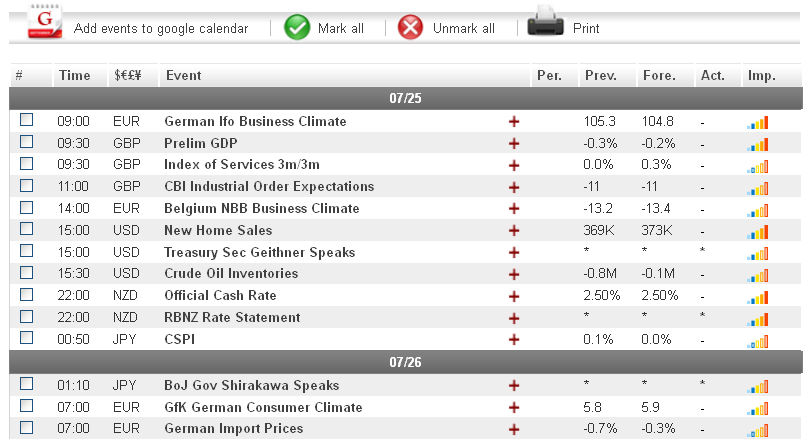

The euro fell once again during the European session yesterday, following the release of a disappointing German Flash Manufacturing PMI. The news was taken as a sign by investors that the euro-zone crisis is weighing down on the region's biggest economy and led to risk-aversion in the marketplace. Today, euro traders will want to pay attention to the German Ifo Business Climate, scheduled to be released at 8:00 GMT. Should the figure come in below the expected 104.8, the euro could see additional losses today. In addition, the US New Home Sales figure could help the dollar extend its bullish trend against the euro if it comes in above the forecasted 373K.

Economic News

USD - Home Sale Figure Set to Impact Dollar

The USD saw a relatively mild trading day yesterday, as investors were cautious about opening long dollar positions ahead of Friday's Advance GDP figure, which is expected to indicate a slowdown in the US economy. Still, the greenback was able to gain moderately against several of its main currency rivals, including the Swiss franc and euro. The USD/CHF gained close to 40 pips during the European session, eventually reaching as high as 0.9942 before staging a downward reversal to stabilize at 0.9925. The EUR/USD fell almost 50 pips yesterday to trade as low as 1.2075. The pair was then able to bounce back, and spent the remainder of the day trading around the 1.2100 level.

Today, dollar traders will want to focus on the US New Home Sales figure, scheduled to be released at 14:00 GMT. The New Home Sales figure has steadily increased over the last several months, and has been one of the few positive signs in the US economic recovery. Should today's figure come in above the forecasted 373K, the greenback could extend its recent upward trend during afternoon trading. In addition, attention should be given to announcements out of the euro-zone. Any negative news may lead to an increase in risk aversion, which could benefit the dollar.

EUR - Euro May Extend Bearish Trend Following German News

The euro remained bearish yesterday, as rising Spanish bond yields combined with a disappointing German Flash Manufacturing PMI resulted in additional risk-aversion in the marketplace. Against the Japanese yen, the common currency fell over 50 pips to trade as low as 94.43 during early morning trading. The euro was able to stage a mild upward correction to stabilize at 94.65. The EUR/AUD fell almost 70 pips yesterday, after positive Chinese boost gave a boost to the aussie. The pair eventually found support at the 1.1745 level.

Today, euro traders will want to pay attention to the German Ifo Business Climate, scheduled to be released at 8:00 GMT. Following yesterday's worse than expected manufacturing PMI, investors are anxiously waiting to see if today's news will signal a further downtrend in the euro-zone's biggest economy. If the news comes in below the forecasted 104.8, the euro could see additional losses throughout the day. That being said, should the German indicator come in higher than expected, the common currency could see moderate gains as a result.

Gold - Gold Sees Mild Gains despite Risk Aversion

Gold saw moderate gains during European trading yesterday, despite risk aversion in the marketplace which typically results in the precious metal turning bearish. The price of gold advanced over $11 an ounce during mid-day trading, eventually reaching as high as $1584.27 before staging a slight downward correction.

Today, gold may turn bearish once again following the release of the German Ifo Business Climate figure at 8:00 GMT. If the indicator signals a further slowing down of the German economy, investors may shift their funds to safe-haven assets, which could result in gold taking losses.

