George Soros is the founder of Soros Fund Management. In 1970 he co-founded the Quantum Fund with Jim Rogers and Christoper Ink, which created the bulk of the Soros fortune. Legendary was his currency speculation against the British Bank of England:

On September 16, 1992, Soros's fund sold short more than USD 10 billion worth of pounds sterling, profiting from the Bank of England's reluctance to either raise its interest rates to levels comparable to those of other European Exchange Rate Mechanism countries or to float its currency. Finally, the Bank of England withdrew the currency from the European Exchange Rate Mechanism, devaluing the pound sterling. Soros earned an estimated worth of USD 1.1 billion in the process. He was dubbed "the man who broke the Bank of England." UK Treasury estimated the total costs of Black Wednesday at GBP 3.4 billion in 1997.

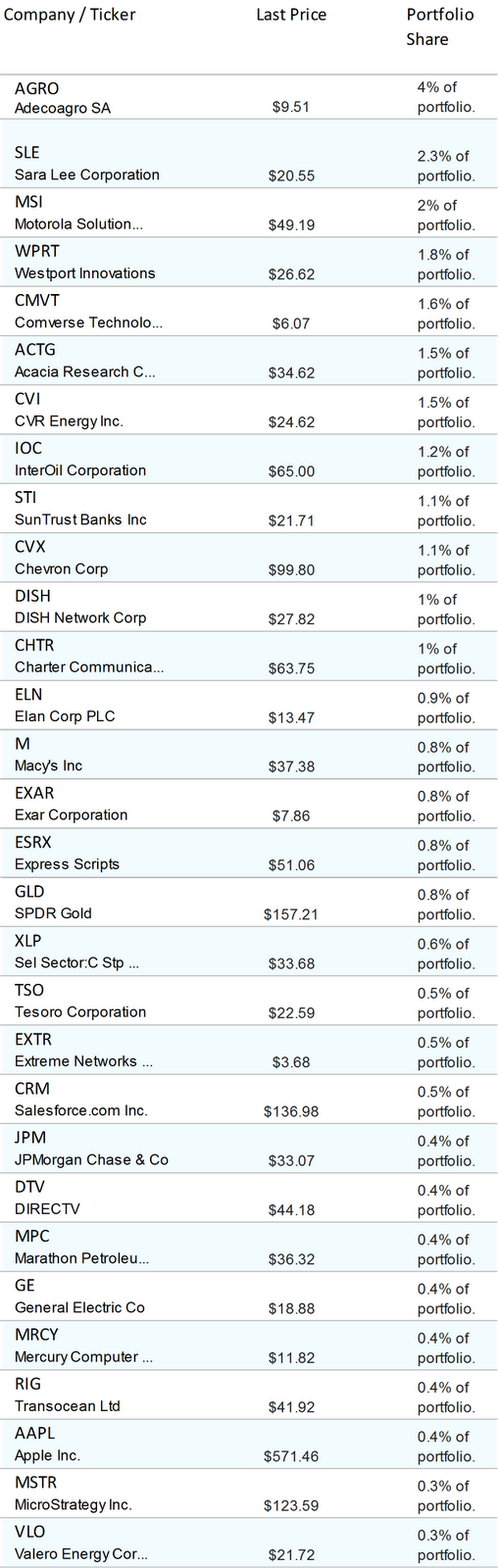

Below is a top 30 list of his investment positions as of March 31, 2012. Soros Fund Management LLC was valued at USD 3.9 billion.

During the quarter, George Soros had 180 total positions.

