Edison recently visited the Kagem emerald mine site in Zambia. This was a timely appreciation of the potential benefits of the well-advanced major high-wall push-back at the Chama pit, trial underground operations, other open-pit exploration targets and gem recovery systems. The Gemfields (GEM.L) Q3 market update showed a strong cash position ahead of one more emerald auction in mid-June.

Kagem open pit and underground trials

Management has delivered a consistent high-quality product giving financial strength to embark on capital projects to ensure longevity. This includes a high-wall push-back that could be extended if positive commercial factors for open pit mining prevail. Underground mining trials continue in parallel with this strategy.

Treatment plant and sort house and exploration sites

Gemfields may introduce more sophisticated designs to the treatment plant sort house, which could improve both emerald recovery and security of both facilities. Active exploration sites were viewed and could also support additional open pits to increase overall production and allow flexibility of operational sites.

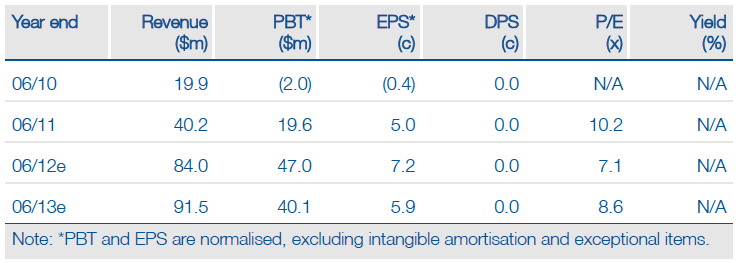

Valuation

The confirmation of a fourth auction in this financial year supports our NPV10% valuation based on projections from current operations, at 43p/share. Increased resource definition, continued strong markets and development of new production sites, together with new coloured gemstone prospects under investigation, should further raise our valuation and enhance Gemfields’ market ratings.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gemfields: Report On Mining Site Visit And Q3 Production

Published 06/07/2012, 03:04 AM

Updated 07/09/2023, 06:31 AM

Gemfields: Report On Mining Site Visit And Q3 Production

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.