iShares S&P GSCI Commodity-Indexed (NYSE:GSG) continues its transformation from venture capital (VC) investment company into an asset manager and marketplace. The secondary share trading platform G|S Market (GSM) set up in 2018 has yet to prove its success and grow in scale. GSG guides to H119 revenue growth of more than 30% y-o-y for its fully consolidated digital media and software subsidiary, Exozet. The proposed sale of its stake remains under consideration. In May 2019, GSG co-founded a start-up aimed at the tokenisation of assets using blockchain technology; the first token (the digital representation of a share in the asset) should be issued later in 2019 and placed via GSM. The successful business model transformation could potentially provide cash flow from commission fees and compress the discount to NAV, which we calculate is 40%.

Deferred tax write-down pushes profits into the red

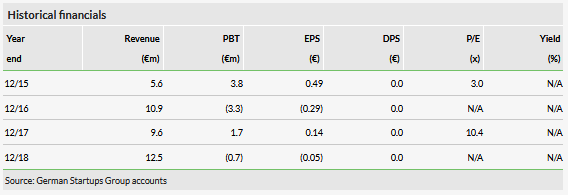

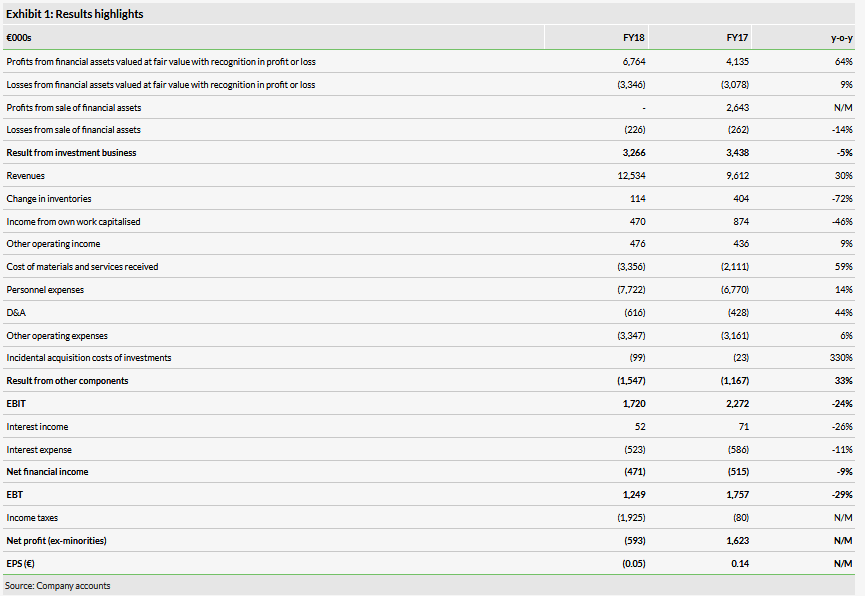

GSG reported basic loss per share of €0.05 in FY18 vs €0.14 profit in FY17. Excluding the €2.0m write-down on deferred tax, fully diluted EPS amounts to €0.10 – a 24% y-o-y decrease. In FY18, financial results were driven by revaluations on portfolio holdings triggered mostly by follow-on funding rounds (€3.4m vs €1.1m in FY17), as exits from Friendsurance and reBuy delivered €1.6m cash inflow, and a €0.2m loss on a sale. In total, during FY18 GSG invested €3m in follow-on funding rounds and an initial investment in Chrono24.

Strategy: Digital disruption company building

GSG is transitioning to an asset manager and marketplace with its secondary shares trading platform GSM, set up in 2018, reporting on the first transactions. Apart from the potential co-operation with SharesPost, a further boost to platform development could be provided by tokenised assets. In May 2019, GSG co-founded German Crypto Tech (taking a 10% stake), which will offer the tokenisation of assets. The first private placement – tokens in a Berlin apartment building in co-operation with German Property Berlin – will be facilitated on GSM later in 2019.

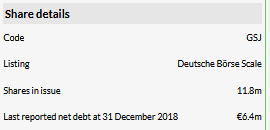

Valuation: Continues to trade at a discount to NAV

GSG’s current share price of €1.46 represents a 40% discount to NAV at end-2018 (based on the book value of equity ex-minorities). Importantly, the NAV may be out of date as the revaluation of minority holdings occurs mostly on transactions. GSG bought back 230k shares in FY18 at an average price of €1.87 and is buying back up to 300k shares (2.6% of shares in issue) at €1.50 per share, planned to conclude on 8 July.

Edison Investment Research provides qualitative research coverage on companies in the Deutsche Börse Scale segment in accordance with section 36 subsection 3 of the General Terms and Conditions of Deutsche Börse AG for the Regulated Unofficial Market (Freiverkehr) on Frankfurter Wertpapierbörse (as of 1 March 2017). Two to three research reports will be produced per year. Research reports do not contain Edison analyst financial forecasts.