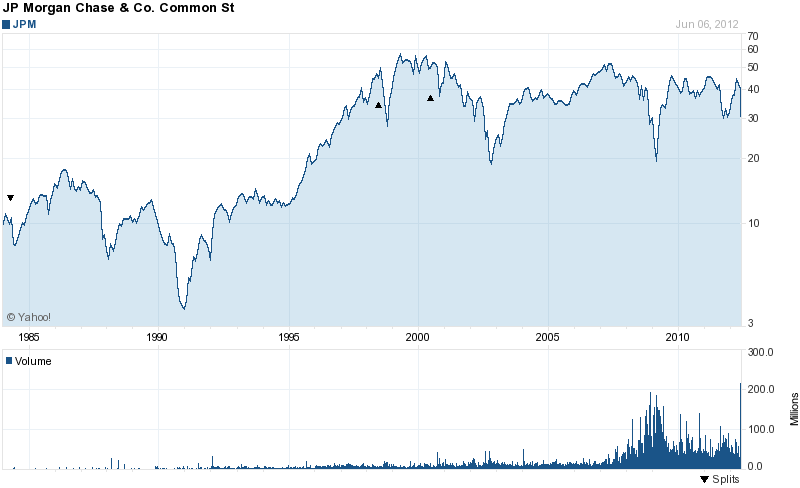

JPMorgan Chase & Co. (NYSE:JPM) has a market capitalization of $125.89Billion. The company employs 261,453 people, generates revenues of $61,293.00 million and has a net income of $18,976.00 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $41,603.00 million. Because of these figures, the EBITDA margin is 67.88 percent (operating margin 27.51 percent and the net profit margin finally 19.52 percent).

