Stocks, commodities and the euro have all risen this morning following the German Constitutional Court ruling in favour of German participation in the European Union’s new “European Stability Mechanism” (ESM) fund. The €500 billion ESM is designed to help eurozone countries stave off sovereign default. The court stated that the €190bn “ceiling” on German contributions can be only raised by lawmakers, which implies that the bill for German taxpayers could easily run higher.

The EUR/USD briefly nudged above $1.29 this morning, and looks like it could be in the early stages of a move that takes it back up to around $1.50. Similarly, the Dollar Index has fallen below 80.00 for the first time since early May. With all the talk of the Federal Reserve firing up the printing presses once again, and even German Finance Minister Wolfgang Schaeuble openly describing US government debt as “much too high” and the global economy as being “burdened” by this debt, the buck is coming under pressure.

This should push commodities – and in particular –precious metal prices higher, as discussed by James Turk in his latest KWN interview.

Why does the euro rally when the inflationistas are getting their way, and why does it sink when the hawkish Bundesbankers are at the centre of media attention? This is paradoxical, considering that the former’s recipe for keeping the currency bloc intact will devalue the euro, and thus – one would have thought – lead to it falling against the dollar and other currencies.

This can be explained by the fact that market attention has been focused in recent months on the question of whether or not countries will leave the eurozone. Given that, in Mr Market’s view, the very survival of the currency was threatened by German intransigence, the fact that this roadblock has been lifted makes traders think that the currency is more likely to survive. So the EUR/USD rises.

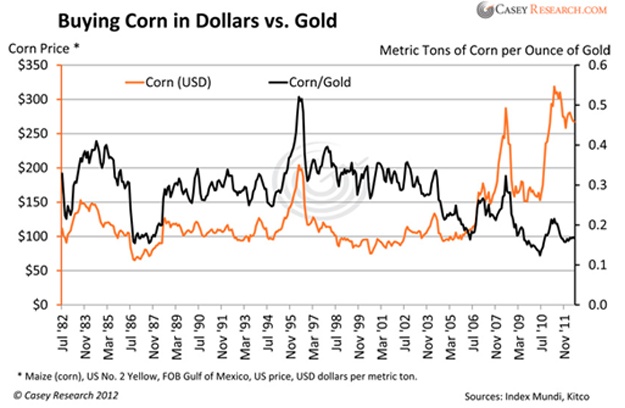

The key takeaway is that such FX measures are relative, not absolute. In absolute terms, all currencies are falling in value, as measured against gold, silver, platinum, palladium, copper, crude oil, rice, and – as illustrated in the neat chart below from Casey Research – corn.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

German Court Ruling Pushes Euro Higher

Published 09/12/2012, 08:23 AM

Updated 05/14/2017, 06:45 AM

German Court Ruling Pushes Euro Higher

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.