Crude Oil - Crude Oil Gets a Boost from Canadian Data

After falling more than $1 a barrel due to a disappointing German manufacturing PMI in early morning trading, crude oil received a boost during the afternoon session yesterday, following a better than expected Canadian Core Retail Sales figure. The Canadian indicator resulted in oil trading as high as $88.82, up from $87.40 earlier in the day.

Turning to today, oil traders will want to pay attention to the US Crude Oil Inventories figure, set to be released at 14:30 GMT. Analysts are predicting that demand in the US, the world's leading oil consuming country, slowed down in the last week. If today's news comes in above the expected 0.0M, oil could begin moving downward during the afternoon session.

Technical News

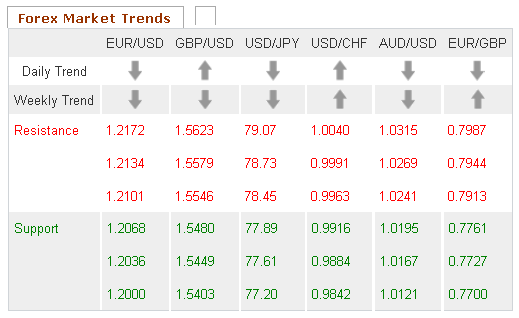

EUR/USD

The weekly chart's Slow Stochastic appears to be forming a bullish cross, indicating that this pair could see an upward correction in the coming days. Furthermore, the same chart's Williams Percent Range has crossed over into oversold territory. Traders may want to open long positions for this pair.

GBP/USD

Long-term technical indicators indicate that this pair is range trading, meaning that no defined trend can be determined at this time. Traders may want to take a wait and see approach, as a clearer picture is likely to present itself in the near future.

USD/JPY

The daily chart's Relative Strength Index has crossed into oversold territory, signaling possible upward movement for this pair in the near future. In addition, the Slow Stochastic on the same chart appears to be forming a bullish cross. Going long may be the wise choice for this pair.

USD/CHF

The weekly chart's Williams Percent Range is currently well into overbought territory, signaling that downward movement could occur in the coming days. Furthermore, the Relative Strength Index on the same chart is currently at the 70 level. Opening short positions may be the wise choice for this pair.

The Wild Card

CAD/CHF

The Bollinger Bands on the daily chart are narrowing, signaling that this pair could see a price shift in the near future. Furthermore, the Relative Strength Index on the same chart has crossed over into overbought territory, indicating that the price shift could be downward. Forex traders may want to open short positions ahead of a possible bearish correction.

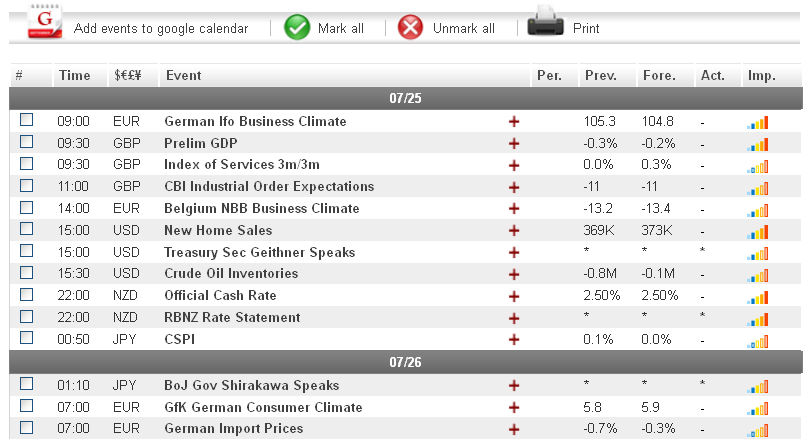

Economic News

USD - Home Sale Figure Set to Impact Dollar

The USD saw a relatively mild trading day yesterday, as investors were cautious about opening long dollar positions ahead of Friday's Advance GDP figure, which is expected to indicate a slowdown in the US economy. Still, the greenback was able to gain moderately against several of its main currency rivals, including the Swiss franc and euro. The USD/CHF gained close to 40 pips during the European session, eventually reaching as high as 0.9942 before staging a downward reversal to stabilize at 0.9925. The EUR/USD fell almost 50 pips yesterday to trade as low as 1.2075. The pair was then able to bounce back, and spent the remainder of the day trading around the 1.2100 level.