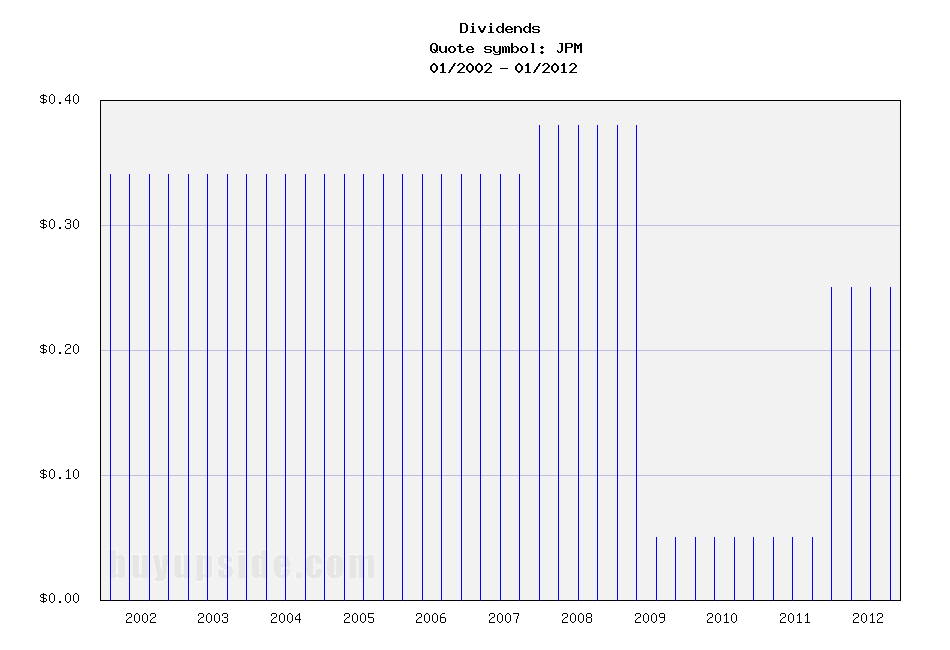

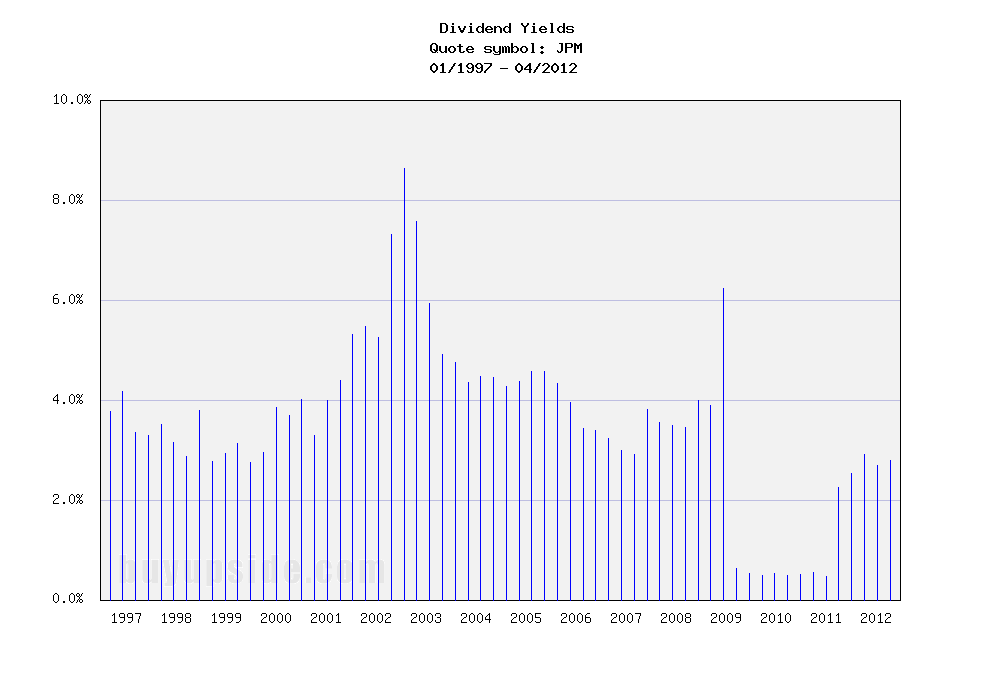

Financial Analysis: The total debt representing 30.22 percent of the company’s assets and the total debt in relation to the equity amounts to 373.04 percent. Due to the financial situation, a return on equity of 10.21 percent was realized. Twelve trailing months earnings per share reached a value of $4.50. Last fiscal year, the company paid $1.00 in form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 7.36, P/S ratio 1.25 and P/B ratio 0.69. Dividend Yield: 3.75 percent. The beta ratio is 1.32.

