We don't expect tomorrow's release to turn any heads. But economic data tells the story of how Canada is reaping the rewards of an exceptionally strong US economy - despite the ongoing trade tensions - and we don't expect that to change anytime soon.

Rebounding retail sales will support growth

As far as Canada's economic performance is concerned, signs of damage from US trade tensions are pretty limited. That’s the story we expect to see in the May GDP figure – released tomorrow - where we forecast growth to have increased by 0.4% month-on-month. As we saw in Q1, manufacturing will be a key driver as it continues to benefit from solid global demand, particularly in the US. Accompanying this is the strong rebound of retail sales in May (+2%MoM) - it appears the sunny weather has tempted Canadian consumers to open their wallets and splash out on summer fashions and building/garden projects.

More hikes on the way

Meanwhile, June inflation saw the biggest year on year increase (+2.5%) in six years and coupled with strong growth; it leads us to predict the Bank of Canada will follow July’s rate hike with another one later this year. The Bank continues to think that contributions from investments and exports will be around double of what they were in 2017, as robust global growth offsets the so far "moderate" impact of tariffs.

NAFTA and trade tensions aren't enough to knock Canadian resilience - just yet

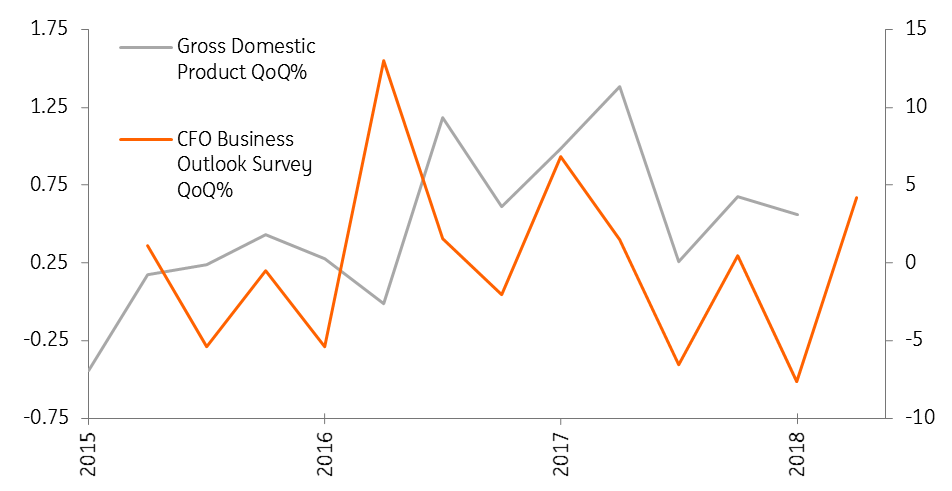

All that said, the broadening of tariffs has clearly increased tensions, and this remains a major risk to Canada. NAFTA talks are notably stagnant at the moment, and this is expected to stretch out until after the US mid-term elections in November, prolonging the period of uncertainty for Canadian firms. This could gradually sap confidence and eventually lead to weaker capex spending and worker hiring.

On the bright side, economic data tells us Canada will continue to reap the rewards of a mighty US economy, underlined by last Friday’s bumper 2Q GDP report. We are confident the momentum in the US economy will continue for at least a few more quarters given the massive fiscal stimulus (tax cuts and spending increases) that are still working their way through the system.

For now, the direction of interest rates is upwards, but a post-summer escalation in trade tensions and or breakdown in NAFTA talks remains the key risk.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”