If you think the last three months have been bad for stock market investors, think about how General Mills (NYSE:GIS) stock investors must be feeling. GIS has been steadily declining since mid-2016. Two and a half years ago, the share price climbed to an all-time high of $72.95. Last week it fell to $36.42, so it is fair to say that General Mills’ market value has been cut in half in less that three years.

Almost everyone was bullish on General Mills stock in July 2016. The stock fell instead. Almost everyone is bearish on GIS now, so can it actually go up this time? Let’s ask the Elliott Wave Principle.

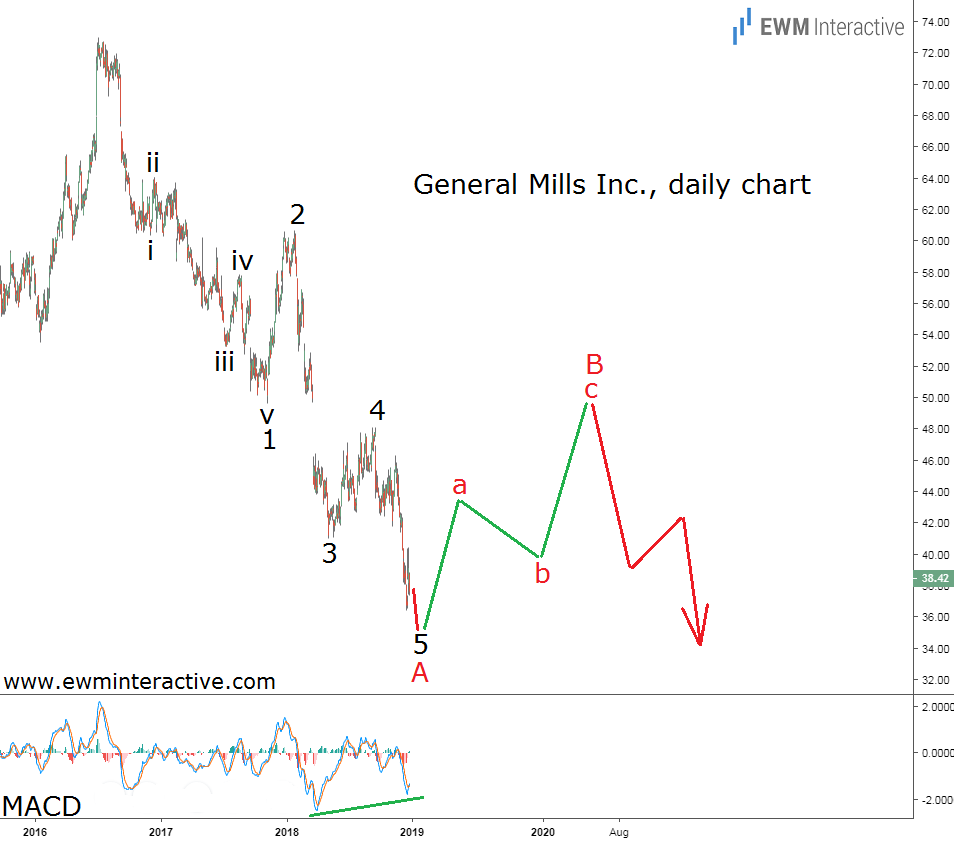

The daily chart above reveals the structure of the whole selloff from $72.95. The stock’s decline appears to have taken the shape of a textbook five-wave impulse, labeled 1-2-3-4-5. According to the Elliott Wave theory, impulses point in the direction of the larger trend. Unfortunately for General Mills investors, this means more weakness can be expected.

The good news is that one of Ralph N. Elliott’s other findings states that every impulse is followed by a correction in the opposite direction before the larger trend resumes. In other words, a bullish reversal should soon follow. We can expect a three-wave recovery in wave B to lift the share price to roughly $50, before the bear market continues.

The MACD indicator provides another reason for short-term optimism. As visible, there is a bullish divergence between waves 3 and 5 of A, highlighting that the bears are about to go in hibernation. This is probably not the best time to bet against General Mills stock. If the above-shown count is correct, the stage is set for a ~30% rally.