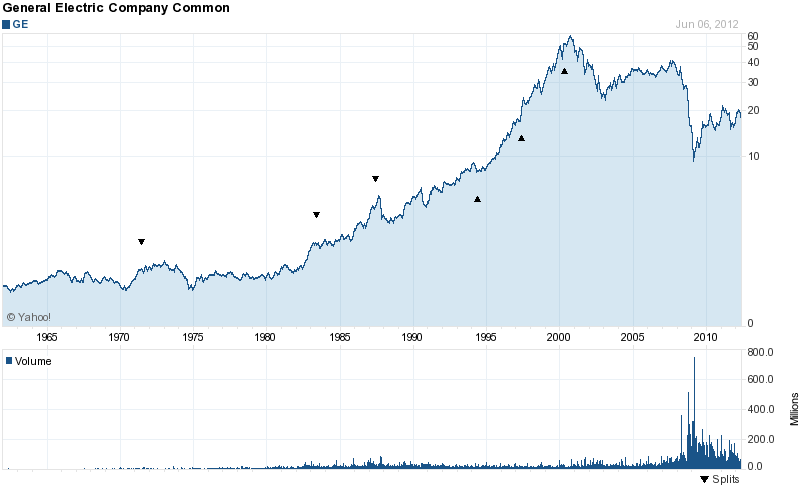

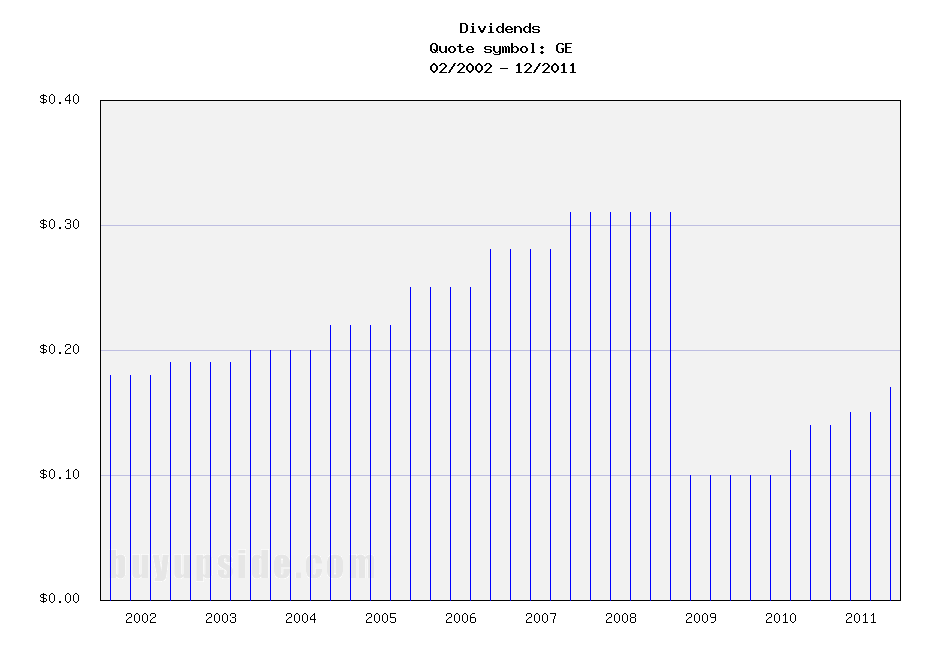

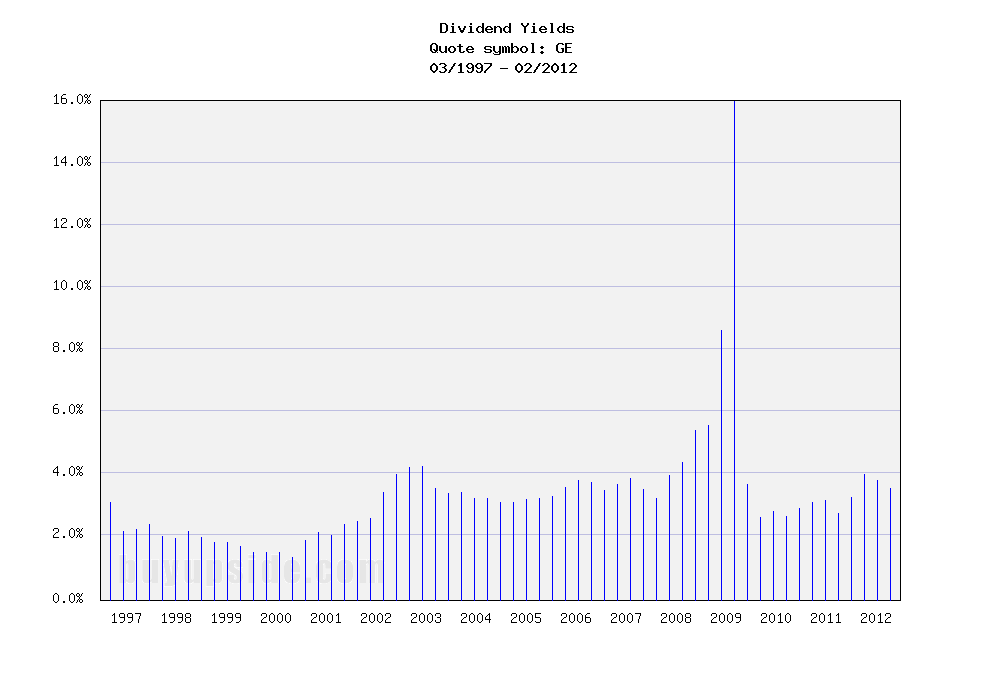

General Electric (NYSE:GE) has a market capitalization of $199.89 billion. The company employs 301,000 people, generates revenues of $147,300.00 million and has a net income of $14,366.00 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $31,015.00 million. Because of these figures, the EBITDA margin is 21.06 percent (operating margin 13.64 percent and the net profit margin finally 9.75 percent).