Business description

German Startups Group is a Berlin-based venture capital investment company primarily focused on providing investment to technology businesses in German-speaking countries. With the launch of its secondary shares trading platform, the company started the transition to a wider business model, including marketplace.

Financials: Net loss on write down

GSG’s basic loss per share in FY18 was €0.05 vs €0.14 profit in FY17. The results were burdened by writing down deferred taxes capitalised in 2013–16 by €2.0m. Excluding the write down, EPS was €0.11, 19% lower y-o-y. Taking into account possible future dilution due to convertible bonds issued in 2018 (10% at a conversion price of €2.5033 per share), adjusted EPS is €0.10. Nonetheless, the company is convinced that, in medium term, the tax loss carried forward should deliver value above its book value.

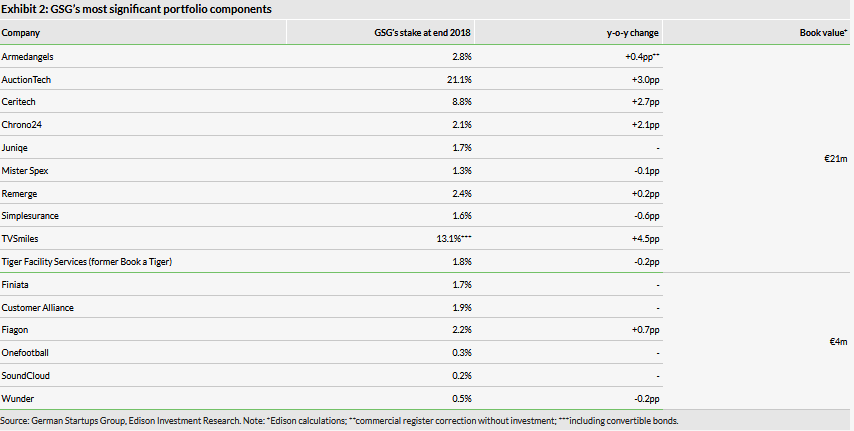

The investment business delivered a profit of €3.3m, 5% lower than in FY17, which was driven by revaluations, as actual loss from the sale of assets amounted to €0.2m (FY17: €2.4m profit). The net revaluation profit was to €3.4m vs €1.1m in FY17. In line with earlier announcements, the company focused on follow-on financing rounds in existing portfolio holdings and in FY18 completed additional investments in Ceritech, AuctionTech, TVSmiles, Remerge and Fiagon. Together with the initial investment in Chrono24 (see our May 2018 update note), GSG invested a total of €3.0m during FY18 (H118: €3.0m; FY17: €1.3m). In FY18, GSG sold its stakes in Friendsurance and reBuy with total book value of €1.6m.

FY18 revenue was €12.5m (30% growth y-o-y), mostly generated by its fully consolidated subsidiary, Exozet. The investment segment reported revenues of €72k, which included the first revenues from fees on trades made on GSM. GSG’s EBIT amounted to €1.7m (down 24% y-o-y), a result of lower profits from the investment business, higher costs due to the development of the GSM platform and lower profitability in the Exozet Group. Exozet’s EBIT amounted to €84k, implying 0.7% EBIT margin, vs €409k and 4.3% in FY17.

In June 2019, GSG announced that it expects Exozet’s revenue to be 30% higher in H119 vs H118, which implies c €6.8m in sales – 55% of the FY18 figure. GSG is considering selling its holding in Exozet, but as yet no binding decisions have been made. In 2018 GSG conducted negotiations on a potential sale, but these were put on hold. In its initial release from May 2018, GSG announced the offer price would translate into a revaluation gain vs book value of around €1.0m, a €1.5m profit on the initial acquisition price and a low single-digit €m cash inflow.

After the reporting date, GSG also announced revaluations on its portfolio companies, which will affect H119 results, although it did not disclose which companies were subject to revaluations. The upward €1.0m change in valuations was partially offset by a €0.7m downward revaluation in another company, resulting in a minimal impact on GSG’s financial results. The sale of a 40% stake in a portfolio company for €1.7m should not have a significant impact on the results as GSG’s states it was sold at close to book value. The proceeds may be used to carry out further share buybacks (although this could negatively affect the stock’s liquidity), as management has indicated previously, or to make early repayments of its loans. At end-FY18, GSG’s consolidated net debt position was €6.4m (Edison estimate), implying a net debt to equity ratio of 21% compared to €2.5m and 8% at end-2017.

