Gemfields Group Limited (Gemfields) provides investors with exposure to major producing coloured gemstone mines at Montepuez Ruby Mining (MRM – rubies) and Kagem Mining (Kagem – emeralds) with additional value upside from the potential turnaround of Fabergé and its investments in Sedibelo Platinum Mines (Sedibelo – platinum group metals) and Jupiter Mines (Jupiter – manganese). Our sum-of-the-parts (SOTP) valuation of Gemfields totals ZAR5.01/share.

Profitable and cash flow-generative core assets

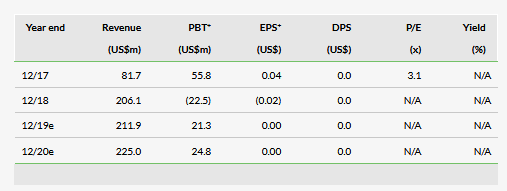

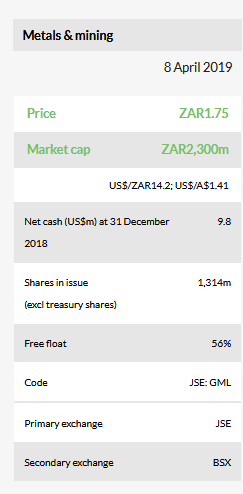

MRM and Kagem are producing, profitable, cash flow-generative core assets and Gemfields’ 2018 results demonstrate the strength of the investment proposition. The group generated EBITDA of US$58.9m (a 29% EBITDA margin) and free cash flow before movements in working capital of US$26.9m, ending 2018 with net cash of US$9.8m and US$41.4m of auction receivables. For 2019, we forecast EBITDA of US$47.8m, growing to US$53.9m in 2020, which puts Gemfields on a forecast 2020 EV/EBITDA of 2.8x against peer group diamond producers on an average of 3.7x.

Significant longer-term EBITDA growth potential

Beyond 2019, we expect strong revenue and EBITDA growth driven by production increases at both Kagem and MRM, which drives our 10-year sales CAGR of 7% – a level we believe can be supported with reference to historic growth rates and which the gemstone market should be able to accommodate. The group expects Fabergé to turn to profitability within two to three years. By 2023, we forecast Gemfields’ revenue of US$293m and EBITDA of US$99m, with only minor additional capital expenditure required to achieve that growth profile.

Valuation: SOTP valuation ZAR5.01/share

We have valued Gemfields’ interest in Kagem, MRM and Fabergé on the basis of discounted cash flow (DCF) valuations at a 10% real cost of capital. We adjust for the value of the group’s investment in Sedibelo (based on resource multiples) and Jupiter (at the current share price of A$0.34/share), corporate overheads (US$197m) and net cash (US$10m), which gives us a total valuation of US$466m (ZAR5.01/share). MRM is the biggest contributor to the SOTP value at US$366m (ZAR3.94/share). Kagem also contributes significant value of US$153m (ZAR1.65/share), despite the recent introduction of a 15% export tax on gemstones in Zambia (subject to ongoing negotiations). Fabergé contributes US$59m (ZAR0.64) to our SOTP valuation.

Business description

Gemfields Group (Gemfields) is a world-leading supplier of responsibly sourced coloured gemstones. Gemfields owns 75% of the Montepuez Ruby Mining in Mozambique, 75% of the Kagem emerald mine in Zambia and the Fabergé jewellery business as well as investments in Sedibelo Platinum and Jupiter Mines.