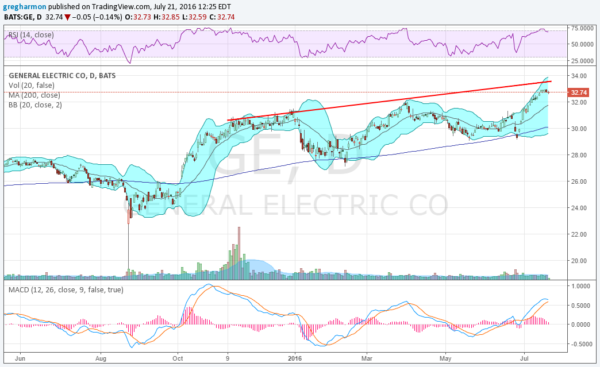

General Electric Company (NYSE:GE) stock dipped below its 200-day SMA in August last year as the market took a turn lower. If you bought that drop, congratulations as you're up over 40%. But given the market sentiment that the world was going to end, I suppose few did buy.

the stock moved back above its 200-day SMA in early October and has stayed there since. There has been a rough trendline resistance parallel to the 200-day SMA -- and it's a limit as to how far above it the stock can move before reverting back. Into earnings on Friday morning, the stock price is sitting just below this imaginary line.

The price has also been consolidating for the past 4 days with a RSI that is pulling back from a slightly overbought situation. The MACD is curling lower and may be ready for another short-term pullback.

Support lower may come at 32 or 30.60, with 29.70 and 29.20 below that. On a move higher there is no prior price history above going back to 2008. Possible resistance from then could be found at 33.25 and 36, before 37.65. Short interest is low at 2.1% into the report. A longer drift higher for the stock but perhaps a short-term reset in this chart.

The options activity shows an expected price move of about $0.70 this week, or 2.1%. That is slightly more than the 1.33% average move over the last 6 reports. Open interest shows the Put side strong from 31 to 32.5 and at 29.5 this week. The biggest open interest sits at 32. The Call side has open interest from 31 to 33.5, but the open interest at the 33.5 Call is much larger than any other on both sides.

Holder

For a holder of the stock you have several options into earnings. Do nothing and don’t worry about your long-term position, sell the stock or protect it against a short-term move. For protection, an options collar is the right trade. With the $0.70 expected move, a July 22 Expiry 32.5 Put or a 32.5/32 Put Spread can protect your stock against a pullback. Buying the July 22 Expiry 32.5 Put and selling the 32 Put would pay you $0.50 on Friday if the stock falls to 32. This spread costs about 13 cents though. In this case, the straight 32.50 Put for 26 cents gives more downside protection at less than 1% cost. To complete the collar, look to sell a covered call. Selling the August 33.5 Call gives a 21-cent credit, lowering your cost for protection to just 5 cents.

Speculator

For the speculator there are several options as well that offer high reward-to-risk ratios:

- Trade Idea 1: Buy the July 22 Expiry 32.5/32 1×2 Put Spread for free.

- Trade Idea 2: Sell the July 22 Expiry/August 32.5 Put Calendar for a 20 cent credit.

- Trade Idea 3: Buy the July 22 Expiry/August 33.5 Call Calendar for 14 cents.

#1 gives the downside short term with leverage and may put you in the stock at 31.5 Friday. #2 gives the downside short term, looking for a reversal before the August expiry, a short-term reversion lower and then a bounce. #3 looks for the upside longer term with protection this week to the large open interest at 33.50. You could make a #4 Trade by combining #2 and #3.

Opportunist

For the opportunist looking for an entry at a better level, options can help as well. One trade I like for these situations is a 1×2 Put Spread. This is buying a higher strike Put and then selling 2 lower strike Puts. For GE, a July 22 32.5/30 1×2 Put Spread gives downside participation from the 32.5/32 Put Spread until the price hits 32. Below 32, the extra short Put may be exercised against you, but with a basis of 31.5. This 1×2 Put Spread requires margin but costs nothing, so there is no capital outlay.