Business development: Entering the tokenisation era

At end December 2018, GSG’s portfolio consisted of 33 companies, down from 37 at end 2017. Of these, 16 are considered of ‘particular significance’ in terms of size and potential, accounting for 91% of the total portfolio value of €27.2m. The top 10 are considered ‘focus investments’ and make up 76% of total portfolio value. In 2018, GSG invested €3.0m, acquiring a 2.1% stake at Chrono24 (see our previous note) and performing follow-on investment rounds in Ceritech, AuctionTech, TVSmiles, Remerge and Fiagon. The most notable exits were Friendsurance and reBuy, realised at around book value as described above. After the reporting date, GSG announced that it had made another follow-on investment of €0.4m in AuctionTech (increasing its stake to 23.4% from 21.1% at end 2018 and 18.1% at end 2017) and a partial exit from one of its portfolio components (it sold 40% of its stake for €1.7m) in line with book value.

As described in our previous note, GSG is transitioning to an asset manager and marketplace. As a first step in achieving this objective, in Q218 it set up GSM, an online matchmaking platform for sellers and buyers of so-called secondary shares in German start-ups and VC funds. GSG aims to earn around 5% of the total volume traded on the platform in fees, which would deliver additional cash flow once trading on the platform reaches stable levels, in addition to GSG’s investments business profits. We believe the platform could also assist GSG’s own portfolio management activities, giving access to new investment opportunities, as well as working as a convenient exit route for its own investments. There are 14 investments available for sale listed on GSM, with a total offer value of €63m, of which €50m constitutes the offer for G|S Tech50 Fund, a passively managed VC fund that will invest in the top 50 highest-valued German start-ups and be managed by a majority-held subsidiary of GSG. The company announced that two transactions, with the value of each transaction exceeding €1m, took place on the platform in late 2018. Of the 10 assets on offer (excluding the undisclosed names and G|S Tech50 Fund), five are among GSG’s most significant portfolio constituents.

In May 2019, GSG co-founded the fintech start-up, German Crypto Tech. It obtained a 10% stake in the company with a call option for another 10% stake to assume the role of lead investor as well as other, undisclosed, pre-emption rights. German Crypto Tech will offer tokenisation of assets based on blockchain technology – a digital and divisible representation of shares in an asset that minimises exposure of sensitive data and reduces risk of unauthorised access. In turn this reduces compliance costs of storage and trading of given asset. The new entity aims to launch its first tokens in 2019 in co-operation with German Property Berlin. German Property Token (GPT) will be a tokenised Berlin apartment building so that token holders will possess shares in rent surpluses and changes in the property value. GSG will not be operationally involved in German Crypto Tech, but GPT will be included in GSM’s matchmaking offer, which could also create publicity for the embryonic platform. German Crypto Tech has positioned itself as an early mover in the market, which is expected to expand in the next few years and, according to the press release, GSG ‘commits little capital’ to the deal.

Valuation: NAV discount widens to 40%

GSG’s NAV (ex-minorities but including goodwill and intangibles) was €28.5m at end December 2018, translating into €2.43 on a per-share basis (Edison estimate). The 3.1% y-o-y decrease in NAV translated into only a 1.2% decrease on a per-share basis due to several share buybacks carried out during 2018. During FY18, GSG bought back a total of 230k shares at an average price of €1.87 per share vs the current share price of €1.46. However, the share price decrease has widened the discount to NAV to 40% currently vs 31% a year ago (see our note on FY17 results). GSG is conducting another share buyback, which it plans to conclude on 8 July 2019 (after extending the initial date of 24 June) and in which it can repurchase up to 300k shares at €1.50 per share (a 2.7% premium to the current price and a 3.4% premium to the closing price on the day before the announcement). The current NAV and discount are likely to be out of date, given that portfolio companies are mostly valued, where possible, by independent third-party transactions, which reflects the prices achieved in recent transactions and follow-on investment rounds. As described above, Exozet could provide upside to the NAV as its book value is not subject to revaluation due to it being fully consolidated. The company did not disclose the change in NAV relative to book value of the follow-on investment in AuctionTech, and the other post-balance sheet date developments described earlier in this note should have had limited impact on current NAV value.

At the end of December 2018, 74% of the total portfolio value was based on third-party valuations, with the average time elapsed since the last valuation of portfolio companies at 317 days (value weighted). Valuations of the remainder of the portfolio were altered to incorporate developments after the last third-party valuation date. Although the current discount to NAV is significant, we believe one of the reasons why is limited transparency on the performance of the portfolio companies, as GSG cannot disclose financial information on minority-held assets.

We should also consider the structure of the company as it operates as a partnership limited by shares (KGaA), with the partner entitled to a preferential profit payment of 25% from the amount of earnings exceeding commercial losses. The company calculates the possible profit advance (assuming all portfolio components are sold at NAV on 31 December 2018) is €0.4m, which translates to 3c per share compared to 8c at end June 2018 and 4c at end 2017.

In 2018 GSG issued €3m in convertible bonds, which could possibly result in future dilution. The bonds mature on 8 March 2023 and can be converted into 1.2m new shares at maturity with a conversion price of €2.50 per share (71% above the current share price). As the conversion price is only slightly higher than NAV per share at end-December 2018, the dilution should not translate into a significant change in our estimated NAV per share of €2.43, at the current portfolio valuation.