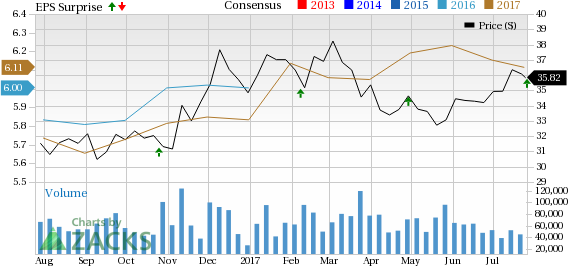

General Motors Co. (NYSE:GM) delivered adjusted earnings of $1.89 per share in second-quarter 2017, surpassing the Zacks Consensus Estimate of $1.72. Earnings increased 5.6% from $1.79 per share in the second quarter of 2016.

Revenues in the reported quarter came in at $37 billion, 1.1% lower than the year-ago quarter. Also, revenues missed the Zacks Consensus Estimate of $40.25 billion.

Total wholesale unit sales declined to 1.21 million vehicles from 1.31 million vehicles in the second quarter of 2016. Worldwide retail unit sales decreased to 2.34 million vehicles from 2.39 million vehicles in the year-ago quarter. The automaker’s global market share was 10.2% during the reported quarter, reflecting a marginal decline from 10.3% in the year-ago quarter.

Segment Results

GM North America (GMNA) generated net sales and revenues of $28.4 billion during the second quarter of 2017, reflecting a decline from $30.2 billion in second-quarter 2016.

GM International Operations’ (GMIO) net sales and revenues came in at $3.2 billion, declining from $3.3 billion in the year-ago quarter.

GM South America (GMSA) generated net sales and revenues of $2.3 billion, increasing from $1.6 billion in the year-ago quarter.

GM Financial generated net sales and revenues of $3 billion during the quarter, increasing from $2.1 billion in the year-ago quarter.

Financial Position

General Motors had cash and cash equivalents of $16.6 billion as of Jun 30, 2017 compared with $12.57 billion as of Dec 31, 2016.

Automotive operating cash flow during the quarter came in at $5.1 billion, reflecting an increase of $0.3 billion from that of second-quarter 2016.

2017 Outlook

General Motors continues to expect 2017 adjusted earnings per share in the range of $6.00–$6.50. The automaker also expects adjusted EBIT and adjusted EBIT margin to remain stable or improve, while revenues are projected to increase from the 2016 level. Further, the automaker is expected to generate around $7 billion in adjusted automotive free cash flow. The company aims at returning capital of up to $7 billion to shareholders in 2017.

Zacks Rank

General Motors currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the auto space include Allison Transmission Holdings, Inc. (NYSE:ALSN) , Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) and Ferrari N.V. (NYSE:RACE) .

Each of these stocks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Allison Transmission, Volkswagen and Ferrari have a long-term expected growth rate of 11%, 17.3% and 14.1%, respectively.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

General Motors Company (GM): Free Stock Analysis Report

Volkswagen AG (VLKAY): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Ferrari N.V. (RACE): Free Stock Analysis Report

Original post

Zacks Investment Research