Genuine Parts Company (NYSE:GPC) reported earnings of $1.29 per share in second-quarter 2017, higher than $1.28, recorded in the year-ago quarter. However, earnings per share missed the Zacks Consensus Estimate of $1.31.

The company recorded a net income of $190 million in the second quarter of 2017, down from $191.4 million in the prior-year quarter.

Revenues in the reported quarter rose 5% year over year and set a record of $4.1 billion. The figure surpassed the Zacks Consensus Estimate of $4.04 billion and the rise was due to growth in the company’s automotive, industrial, electrical and office operations businesses. Industrial and electrical segments were the best performers out of the four.

Operating profit increased to $349.3 million from $340.5 million in the second quarter of 2017, and selling, general and administrative expenses rose to $903.3 million from $829.5 million a year ago.

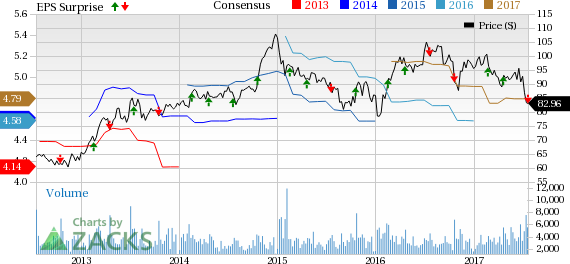

Genuine Parts Company Price, Consensus and EPS Surprise

Segment Results

Revenues at the Automotive Parts segment improved 4% to $2.2 billion from the year-ago level of $2.1 billion. The segment’s operating profit increased to $207.3 million in the reported quarter from $203.6 million, a year ago.

Revenues at the Motion Industries or Industrial segment increased 7% to $1.25 billion. Operating profit at the segment was $96.3 million, up from $88.3 million in the year-ago quarter.

The Electrical or EIS segment’s revenues rose 11% year over year to $204.6 million. Operating profit decreased to $15.5 million from $16 million from the year-ago quarter.

The S. P. Richards or Office Products segment’s revenues improved 5% to $504 million. Operating profit at the segment declined to $30.1 million from $32.6 million, recorded a year ago.

Financial Position

Genuine Parts had cash and cash equivalents of $203.1 million as of Jun 30, 2017, down from $233.6 million as of Jun 30, 2016. Also, long-term debt increased to $550 million as of Jun 30, 2017 from $250 million as of Jun 30, 2016.

In second-quarter 2017, Genuine Parts’ net cash flow from operations decreased to $345.3 million from $530.5 million, in the prior-year period. Capital expenditures increased to $39.2 million from $38.1 million, in the year-ago period.

Guidance

For 2017, Genuine Parts continues to expect annual revenues to increase 3%-4%. Earnings per share in 2017 are expected to be in the $4.75–$4.85 range, on par with the previous expectation.

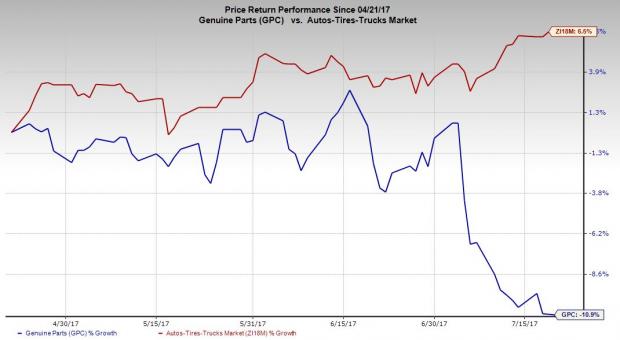

Price Performance

Genuine Parts has underperformed the Zacks categorized Auto/Truck Replacement Parts industry over the last three months. During this period, the company’s share price has decreased 10.9%, while the industry has gained 6.5%.

Zacks Rank & Key Picks

Genuine Parts currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the auto space are Westport Fuel Systems Inc. (NASDAQ:WPRT) , Cummins Inc. (NYSE:CMI) and Peugeot SA (OTC:PUGOY) , all stocks carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Westport Fuel Systems has expected long-term growth rate of 30%.

Cummins has expected growth rate of around 11.4% over the long term.

Peugeot has expected long-term growth rate of 11.4%.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

PEUGEOT SA (PUGOY): Free Stock Analysis Report

Genuine Parts Company (GPC): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Westport Fuel Systems Inc (WPRT): Free Stock Analysis Report

Original post

Zacks Investment Research