GE Capital Aviation Services (GECAS), a unit of General Electric Company (NYSE:GE) , has recently agreed to sell 45 leased aircraft worth $2 billion to Bohai Financial's subsidiaries.

Two of Bohai’s subsidiaries, Avolon Aerospace Leasing Ltd and Hong Kong Aviation Capital Ltd (HKAC), will enter into an agreement with General Electric.

As per sources, the Chinese aviation and shipping conglomerate, HNA, which is also the controlling shareholder of Bohai Financial, is a leading contender for the aviation assets of U.S. lender CIT Group Inc. The deal will boost Bohai’s foothold in the aviation industry as well as improve General Electric’s revenues from its aviation segment.

Bohai’s Subsidiaries

Bohai is a listed leasing company on the Chinese A-Share stock market and is primarily owned by HNA Group, a Fortune 500 company. It has operations across a range of sectors including aviation, leasing, logistics, tourism and transportation.

Recently acquired on Jan 10, 2016, Avolon is a wholly owned, indirect subsidiary of Bohai Leasing, a global leader in transportation (container and aircraft) asset leasing. Including Avolon, HKAC and other aircraft leasing assets, Bohai has a total fleet strength of over 500 aircraft, which makes it the world’s fourth largest aircraft leasing business by means of asset value.

About GECAS

GECAS is an Irish-American commercial aircraft financing and leasing company. It is the largest commercial airline leasing and financing company in the world. It is a part of GE Capital, a segment of General Electric. GECAS comprises a fleet of over 1800 aircraft, used by 245 airlines.

GECAS purchases its aircraft from manufacturers like Airbus and Boeing (NYSE:BA) and leases them to airlines. Typically the leases extend for eight years. The company has three global headquarters, located in Singapore; Shannon, County Clare and Norwalk, CT.

The primary competitor of GECAS is AerCap Holdings N.V. (NYSE:AER) . Revenues of these two companies together account for $228 billion.

General Electric is one of the largest and also one of the most diversified technology and financial services firms in the world. Its products and services range from aircraft engines, power generation, water processing, and security technology to medical imaging, business and consumer financing along with other industrial products.

GE Aviation accounted for 22.5% of the company’s revenues in the past quarter. It offers commercial and military jet engines and components and aftermarket services.

Earnings Dates for GE and its Peers

General Electric will be announcing its earnings on Jul 22, before the market opens. A couple of its peers in the same space, Honeywell International Inc. (NYSE:HON) and Carlisle Companies Incorporated (NYSE:CSL) , will declare their earnings on Jul 22 and Jul 26, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

HONEYWELL INTL (HON): Free Stock Analysis Report

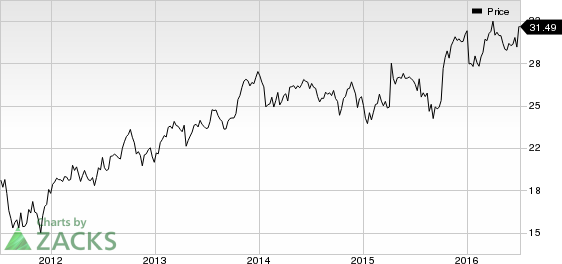

GENL ELECTRIC (GE): Free Stock Analysis Report

CARLISLE COS IN (CSL): Free Stock Analysis Report

AERCAP HLDGS NV (AER): Free Stock Analysis Report

Original post

Zacks Investment Research