Ben Bernanke’s speech last night proved to be a non-event if truth be told with the focus of his speech more readily about the upcoming debt ceiling fight than the state of the US economy or monetary policy. Bernanke echoed Obama’s earlier thoughts that it was important that the debt ceiling was raised and emphasised that it was not about new spending, but paying bills already incurred.

The market also took little notice of his emphasis that the US economy was still going through a “relatively fragile recovery” and no light was shone on the divisions seen in the recent minutes.

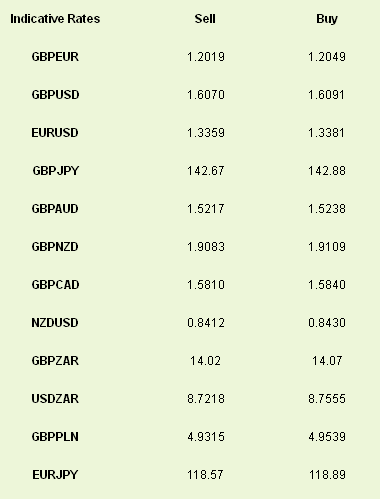

The recent strength of the Japanese yen was called into question by economy minister Amari last night. In an interview overnight he stated that “excessive JPY weakness has negative effects on people’s livelihoods via inflation” and that there were limits to government’s ability to extract the value of the yen. USDJPY tipped about 0.5% lower as the comments came out. EURUSD and GBPUSD also dropped at a similar time which suggests that the market was looking to take profit on recent moves and was merely looking for an excuse.

Further selling impetus could be afforded this morning with data from Germany likely to show that the largest economy in Europe only grew at about 0.8% in the entirety of 2012. This is down from the previous reading of 3% which would suggest that the last quarter of 2012 was dire. Obviously this still compares favourably to the flat economy we saw in the UK over the same period but will provide the EZ with little comfort.

German inflation has already been released this morning as expected at 2.1%; little news there for us hoping that the ECB loosens its anti-inflation paranoia in time to cut rates.

The harsh reality of the UK High St was once again in evidence overnight as another household name, HMV, brought in the administrators. 4,350 jobs are on the line following the closure and this takes the number of people made unemployed by companies entering administration since 2010 to 170,000 – a number roughly similar to the population of Wigan. GBP has bounced back off the lows it plumbed yesterday but you’d be a brave man to bet that we have seen the last of the weakness.

Sterling data comes in the form of inflation today with CPI and RPI announcements at 09.30. We have been vocal on the issue of inflation and the need for vigilance over future price rises. Expectations are that we will see CPI and RPI remain at 2.7% and 3% respectively but rises to come further in the quarter from increased fuel, food and transport prices.

US retail sales are also due at 13.30. We are forecasting only a slight rise with petrol, car and manufacturers sales trending lower and likely to hurt things going forward. We estimate that the uncertainty over the “fiscal cliff” will have made little impact however.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

German GDP Disappoints Ahead Of UK Inflation

Published 01/15/2013, 06:05 AM

Updated 07/09/2023, 06:31 AM

German GDP Disappoints Ahead Of UK Inflation

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.