General Dynamics Corp.’s (NYSE:GD) Mission Systems business unit has won a modification contract in relation to the AN/BYG-1 weapons control system. Work related to this deal is scheduled to be over by Jun 2019.

Details of the Deal

Valued at $22.6 million, the contract was awarded by the Naval Sea Systems Command, Washington, D.C. Per the terms, General Dynamics will exercise options for technology insertion and advanced processing build software upgrade of the AN/BYG-1 weapons control system.

Work will be executed in Pittsfield, MA. General Dynamics will utilize fiscal 2017 research, development, test and evaluation (Navy), and fiscal 2017 other procurement (Navy) fund to complete the work.

What’s AN/BYG-1?

AN/BYG-1 is an open-architecture submarine combat control system that analyzes and tracks submarine and surface ship contacts, providing situational awareness, as well as the capability to target and employ missiles.

The AN/BYG-1 software system uses commercial off-the-shelf hardware in an open-architecture computing environment. It ensures that the submarine combat control systems are consistently maintained and updated with the latest technology advancements. The Navy's Los Angeles, Seawolf, Virginia and SSGN-class submarines and the Royal Australian Navy's Collins-class submarines use the AN/BYG-1 software and hardware.

What’s Favoring General Dynamics?

General Dynamics’ Mission Systems unit is a leading integrator of C4ISR systems for land, sea, air, space and cyber defense. It boasts an established global presence in secure communications systems, command and control systems, imagery sensors, and cyber products.

This unit falls under the company’s Information Systems & Technology (IS&T) business segment, which offers high-assurance mission and display systems, signal and sensor processing and command-and-control solutions for airborne platforms. Its aircraft mission computers are on the Navy’s F/A-18 Super Hornet strike fighter and the Marine Corps’ AV-8B Harrier II aircraft, giving pilots advanced situational awareness and combat systems control.

During the first quarter of 2017, the IS&T segment revenues represented 28.8% of the company’s total revenue. We can expect strong demand for its reliable products and frequent contract wins, like the aforementioned ones, to substantially boost this segment’s top-line growth in the coming days.

Price Performance

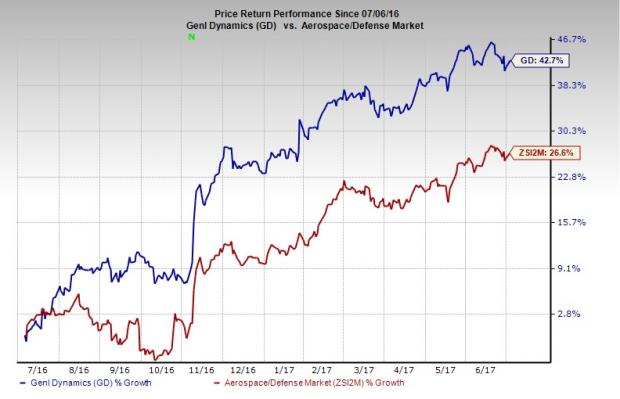

Shares of General Dynamics have rallied 42.7% over the last 12 months, outperforming the Zacks categorized Aerospace–Defense industry’s gain of 26.6%. This could be because General Dynamics consistently maintains a strategic alliance with the U.S. Department of Defense that allows it to enjoy a steady flow of contracts. It also offers strong competition to its peers like Boeing (NYSE:BA) , Lockheed Martin Corp. (NYSE:LMT) and Huntington Ingalls Industries, Inc. (NYSE:HII) .

Zacks Rank

General Dynamics currently holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Boeing Company (The) (BA): Free Stock Analysis Report

General Dynamics Corporation (GD): Free Stock Analysis Report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII): Free Stock Analysis Report

Original post