Financial Analysis: The total debt representing 63.22 percent of the company’s assets and the total debt in relation to the equity amounts to 389.43 percent. Due to the financial situation, a return on equity of 11.06 percent was realized. Twelve trailing months earnings per share reached a value of $1.22. Last fiscal year, the company paid $0.61 in form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 15.44, P/S ratio 1.31 and P/B ratio 1.66. Dividend Yield: 3.73 percent. The beta ratio is 1.59.

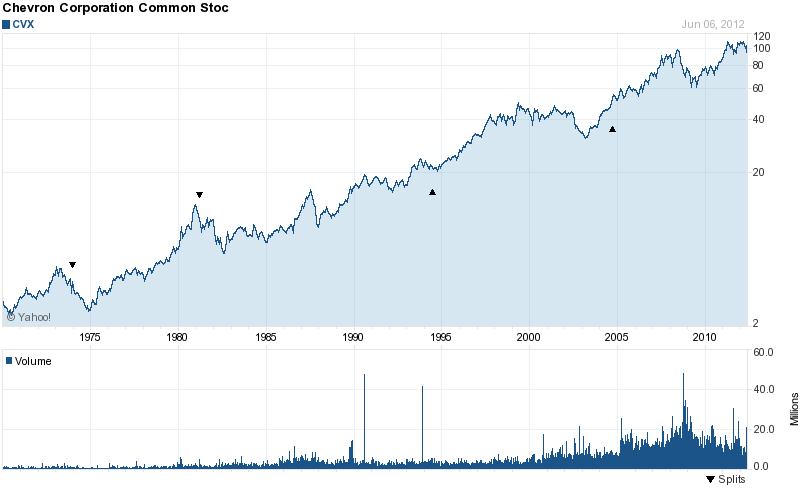

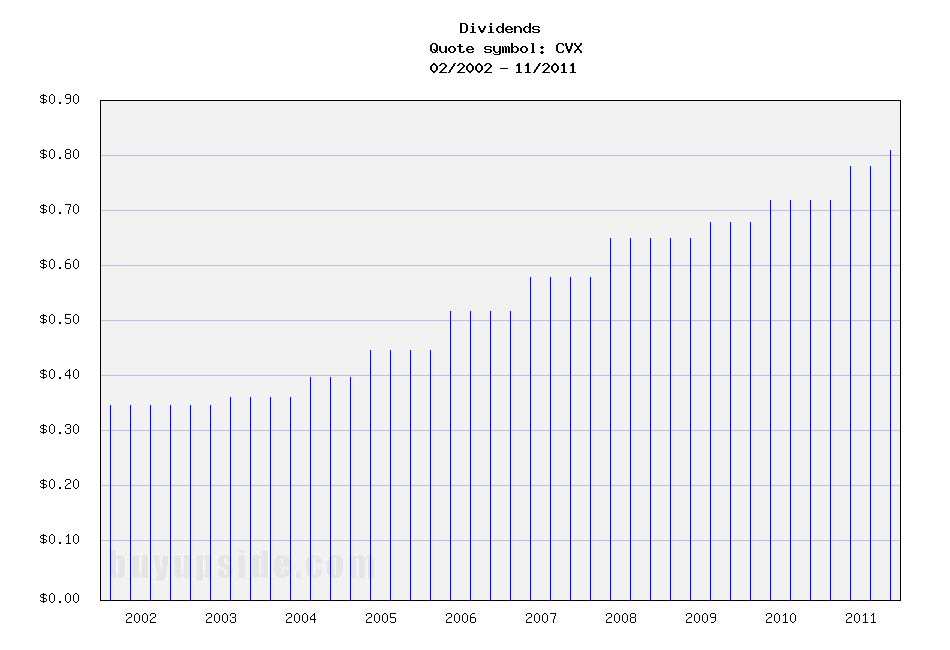

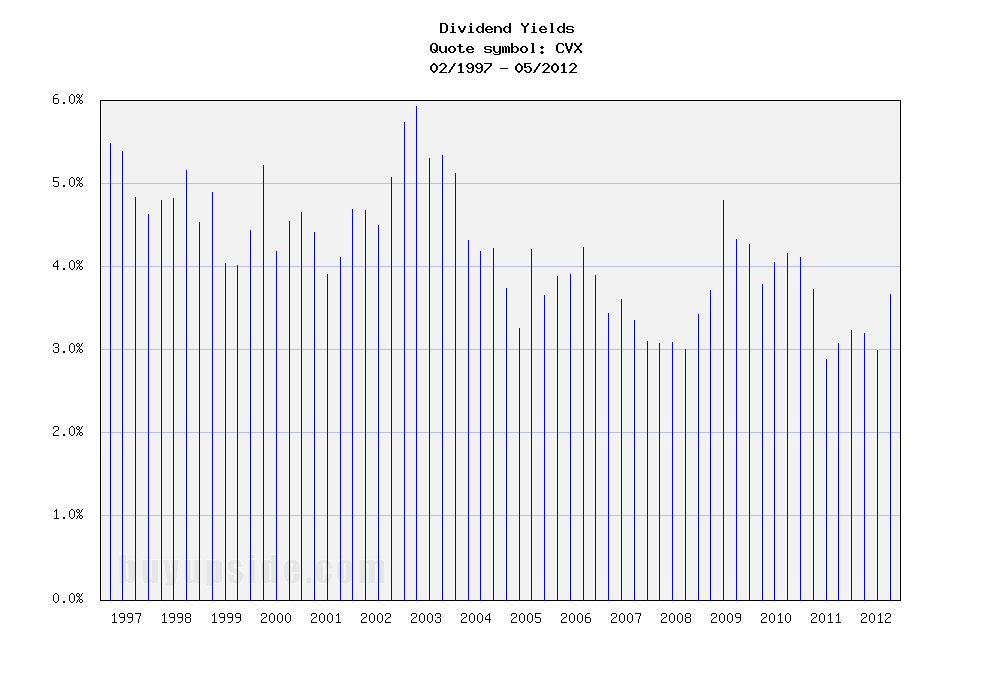

Chevron Corporation (NYSE:CVX) has a market capitalization of $196.87Billion. The company employs 61,000 people, generates revenues of $253,706.00 million and has a net income of $27,008.00 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $60,545.00 million. Because of these figures, the EBITDA margin is 23.86 percent (operating margin 18.78 percent and the net profit margin finally 10.65 percent).

Financial Analysis: The total debt representing 4.85 percent of the company’s assets and the total debt in relation to the equity amounts to 8.36 percent. Due to the financial situation, a return on equity of 23.75 percent was realized. Twelve trailing months earnings per share reached a value of $13.61. Last fiscal year, the company paid $3.09 in form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 7.33, P/S ratio 0.75 and P/B ratio 1.57. Dividend Yield: 3.73 percent. The beta ratio is 0.78.

