During the day on Monday, the first announcement that will be worth watching is the Swiss unemployment rate. It is anticipated to come out at 3%, and this will more or less only affect the USD/CHF pair, and as a result unless you are trading at Forex market pair, it’s very likely that this announcement won’t do much for you. However, if we get strong Swiss employment numbers, we could see a little bit of a dip for the short-term move.

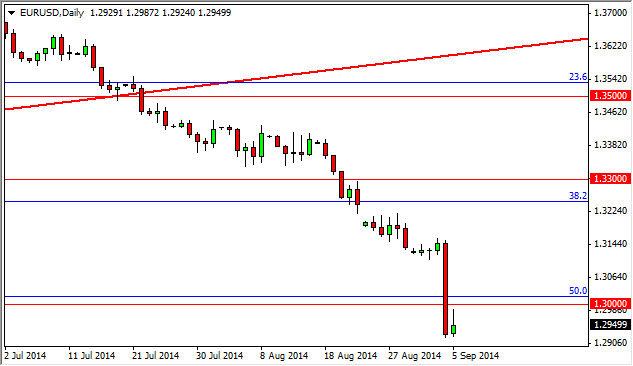

The German Trade Balance numbers come out shortly after that, anticipated to be at €16.8 billion. Any disappointment in that number will more than likely add continued downward pressure to the EUR/USD pair, which closed at roughly 1.2950 for the week. With that, we believe that the market is still heading down to the 1.28 handle, and as a result the Euro simply should be shorted every time it rallies. On the other hand, the DAX might be a different story as the more the likelihood of easing comes along by the ECB, the higher the DAX should go overall.

In Australia, we have the NAB Business Confidence numbers, which will more than likely only of fact the AUD/USD pair, which is currently range bound. We see a floor at the 0.9250 handle, and a ceiling at the 0.95 handle. In the meantime, we anticipate the market to bounce around there, but could see a little bit of a movement based upon the aforementioned Business Confidence announcement. At the end of the day though, this market is going to be technically driven at best for Monday, and therefore we do not think there’s much in the way of economic announcements to move this marketplace.