Georgia Gulf Corporation (GGC) is a manufacturer and international marketer of two integrated chemical product lines, chlorovinyls and aromatics. The Company’s primary chlorovinyls products are chlorine, caustic soda, vinyl chloride monomer (VCM), vinyl resins and vinyl compounds, and its aromatics products are cumene, phenol and acetone.

This one is all about a hostile bid, rejections of that bid, upped bids and then a rejection of that as well... with a caveat... I've included a timeline with news snippets and links, below:

Westlake Chemical Makes Unsolicited $1.03 Billion Offer [$30 / share] for Georgia Gulf

Georgia Gulf Rejects Unsolicited Proposal from Westlake Chemical

Westlake Chemical increased offer for Georgia Gulf to $35 per share, CNBC says

Georgia Gulf rejects higher buyout offer from Westlake Chemical

Georgia Gulf Says It’s Open to Talks With Westlake

There you go. A $30 bid and rejection. A $35 bid, and rejection, but... A consideration to play nice. Or, in English, "how about a little more, eh?"

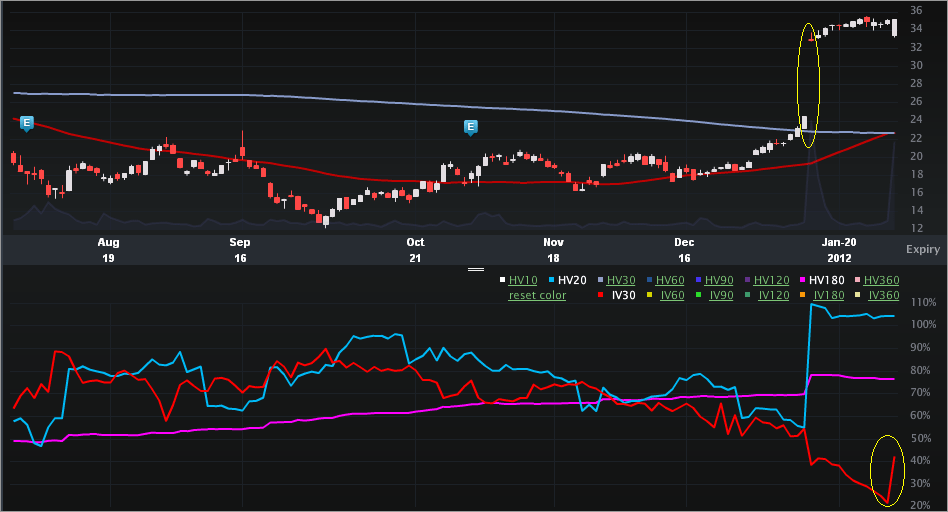

Let's look to the Charts Tab (6 months), below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

In the stock portion we can see the awesome pop on the original takeover news. The stock closed at $32.93, while the bid was $30 / share. So the equity market reflected the potential for a higher bid -- that reflection proved to be correct. On that same day, the IV30™ dropped significantly from 54.51% to 38.72%. As the quiet period of speculation and waiting went on, the IV30™ dropped all the way to 21.92%. And then, there was today...

IV30™ has spiked to 42.45% (as of this writing), or a 93.7% increase. It's very "interesting" how GGC stock moved from $18.57 on 12-28-2012 to $24.48 on 1-12-2012. That's a 31.8% pop in two weeks (ish) before any news. That "kinda" means that the takeover bid for $30 / share perhaps shouldn't be compared to the $24.48 closing price pre-bid, but really the ~$18.50 level before the, ummm, the... "rumor." So maybe it's not a 23% premium, but really a 62% premium. In any case, $35 / share is the new bid. Using those same two starting prices, it's a 43% or 89% premium. So, yeah, GGC management is "Open to Talks With Westlake." Duh...

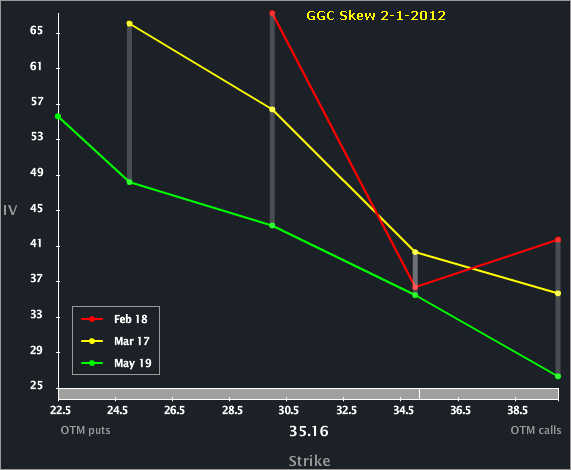

Let's turn to the Skew Tab.

We can see the upside bend to the Feb options, while Mar and May are more normal shaped. Said another way, in the very near-term, the risk reflected by the options is two-sided -- a higher bid or a deal that falls apart. But, looking out further, the risk reflected is more of a failed bid / takeover, than a higher bid. In English, the options market reflects that if a higher bid is coming, it'll have to come soon. Another interesting point is that while the underlying is still trading above the new takeover bid, it's just by a little (as opposed to over $2 on news of the $30 bid). Tricky...

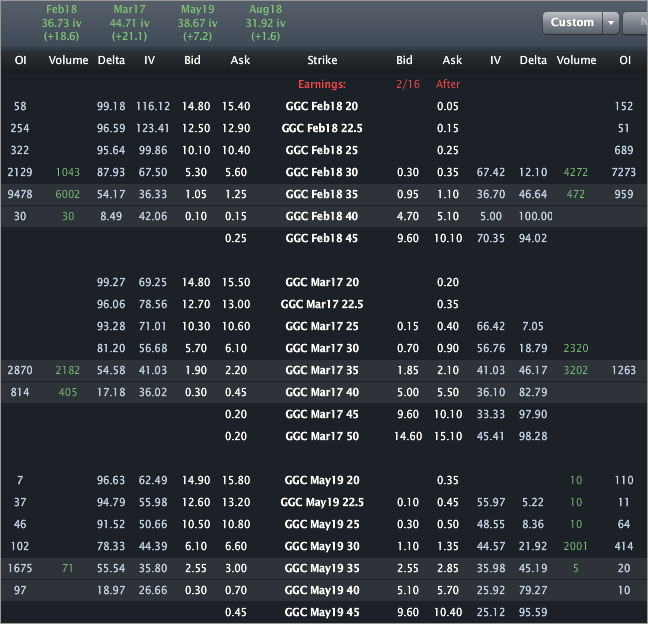

Finally, let's turn to the Options Tab.

Recalling that this was an ~$18.50 stock before the news, the downside skew seems kinda, um, not scared.

This is trade analysis, not a recommendation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Georgia Gulf:Equity Markets Reflected Higher Takeover Bid; Now Option and Equity Markets Don't

Published 02/02/2012, 02:05 AM

Updated 07/09/2023, 06:31 AM

Georgia Gulf:Equity Markets Reflected Higher Takeover Bid; Now Option and Equity Markets Don't

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.