- GBPUSD in a steady decline since mid-July

- Found its footing just shy of the 200-day SMA

- Can the bulls stage a comeback?

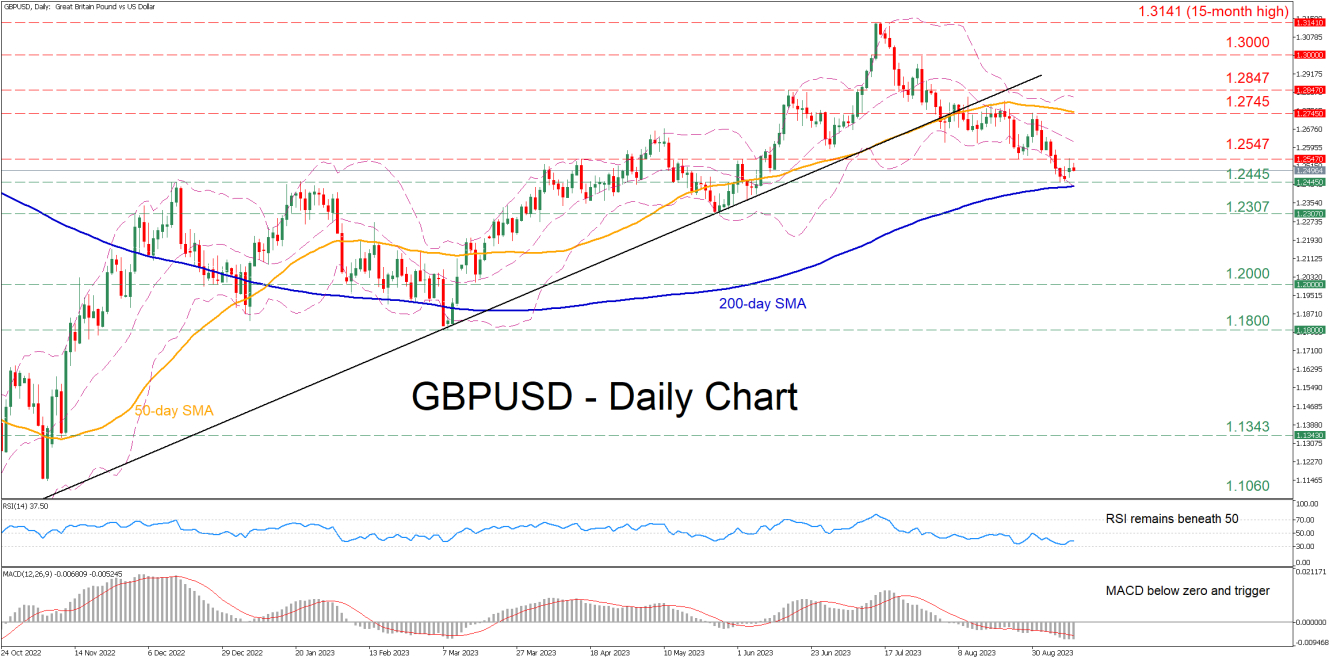

GBPUSD has been forming a structure of lower highs and lower lows since its 15-month peak of 1.3141. Despite the latest rebound from a three-month low, the short-term oscillators are pointing to further downside as both the RSI and MACD are well within their negative territories.

If the selling interest intensifies, the pair could face the recent support of 1.2445, which acted as resistance in January and also coincides with the 200-day simple moving average (SMA). Sliding beneath that floor, the price might descend towards the May bottom of 1.2307. Further declines could then cease at the 1.2000 psychological mark.

On the flipside, should the recent bounce extend, the bulls may target 1.2547, which has acted both as support and resistance in the past month. A break above that region could open the door for the August resistance of 1.2745, which overlaps with the 50-day SMA. Even higher, the June peak of 1.2847 could curb further upside attempts.

In brief, it seems that the GBPUSD’s pullback is starting to lose steam, but it’s too early to call for a reversal. Indeed, the short-term decline could even accelerate in the case that the pair profoundly closes below the 200-day SMA.