During the Tuesday session without a doubt the most important announcement is going to be the German quarter over quarter GDP numbers. Because of this, we feel that the EUR/USD pair should be followed, just as the DAX should. That being said, we recognize that the DAX is a bit overextended so quite frankly we look at pullbacks as potential call buying opportunities and will be paying close attention.

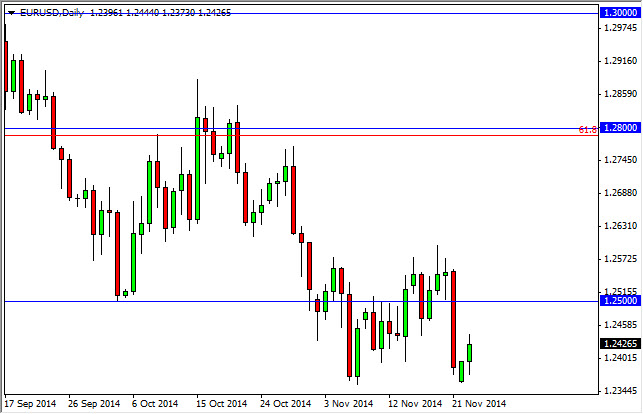

However, the EUR/USD pair provides a different type of market. After all, we are in a massively bearish trend, and we recognize that rallies are put buying opportunities the 1.25 level is having less and less significance as we sliced through it several times.

The FTSE looks like it’s ready to pull back a little bit too, so were just below the 6700 level we believe that calls are able to be purchased. We have no interest in buying puts, as we recognize that the FTSE has a significant amount of bullish pressure underneath it. With that being said, we feel that the market should then go to the 6900 level, and possibly even higher than that given enough time.

The GBP/USD pair looks as if it is stuck in a range, and as a result we are looking for put buying opportunities on short-term charts as the area around 1.57 level should offer plenty of bearish pressure based upon the recent action and range that we have been stuck in. We believe that the market will then head to the 1.55 level, so we are interested in buying puts at the first signs of resistance as we believe that the US on will continue to be by far the most favored currency out there. Stock markets by become a quiet in the United States this week, so we will focus more upon the Forex markets as the thanks giving holiday will of course have an effect on liquidity in America.