General Mills (NYSE:GIS) stock plunged by 50% in the second half of 2018, following a decline from its July peak of $72.95. So, when the stock touched $36.42 in late-December most investors were not exactly optimistic about it, to put it mildly.

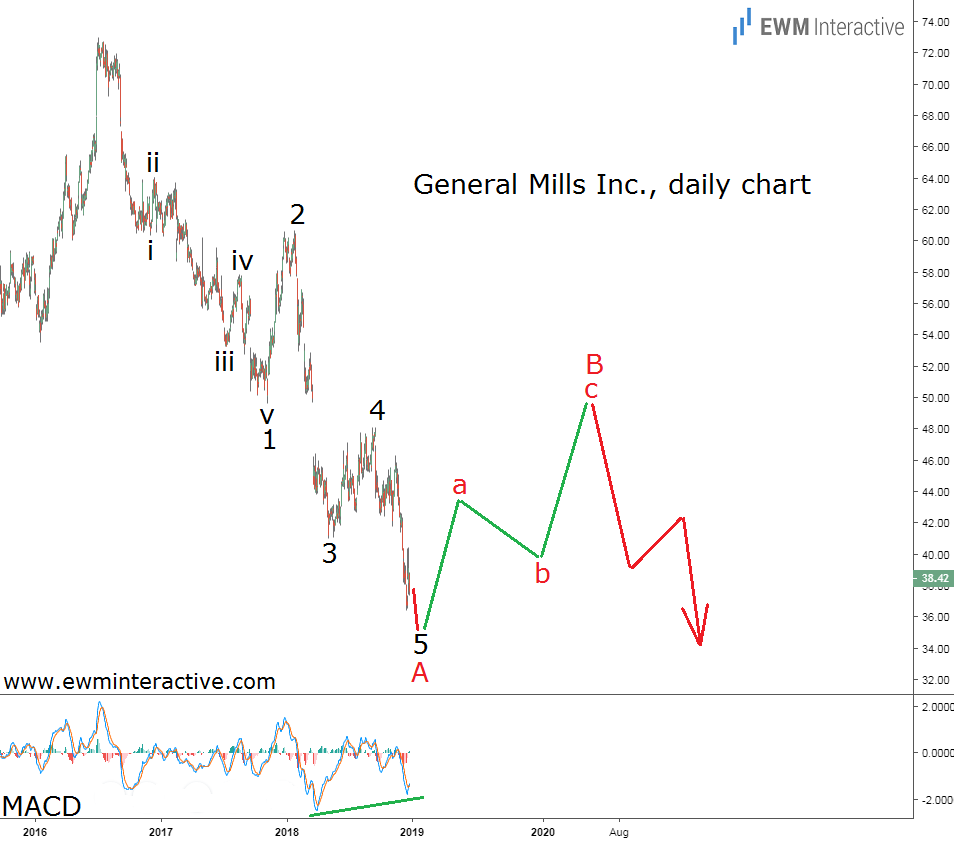

On the other hand, the Elliott Wave analysis of GIS‘ daily price chart, published three months ago, revealed a different picture. Take another look at it below.

First, the decline from roughly $73 to under $36.50 had a the structure of a perfect five-wave impulse, labeled 1-2-3-4-5. According to the theory, a three-wave correction in the opposite direction was supposed to follow. In addition, there was a strong bullish MACD divergence between waves 3 and 5 – another reason not to trust the bears too much.

General Mills Stock – a Top Performer in Q1 2019

So instead of extrapolating General Mills stock’s decline into the future, we thought the stage was “set for a ~30% rally.” The resistance near $50 a share looked like a viable first target in wave B.

Yesterday, General Mills stock closed at $51.09, up 33% since we examined its chart. The problem is that this recovery was much sharper than we expected, which means wave B is not over yet. The manner in which the bulls conquered $50 opens the door to $60 a share, which also coincides with the 61.8% Fibonacci retracement level.

Wave B is still supposed to develop as a three-wave pattern. Once the current rally in wave “a” is over, a pullback in wave “b” of B should be expected before wave “c” can complete the sequence. In other words, General Mills stock can still add another ~20% before wave C down begins.