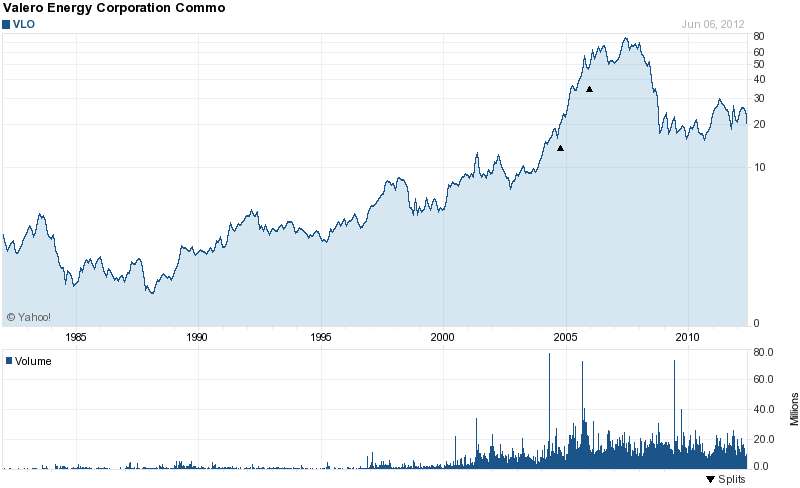

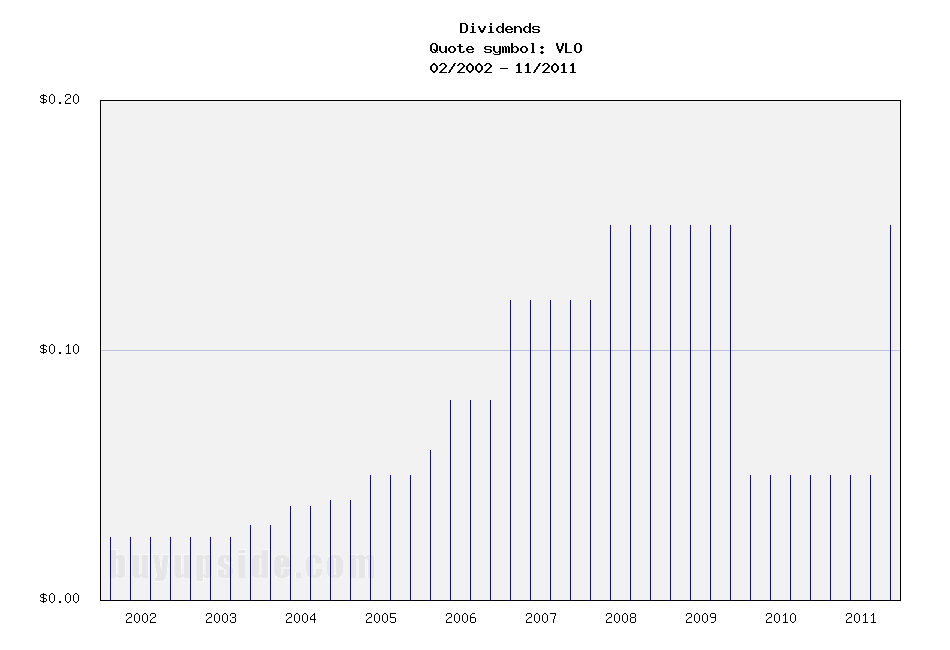

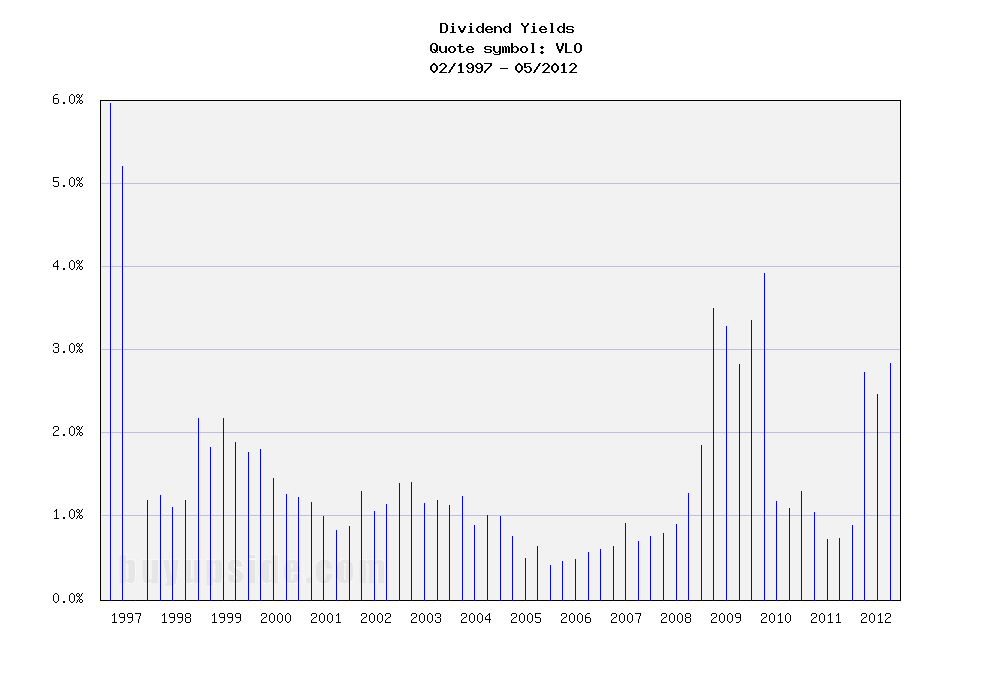

Valero Energy (NYSE:VLO) has a market capitalization of $12.01 billion. The company employs 21,942 people, generates revenues of $125,987.00 million and has a net income of $2,096.00 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $4,798.00 million. Because of these figures, the EBITDA margin is 3.81 percent (operating margin 2.92 percent and the net profit margin finally 1.66 percent).

Financial Analysis: The total debt representing 18.09 percent of the company’s assets and the total debt in relation to the equity amounts to 47.14 percent. Due to the financial situation, a return on equity of 13.33 percent was realized. Twelve trailing months earnings per share reached a value of $2.71. Last fiscal year, the company paid $0.30 in form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 8.02, P/S ratio 0.09 and P/B ratio 0.71. Dividend Yield: 2.86 percent. The beta ratio is 1.43.

Here are the top 30 positions sorted by portfolio share:

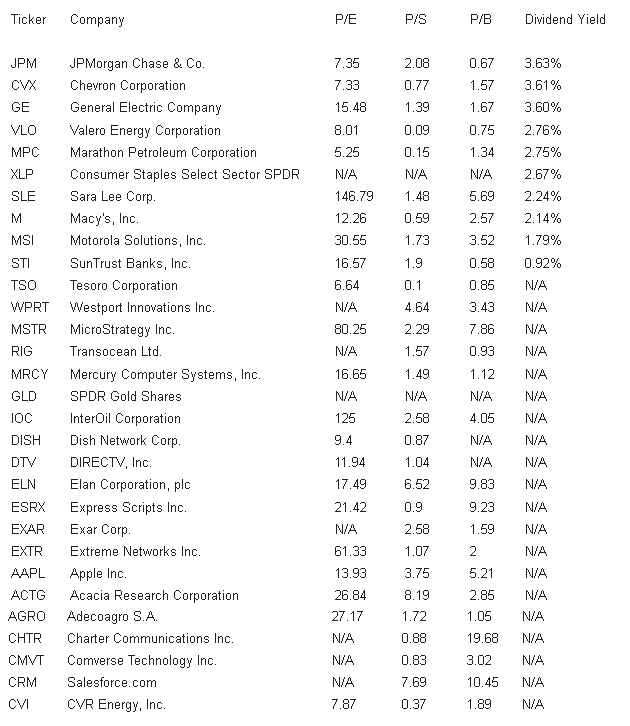

Here are the market ratios of George Soros stock holdings:

Top New Buys: CVI, STI, CVX, M, XLP, TSO, CRM, JPM, MPC, GE

Related stock ticker symbols:

AGRO, SLE, MSI, WPRT, CMVT, ACTG, CVI, IOC, STI, CVX, DISH, CHTR, ELN, M, EXAR, ESRX, GLD, XLP, TSO, EXTR, CRM, JPM, DTV, MPC, GE, MRCY, RIG, AAPL, MSTR, VLO

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

George Soros Quantum Fund Investment Portfolio As Of Q1/2012

Published 06/07/2012, 05:35 AM

Updated 07/09/2023, 06:31 AM

George Soros Quantum Fund Investment Portfolio As Of Q1/2012

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.