Today, dollar traders will want to focus on the US New Home Sales figure, scheduled to be released at 14:00 GMT. The New Home Sales figure has steadily increased over the last several months, and has been one of the few positive signs in the US economic recovery. Should today's figure come in above the forecasted 373K, the greenback could extend its recent upward trend during afternoon trading. In addition, attention should be given to announcements out of the euro-zone. Any negative news may lead to an increase in risk aversion, which could benefit the dollar.

EUR - Euro May Extend Bearish Trend Following German News

The euro remained bearish yesterday, as rising Spanish bond yields combined with a disappointing German Flash Manufacturing PMI resulted in additional risk-aversion in the marketplace. Against the Japanese yen, the common currency fell over 50 pips to trade as low as 94.43 during early morning trading. The euro was able to stage a mild upward correction to stabilize at 94.65. The EUR/AUD fell almost 70 pips yesterday, after positive Chinese boost gave a boost to the aussie. The pair eventually found support at the 1.1745 level.

Today, euro traders will want to pay attention to the German Ifo Business Climate, scheduled to be released at 8:00 GMT. Following yesterday's worse than expected manufacturing PMI, investors are anxiously waiting to see if today's news will signal a further downtrend in the euro-zone's biggest economy. If the news comes in below the forecasted 104.8, the euro could see additional losses throughout the day. That being said, should the German indicator come in higher than expected, the common currency could see moderate gains as a result.

Gold - Gold Sees Mild Gains despite Risk Aversion

Gold saw moderate gains during European trading yesterday, despite risk aversion in the marketplace which typically results in the precious metal turning bearish. The price of gold advanced over $11 an ounce during mid-day trading, eventually reaching as high as $1584.27 before staging a slight downward correction.

Today, gold may turn bearish once again following the release of the German Ifo Business Climate figure at 8:00 GMT. If the indicator signals a further slowing down of the German economy, investors may shift their funds to safe-haven assets, which could result in gold taking losses.

Crude Oil - Crude Oil Gets a Boost from Canadian Data

After falling more than $1 a barrel due to a disappointing German manufacturing PMI in early morning trading, crude oil received a boost during the afternoon session yesterday, following a better than expected Canadian Core Retail Sales figure. The Canadian indicator resulted in oil trading as high as $88.82, up from $87.40 earlier in the day.

Turning to today, oil traders will want to pay attention to the US Crude Oil Inventories figure, set to be released at 14:30 GMT. Analysts are predicting that demand in the US, the world's leading oil consuming country, slowed down in the last week. If today's news comes in above the expected 0.0M, oil could begin moving downward during the afternoon session.

Technical News

EUR/USD

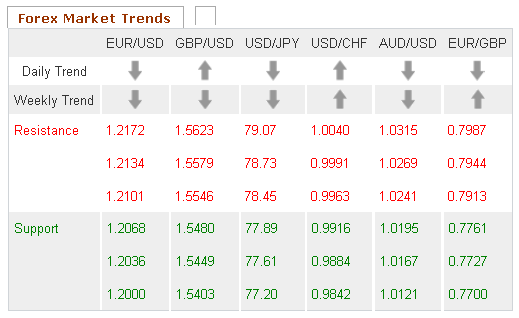

The weekly chart's Slow Stochastic appears to be forming a bullish cross, indicating that this pair could see an upward correction in the coming days. Furthermore, the same chart's Williams Percent Range has crossed over into oversold territory. Traders may want to open long positions for this pair.

GBP/USD

Long-term technical indicators indicate that this pair is range trading, meaning that no defined trend can be determined at this time. Traders may want to take a wait and see approach, as a clearer picture is likely to present itself in the near future.

USD/JPY

The daily chart's Relative Strength Index has crossed into oversold territory, signaling possible upward movement for this pair in the near future. In addition, the Slow Stochastic on the same chart appears to be forming a bullish cross. Going long may be the wise choice for this pair.

USD/CHF

The weekly chart's Williams Percent Range is currently well into overbought territory, signaling that downward movement could occur in the coming days. Furthermore, the Relative Strength Index on the same chart is currently at the 70 level. Opening short positions may be the wise choice for this pair.

The Wild Card

CAD/CHF

The Bollinger Bands on the daily chart are narrowing, signaling that this pair could see a price shift in the near future. Furthermore, the Relative Strength Index on the same chart has crossed over into overbought territory, indicating that the price shift could be downward. Forex traders may want to open short positions ahead of a possible bearish correction.