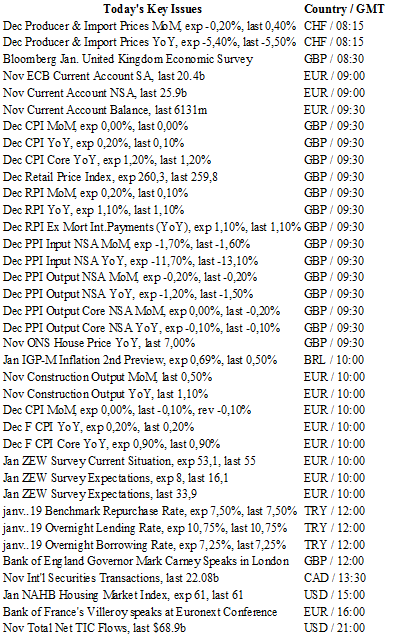

Over the last three months German ZEW expectations have bounced back on hopes of a global recovery. Yet, global turmoil is far from being over. China is in the middle of a financial crisis which is weighing on overall sentiment. The ZEW has printed in this morning at 10.2 points, but way below December data which came at 16.1.

Earlier this morning, final German inflation data for December was released and remains at 0.3% year-on-year. Yet, we believe that the decline in energy prices should weigh more heavily on Germany's CPI. The fundamentals remain positive as Germany has been able to run a budget surplus for the past three years. Concerns persist as November retail sales and exports printed below expectations at 2.3% y/y vs 3.7% y/y and 0.4% m/m vs 0.5 m/m. Weakening German conditions could trigger discussions about further easing by the ECB, although not at this week’s meeting. We remain bearish on the EUR/USD and we target the pair to head back towards 1.0800.

HKD sell-off but no de-peg

USD/HKD continues to rally reaching a 7.8093 high today. Aggressive selling for the HKD regained momentum after China announced that GDP grew 6.9% (in-line). Hong Kong’s close ties with China have caused investors to link the two nation’s currencies. China’s weaker growth, expected capital outflows and devaluation are also expected to become Hong Kong problems. Within the three-decade old currency peg regime, the value of the USD/HKD can fluctuate within a 7.75 to 7.85 band. This current move feels more like positioning rather than a shift in sentiment over Hong Kong economic fundamentals or change in policy. In addition, given the real HKD effective exchange rate and inflation differentials with the US, this does not warrant significantly higher USD/HKD. Hence, we do not see the Hong Kong Monetary Authority abandoning the peg any time soon. Furthermore, we suspect that the China proximity argument is weak and a devalued CNY should not necessarily trigger HKD selling. The HKD peg has been extremely positive for Hong Kong’s prosperity by providing stability and allowing the nations to become a hub of international finance. Monetary conditions in Hong Kong remain accommodating with the spread between US-HK interbank rates favouring the US by 17bp. Further capital outflow (estimated at $300bn) will need to leave before liquidity conditions tighten and push up short-term HIBOR.

The Risk Today

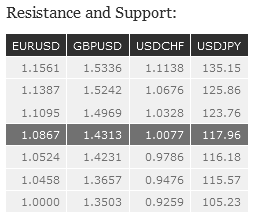

EUR/USD EUR/USD lies in a short-term uptrend channel. Hourly resistance may be found at 1.1096 (28/10/2015 low) while hourly support can be found at 1.0524 (03/12/2015). Expected to show further increase. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD GBP/USD has bounced before testing key support at 1.4231. Hourly resistance is given at 1.5242 (13/12/2015 high). Stronger resistance can be found at 1.5336 (19/11/2015 high). Expected to show further monitoring of the support at 1.4231. The long-term technical pattern is negative and favours a further decline towards the key support at 1.4231 (20/05/2010 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY USD/JPY is trading sideways. Hourly resistance lies at 123.76 (18/11/2015 high). Expected to show further decline towards hourly support at 116.18 (24/08/2015 low). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF USD/CHF's uptrend momentum keeps going as long as the pair remains in the upward channel. Hourly support is located at 0.9876 (14/12/2015 low) while hourly resistance can be found at 1.0125 (05/01/2015 high). Expected to monitor hourly resistance at 1.0125. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.