Recently, the Gold and gold-mining stocks have surged higher over the past three weeks. The highly followed Market Vectors Gold Miners ETF (ARCA:GDX) jumped higher by more than $4 a share since May 29, 2014.

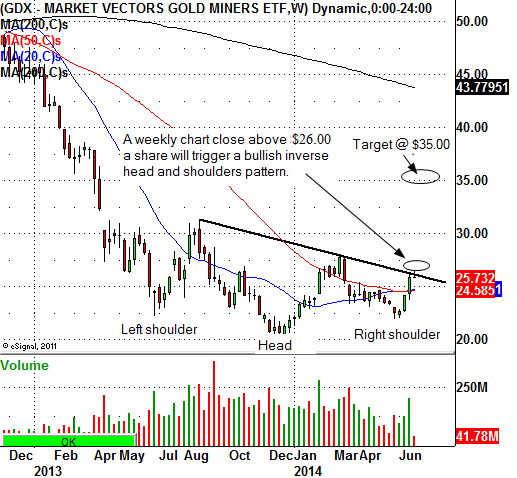

Today, GDX is trading lower by 0.37 cents to $25.90 a share. The ETF is now overbought on a daily chart, so a pullback over the next couple of days to weeks should be somewhat expected. While a pullback is possible, traders and investors must now keep an eye on the weekly inverse head and shoulder pattern that is forming on the chart. A weekly chart close above $26 a share on the Market Vectors Gold Miners ETF would trigger a buy signal for the pattern. The target for the bullish inverse head-and-shoulder pattern indicates a move up to the $35 area.

Leading gold mining stocks such as Royal Gold (NASDAQ:RGLD) and Goldcorp (NYSE:GG) also have the same weekly chart head-and-shoulders pattern as GDX. Please understand that these patterns have not yet triggered, so until they do, these equities could still be somewhat volatile in the near term.