With the end of the Premiership season leaving football fans bereft, focus now turns to the European Championships that start in 3.5weeks. Unfortunately, much like in economic terms, the Germans are the favourites and we’ll be lucky to make it out of the group stages.

Germany’s economic dominance was for all to see this morning as it released the preliminary estimate of its Q1 GDP at a staggering 0.5% compared to analyst estimates of closer to 0.1%. The weaker euro will have helped the country’s export sector with demand from non-EU countries said to be higher on the quarter. This will further exacerbate the fact that a strong Europe is impossible with a strong Germany as it will suck up productivity from the periphery, leaving their economies threadbare.

France also reported this morning and, they too, beat the UK’s -0.2% reading by coming in flat on the quarter. The problem with French growth is that it is mainly being fuelled by consumption which is obviously very susceptible to confidence shocks and, with austerity measures to increase later in the year, is unlikely to kick on for a while. It also makes Francois Hollande’s job of reducing the deficit even more tricky.

The good news from Germany has picked EUR off the lows this morning, although it still remains at depressed levels. GBPEUR is looking to base above 1.25 while EURUSD has traded as low as 1.2814 before recovering to 1.2850.

It was the political aspect that once again hurt the single currency over the Asian session with harsh stances on the Greek situation coming from some European finance ministers. This, alongside the realisation that a coalition is not going to be formed in Greece anytime soon, will keep the onus against the euro but bounce backs on good data, such as the German GDP number, cannot be discounted.

Yesterday’s bond auctions confirmed that the contagion, should Greece exit the euro, is likely to be felt primarily on the Iberian peninsula. Spain auctioned off 12 and 18 month debt with demand lower and yields higher on the fears that they would be next to view a European exit as a viable option. The difference between the good and the bad of the European economy can be summarised as such; Spain now pays twice as much to borrow money for a year as Germany has to pay to borrow for 10 years.

Other GDP measures will come in over the morning, ahead of the Eurozone wide figure due at 09.30 and expected to come in at -0.2%. We also have the latest UK trade balance number at 09.30 which is set to improve slightly.

German economic sentiment is due in the form of the ZEW survey at 10am with a deterioration expected in feeling expected following the past month’s fun and games. We then close out the day with advance Retail Sales from the US which may have slipped following the pull lower in the jobs market of late.

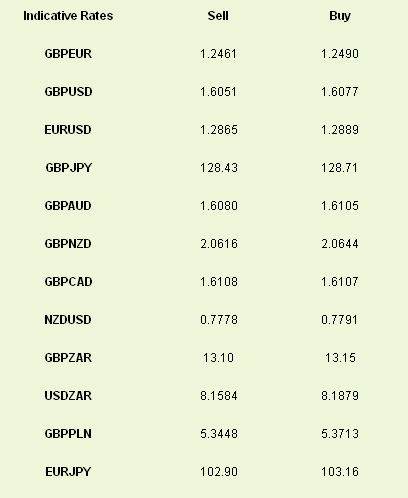

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

German GDP Rescues EUR For Now

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.