Hope for the euro has not been crushed completely by the actions of the ratings agency Standard and Poors in the past few days with it fighting back well yesterday. Surprisingly strong data from the German economy together with decent bill auctions from Spain, Belgium and the European Financial Stability Facility has put GBP/EUR back down towards the 1.20 level and EUR/USD has bounced back over the 1.28 mark. Sterling also took a leg lower as it was confirmed that inflation had dipped by the most since April 2009.

The main catalyst for the bounce back in risk was the German ZEW number. Investor confidence in the German economy jumped the most on record from -53.8 to -21.6. The reason behind this move was likely optimism over the EU policy response to the debt crisis, although this is obviously subject to the vacillations of politicians. While a near term negative output number is expected in Germany for Q4, a recession still looks unlikely and in 6 months’ time we suspect that the German economy will once again be showing the UK, for example, growth figures to be envious of. The debt crisis has not caused the Germans to lose their high quality goods or their levels of competitiveness; in fact a weaker euro is only going to make their exports cheaper and more competitive.

While Spain and Belgium both had debt sales yesterday it was the European Financial Stability Facility whose auction got the most attention yesterday. The fund had been downgraded on Monday by Standard and Poors yet still managed to sell 6 month money to a yield of 0.2664% which is only slightly higher than the previous auction and similar to the yields of French debt for the same term. Demand was strong however with 3x as much sold as was expected. The caveat to this is that the auction is of short term money and therefore is not really a reliable arbiter of the current economic position of the territory or entity concerned. We do have longer-term (4, 7 and 10yr auctions) sales from Spain tomorrow and should they prove to be negatively received they will do more damage to risk than the positive bill sales yesterday were able to conjure up.

The periphery nation that forms part of the PIIGS crew that we mention the least is probably Portugal. The country’s credit rating was cut to junk by S&P on Friday but this was lost in the hubbub and schadenfreude in covering the French reaction. Investors have been selling their positions in Portuguese debt heavily over the past few days and the marker now puts the probability of a default on Portuguese assets at around 65% over the next 5yrs. This is classic contagion theory and is based on the belief that Greece will default soon. Portugal sells short-term debt today at 10.30.

As was covered extensively on the news last night, the UK has seen CPI inflation slip by the most since April 2009 as clothing and food costs were cut in December to try and tempt people through supermarkets’ doors. CPI currently stands at 4.2% and fell from 4.8% in November. There will be a disconnect between the falling inflation and rising retail sales and consumer confidence by a couple of months and we must bear in mind that there are still pressures in jobs and credit markets that will hurt spending going forward. This number is a positive but 2012 is still going to be a difficult year however and as a result we believe this galvanises the Bank’s argument that further quantitative easing is necessary and will come down the slipway in February.

Apart from today’s unemployment data from the UK the calendar is quite quiet. We are with the consensus in expecting the unemployment rate to remain at 8.3% although clearly the risk is to the upside. There are also rumours that the talks between Greek politicians and the private sector investors in Greek debt may be coming to some form of climax today. This follows a break up of talks on Friday. An agreement would largely be seen as risk positive although it would depend on the scale of the haircut that these investors would have to swallow.

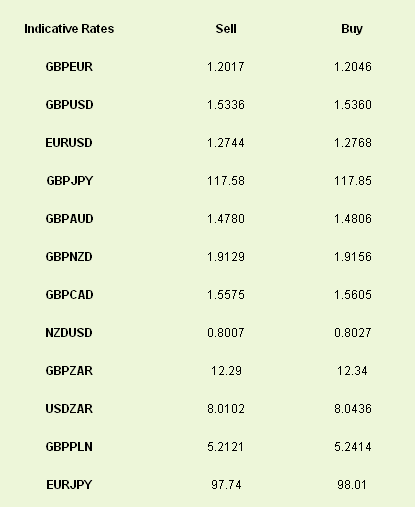

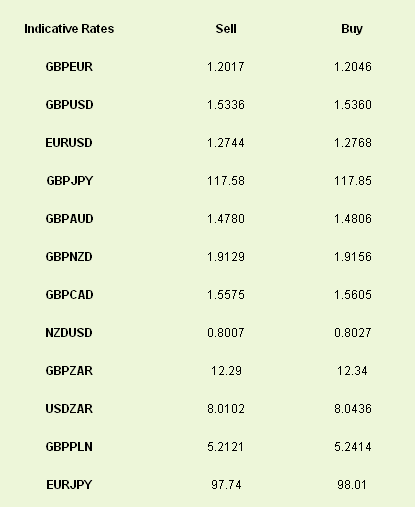

Latest exchange rates at time of writing

The main catalyst for the bounce back in risk was the German ZEW number. Investor confidence in the German economy jumped the most on record from -53.8 to -21.6. The reason behind this move was likely optimism over the EU policy response to the debt crisis, although this is obviously subject to the vacillations of politicians. While a near term negative output number is expected in Germany for Q4, a recession still looks unlikely and in 6 months’ time we suspect that the German economy will once again be showing the UK, for example, growth figures to be envious of. The debt crisis has not caused the Germans to lose their high quality goods or their levels of competitiveness; in fact a weaker euro is only going to make their exports cheaper and more competitive.

While Spain and Belgium both had debt sales yesterday it was the European Financial Stability Facility whose auction got the most attention yesterday. The fund had been downgraded on Monday by Standard and Poors yet still managed to sell 6 month money to a yield of 0.2664% which is only slightly higher than the previous auction and similar to the yields of French debt for the same term. Demand was strong however with 3x as much sold as was expected. The caveat to this is that the auction is of short term money and therefore is not really a reliable arbiter of the current economic position of the territory or entity concerned. We do have longer-term (4, 7 and 10yr auctions) sales from Spain tomorrow and should they prove to be negatively received they will do more damage to risk than the positive bill sales yesterday were able to conjure up.

The periphery nation that forms part of the PIIGS crew that we mention the least is probably Portugal. The country’s credit rating was cut to junk by S&P on Friday but this was lost in the hubbub and schadenfreude in covering the French reaction. Investors have been selling their positions in Portuguese debt heavily over the past few days and the marker now puts the probability of a default on Portuguese assets at around 65% over the next 5yrs. This is classic contagion theory and is based on the belief that Greece will default soon. Portugal sells short-term debt today at 10.30.

As was covered extensively on the news last night, the UK has seen CPI inflation slip by the most since April 2009 as clothing and food costs were cut in December to try and tempt people through supermarkets’ doors. CPI currently stands at 4.2% and fell from 4.8% in November. There will be a disconnect between the falling inflation and rising retail sales and consumer confidence by a couple of months and we must bear in mind that there are still pressures in jobs and credit markets that will hurt spending going forward. This number is a positive but 2012 is still going to be a difficult year however and as a result we believe this galvanises the Bank’s argument that further quantitative easing is necessary and will come down the slipway in February.

Apart from today’s unemployment data from the UK the calendar is quite quiet. We are with the consensus in expecting the unemployment rate to remain at 8.3% although clearly the risk is to the upside. There are also rumours that the talks between Greek politicians and the private sector investors in Greek debt may be coming to some form of climax today. This follows a break up of talks on Friday. An agreement would largely be seen as risk positive although it would depend on the scale of the haircut that these investors would have to swallow.

Latest exchange rates at time of writing