Action in gold and the gold shares continues to be brutal. But one thing that has really piqued my interest from a trading perspective was the high volume flushout in the Gold Miners ETF (GDX) back on January 25th.

That was the highest volume GDX has done to date and it really looked like it was the type of volume that reeked of total fear and emotion taking over and bad decisions being made. If you’ve followed charts for a while you’ll often see huge high volume days right at the bottom, when everyone wants to head for the exits at the same time. It doesn’t necessarily mean the market is ready to rocket higher at that point, but oftentimes it marks bottoms or very close to the bottom since sellers have finally capitulated. It’s really kind of a cool thing to look at because the raw emotion is staring at you right in the face with the big red candle on high fear drenched volume.

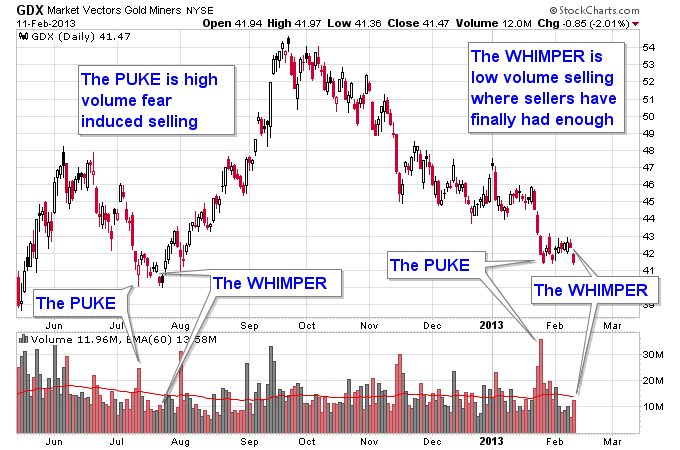

I got further intrigued when I noticed a similar pattern in recent action in GDX to what happened back in July 2012, when GDX put in a bottom and started rocketing higher. It’s possible I could come up with a better name for this pattern but for right now I’m going to call it The Puke and The Whimper pattern. The Puke is simply the high volume fear based selling, when shares are literally being puked up by sellers who can’t take the sickness to their stomach anymore.

The Whimper is the interesting part as it comes after the sellers are puked out, but they still are moaning and want to make it appear like they are still in pain. But since they have done most of their selling all they can do is utter a mere whimper.

Here’s the chart with The Puke and The Whimper pattern back in July 2012 and the possible second addition of the pattern after the action on February 11th. Notice how each Whimper was a low volume gap down, if you look closely at the chart I don’t think you’ll find lower volume on a gap down than either of those 2 days. In the first edition of the pattern the Whimper came about 6 trading days after the Puke, with the Whimper requiring one additional day after the gap down before it was off to the races. Currently the Whimper is about 10 trading days after the Puke, and it’s possible this Whimper would need a little more time to play out based on the strength of the recent Puke.

What I find intriguing about all of this is the nature of trading and making winning trades. Will the 35+ million shares that were sold on January 25th end up being part of a winning trade? They were sold into a support area, and at the end of a multi-month downleg, within the confines of a long term secular bull market.

That sounds more like a fear induced stampede, with the short term as the focus, than well thought out selling with a long term time frame in mind. And at the end of the day is being part of the herd how you win at trading?

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

GDX: Fear Induced Stampede Or Well Thought Out Selling?

Published 02/12/2013, 02:13 AM

Updated 07/09/2023, 06:31 AM

GDX: Fear Induced Stampede Or Well Thought Out Selling?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.