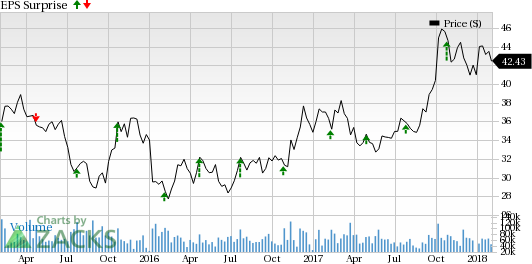

General Motors Company (NYSE:GM) is set to report fourth-quarter and full-year 2017 results before the opening bell on Feb 6. Last quarter, the company delivered a positive earnings surprise of 23.4%.

In fact, in each of the trailing four quarters, the company delivered a positive earnings surprise, the average beat being 15.7%. Also, the long-term expected earnings growth for the company (over three to five years) is currently pegged at 9.3%.

General Motors’ shares have returned 24.3% in the past six months, outperforming the 12.4% growth of the industry it belongs to.

Let’s see how things are shaping up for this announcement.

A Likely Positive Surprise?

According to our quantitative model, chances of General Motors beating the Zacks Consensus Estimate in the fourth quarter are high. This is because it has the right combination of the two key ingredients, a positive Earnings ESP and a Zacks Rank #3 (Hold) or better, which is required to increase the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: Earnings ESP for General Motors is +2.13%. This is because the Most Accurate estimate and the Zacks Consensus Estimate are pegged at $1.35 and $1.32 respectively.

Zacks Rank: General Motors carries a Zacks Rank #3. This when combined with a positive ESP makes us reasonably confident of an earnings beat.

Conversely, we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

What’s Driving the Better-Than-Expected Earnings?

General Motors has a bullish outlook for 2017, mainly backed by strong retail crossover sales. The company projects 2017 earnings per share at the upper end of its guided range of $6-$6.5. Further, for 2018, it expects the metric almost in line with the tally of 2017. The 2018 performance will be driven by its strengthening presence in the North American and Chinese markets as well as an improvement in the South American market.

General Motors closed the year 2017 with a third consecutive monthly sales decline. In 2017, sales in the United States were down 1.3% from that of 2016 to more than 3 million vehicles. In December, sales declined 3.3% to 308,539 units. However, crossover sales increased 11% in December.

For the soon-to-be-released quarter, the Zacks Consensus Estimate for net sales and revenues of the General Motors North America (GMNA) is $27.9 billion. In third-quarter 2017, net sales and revenues of the General Motors North America were $24.8 billion. Notably, in 2016, around 71.5% of total revenues of the company were derived from the GMNA segment.

Stocks to Consider

Here are a few stocks from the same space that posses the right combination of elements to beat on earnings this time around:

Allison Transmission Holdings, Inc. (NYSE:ALSN) has an Earnings ESP of +10.40% and a Zacks Rank #3. The company is expected to report fourth-quarter 2017 results on Feb 14. You can see the complete list of today’s Zacks #1 Rank stocks here.

BorgWarner, Inc. (NYSE:BWA) has an Earnings ESP of +0.39% and a Zacks Rank #3. The company’s fourth-quarter 2017 financial results are expected to be released on Feb 8.

Tenneco Inc. (NYSE:TEN) has an Earnings ESP of +1.52% and a Zacks Rank of 3. The company’s fourth-quarter 2017 results are slated to be announced on Feb 9.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks>>

General Motors Company (GM): Free Stock Analysis Report

BorgWarner Inc. (BWA): Free Stock Analysis Report

Tenneco Inc. (TEN): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Original post