Genpact Limited (NYSE:G) delivered impressive fourth-quarter 2018 results, with earnings and revenues beating the Zacks Consensus Estimate.

The stock has gained 4.2% on Thursday’s after hours trading on encouraging 2019 guidance. Management projects revenues in the range of $3.33-$3.39 billion, which is above the current Zacks Consensus Estimate of $3.29 billion.

Adjusted earnings per share of 52 cents in the quarter outpaced the consensus mark by 4 cents and increased 21% year over year. The bottom line was driven by a positive impact of 11 cents from higher operating profits and a penny from lower share count, which were, however, partially offset by a tax impact of 3 cents due to the U.S. tax laws.

Revenues amounted to $835 million, which beat the consensus estimate by $25.6 million and improved 14% year over year on a reported basis and15% on a constant-currency (cc) basis. The top line was driven by strong growth in the company’s Hi-tech, consumer goods and retail and manufacturing verticals.

So far this year, shares of Genpact have gained 13.8% compared with 10.8% rise of the industry.

Let’s check the numbers in detail.

Revenues in Detail

Total BPO revenues (84% of total revenues) increased 14% year over year to $700 million. Total IT revenues (16% of total revenues) totaled $135 million, up 12% year over year.

Global Clients (90% of total revenue) revenues climbed 13% year over year on a reported basis and 14% at cc to $755 million.

Under Global Client, Global Client BPO revenues of $650 million improved 13% year over year on a reported basis and 14% at cc. Global Client IT revenues grew 11% year over year to $105 million.

General Electric (NYSE:GE) revenues of $80 million increased24% year over year. It contributed 10% total revenues.

GE BPO revenues improved 30% year over year to $50 million. GE IT revenues of $31 million increased 16% from the year-ago quarter’s number.

Operating Results

Adjusted income from operations totaled $142 million, up 24% year over year. Adjusted operating income margin increased to 17% from 15.7% in the year-ago quarter.

Selling, general & administrative (SG&A) expenses amounted to $178.58 million, down 5.4% year over year. As a percentage of revenues, SG&A expenses were 21.4% compared with 25.7% in the prior-year quarter.

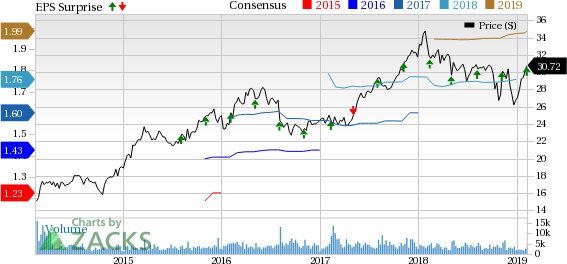

Genpact Limited Price, Consensus and EPS Surprise

Genpact exited the fourth quarter with cash and cash equivalents of $504.47 million compared with $401.23 million at the end of the previous quarter. Long-term debt (less current portion) totaled $1 billion compared with $983.88 million at the end of third-quarter 2018.

The company generated $136.71 million of cash from operating activities in the reported quarter. Capital expenditures were $13.9 million.

Genpact returned almost $215 million to shareholders through share repurchase and dividend payment in 2018.

Guidance

For 2019, Genpactexpectsrevenues in the range of $3.33-$3.39 billion, which indicates year-over-year growth of almost 11-13% on a reported basis and 12-14% at cc. The Zacks Consensus Estimate is pegged at $3.29 billion.

Global Client revenues are expected to register 9.0-10.5% growth on a reported basis and 10.0-11.5% riseat cc. Adjusted operating income margin is anticipated to be around 16%.

Adjusted earnings are projected between $1.96 and $2.00.The Zacks Consensus Estimate is peggedat $1.98.

Zacks Rank & Upcoming Releases

Genpact currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Investors interested in the broader Zacks Business Services sector are keenly awaiting fourth-quarter 2018 earnings reports of key players like IQVIA Holdings (NYSE:IQV) , Waste Management (NYSE:WM) and TransUnion (NYSE:TRU) . All these companies are scheduled to release resultson Feb 14, before market open.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

TransUnion (TRU): Free Stock Analysis Report

Genpact Limited (G): Get Free Report

Waste Management, Inc. (WM): Get Free Report

IQVIA Holdings Inc. (IQV): Free Stock Analysis Report

Original post