On a fairly light day as far as economic announcements are concerned, we are watching the German Business Climate Index number, expected to be 105.7 at the announcement. The number can move the DAX and the EUR/USD pair, with a better than anticipated number of course been positive for both of those markets, while a weaker than expected number been negative for the same markets.

We believe that the EUR/USD pair will continue to be one that you can buy puts every time it rallies, especially as the 1.30 level has shown itself to be so resistive overall. It is not until we get above there that we would even consider buying calls in that market, and quite frankly we feel that the market is trying to eventually break down below the 1.28 handle, although that will be a major undertaking.

The S&P 500 fell during the session initially on Tuesday, but has shown itself to be supported below. Because of this, we do like buying calls in this marketplace, as we think the market will eventually try to break out and above the 2020 level, an area that should significant resistance recently. However, we are most certainly in an uptrend, and don’t see that changing anytime soon. With that, we think that pullbacks all the way to 1980 should be supportive, and therefore we look at dips in this marketplace as buying opportunities.

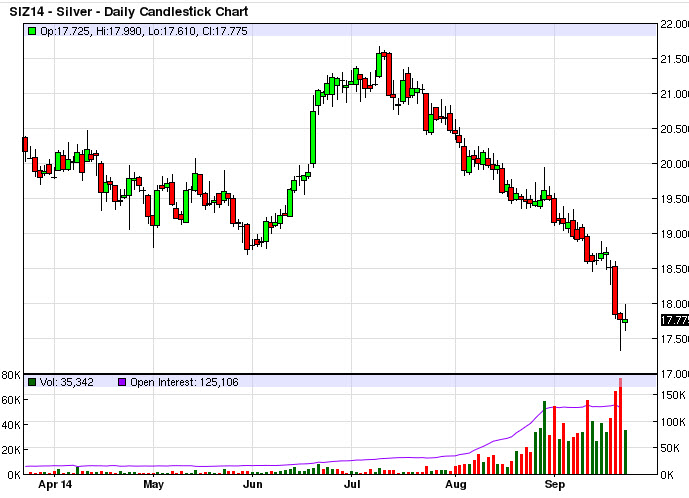

The silver market tried to rally during the session on Tuesday, but we believe that every rally will be met with selling pressure, making it a commodity that we want to buy puts and on short-term charts. We think ultimately this marketplace should continue to drop, probably heading towards the $15 level given enough time. Expect a lot of volatility though, as silver tends to be one of the choppy or markets out there.