“USD Prelim GDP q/q “1.0% v 0.4% expected)”

The US economy expanded in Q4 2015, giving USD bulls reason to be optimistic on the overall health of the economy.

Gross Domestic Product printed a 1% annualised growth rate compared with the 0.4% expected, sending the dollar rallying as the Fed comes back into play for 2016.

With further rate increases being all but written off after the horrible start to the calendar year, the GDP print removes the talk of recession and points to a continued rebound.

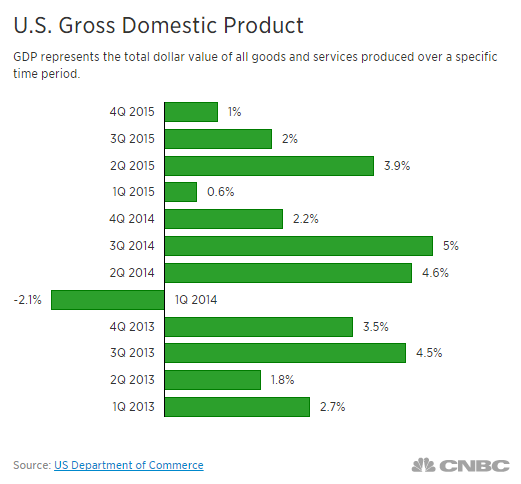

The above CNBC chart shows the data from a visual viewpoint and while it is certainly contracting, it’s not as bad as what has been priced in. It’s this ‘not as bad as it could have been’ point that markets are lapping up at least for the short term.

– Inventories +$81.7 billion annualised rate.

– Growth -0.14% (-0.45% previous).

– Trade gap -0.25% (-0.47%).

– Household consumption +2% annualised rate (2.2% previous) – This is a huge part of the economy.

The summarised numbers above all point to the Fed being back in play this year. Each new piece of data causes the probability of a hike to swing wildly and it’s this perception that traders can take advantage of as Forex markets price and re-price one month to the next.

The probability of a June hike rose to 35% from 24% last week, while a December hike jumped above the magic 50% level to 53% from 36% last week. Crazy.

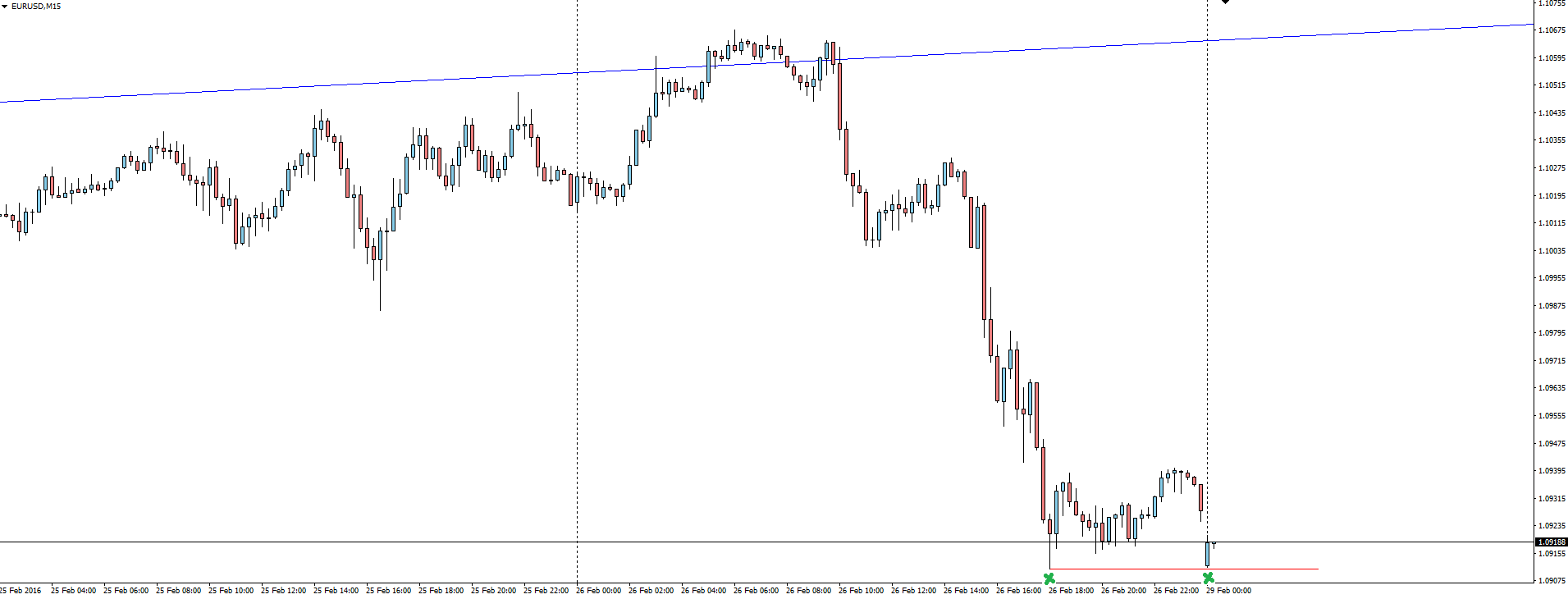

EUR/USD 15 Minute:

After Friday’s huge fall in EUR/USD on the data release, we open with a nice gap and an opportunity to fill.

