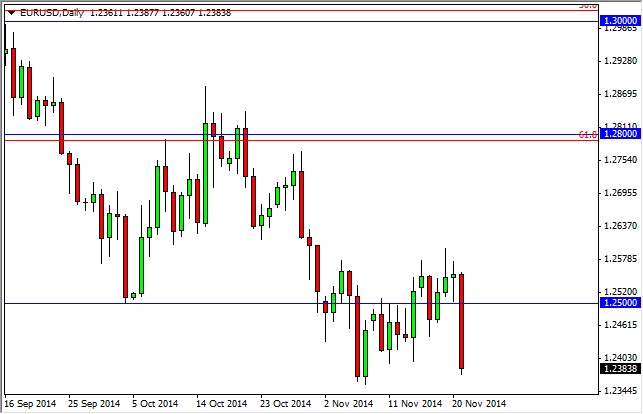

We believe that the Monday session will continue to offer plenty of selling opportunities in the EUR/USD pair. After all, we had a significant fall during the session on Friday, just simply showing that the market is more than likely to continue falling over the longer term as well. Because of this, it’s very likely that rallies will continue to be put buying opportunities as the market should become more and more comfortable staying below the 1.25 handle which was once a rather significant support area.

The DAX looks healthy at the moment, and we like buying pullbacks in the DAX on signs of support. Going long via calls in the DAX on short-term charts is one strategy, but we also believe that the longer-term move is probably to the €9800 level, and then possibly the €10,000 level. In other words, we have no interest whatsoever in shorting the DAX and believe that it will continue to be one of the better performing markets in the European Union.

The gold and silver markets both offer plenty of selling opportunities over the longer term, but we may have a little bit of upward momentum in the short-term. We look at that as a simple opportunity to buy puts, and will continue to do so when we see signs of resistance. Above the $1200 level in the gold market is particularly resistive, just as above the $17 level is in the silver market. When you look at the strength of the US dollar overall, it should continue to put significant pressure on precious metals, and with that we believe the puts are the only way you can trade them. Ultimately, we believe that the US dollar continues to be by far the strongest asset you can own over the longer term.