EDIT: Price of course filled the gap before I hit publish on the blog. Kudos to those that jumped on board!

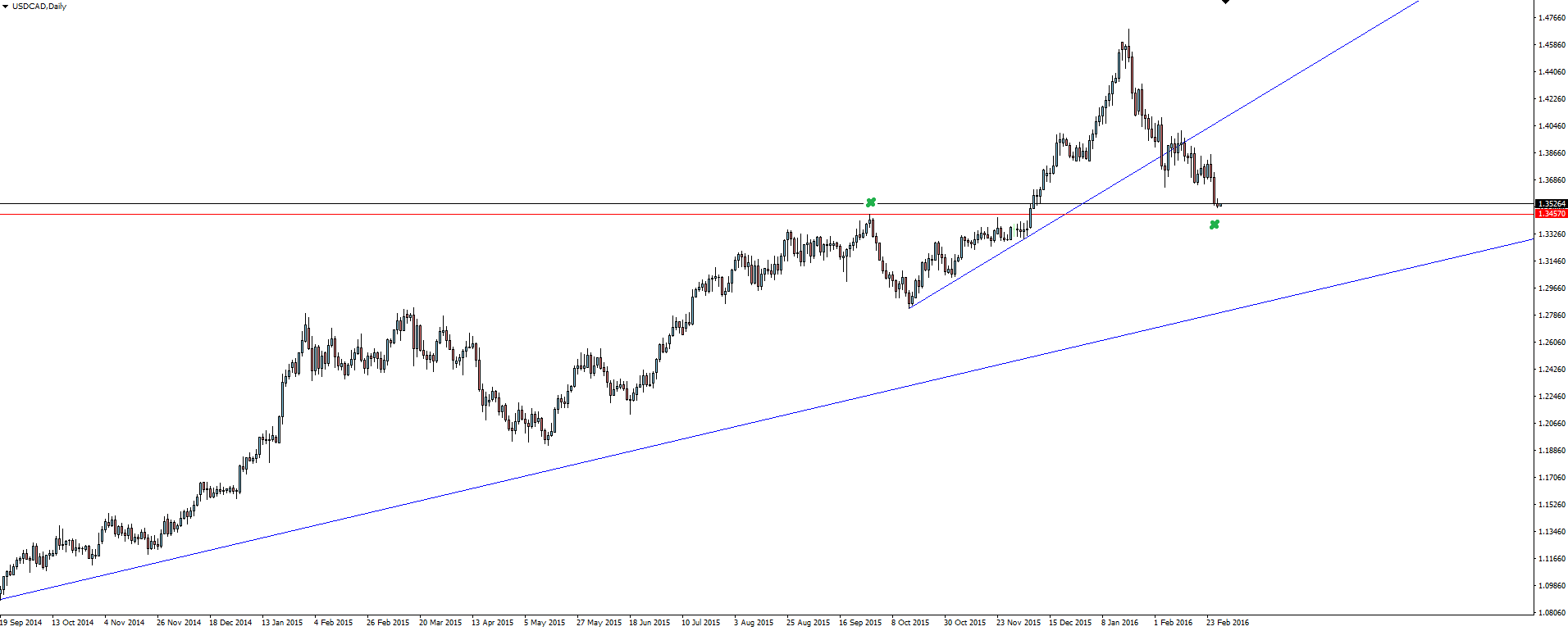

Chart of the Day:

The fact that USD/CAD hasn’t managed any sort of a bounce throughout last week’s US GDP number highlights the short-term weakness in the pair. Of course I say short term as even a further 600 pip pull-back will still see the pair correct healthily to the weekly bullish trend line and still remain bullish overall.

Today’s chart of the day sees price return to marked previous resistance with the potential to this time act as support. With stops lurking below the obvious level, some of the pair’s weakness in the face of broader USD strength is surely due to the stops lurking below this level and the market wanting to take them out before bouncing.

On the Calendar Monday:

JPY Retail Sales y/y

NZD ANZ Business Confidence

EUR German Retail Sales m/m

USD Chicago PMI

USD Pending Home Sales m/m

A whole raft of second and third tier data on the economic calendar today. With the juicy data to come later in the week, not much is expected around today’s numbers but something to be aware of nonetheless.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX on the MT4 platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.